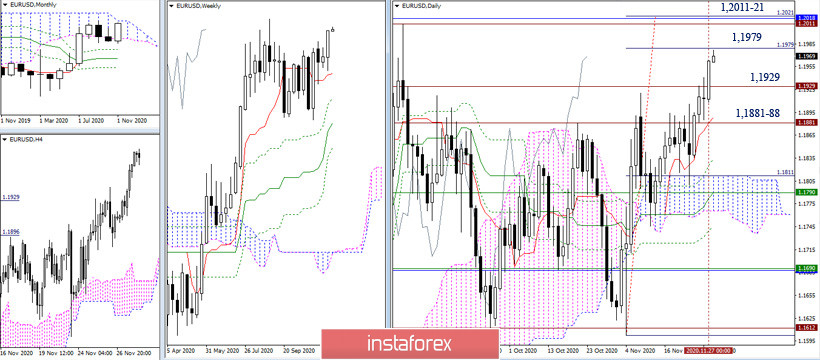

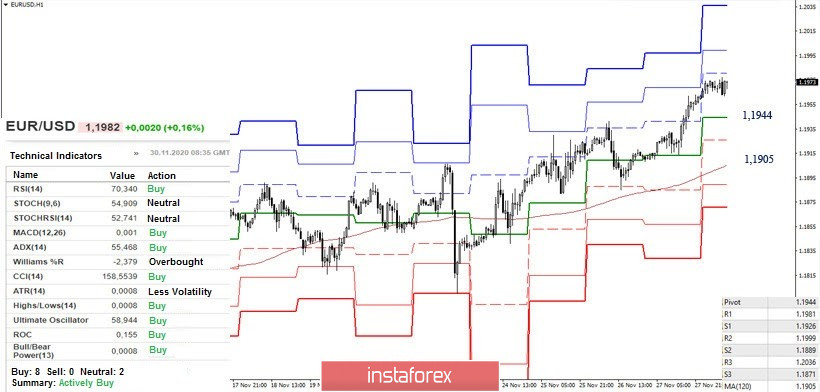

EUR / USD

The bulls closed last week's trading as optimistically as possible. Today, the month will be closed and the bulls will most likely try to maintain their mood. The positions held will allow directing all available potential to the area of 1.2011-21 (daily target for cloud breakdown + high extremum of the upward trend + upper limit of the monthly cloud). The main task of the bulls is to break through this zone in December.

The resistances are strong enough and breaking through them will be important for the further development of the situation. In case of a correctional decline, the nearest support can be noted at the passed levels 1.1929 and 1.1881-88 (daily Tenkan). A decline below, and even more so the loss of the daily cloud in December, strengthened by the weekly short-term (1.1790), will greatly affect the current distribution of forces and will require a new assessment of the situation.

On the smaller time frames, the bullish traders are currently in favor and they are continuing the upward trend. The resistances in the central pivot levels (1.1981-1.1999-1.2036) serve as an upward intraday pivot. In case of a correction, the key supports on the same time frame are expected today at 1.1944 (central pivot level) and 1.1905 (weekly long-term trend). The nearest support can be noted at 1.1926 (S1).

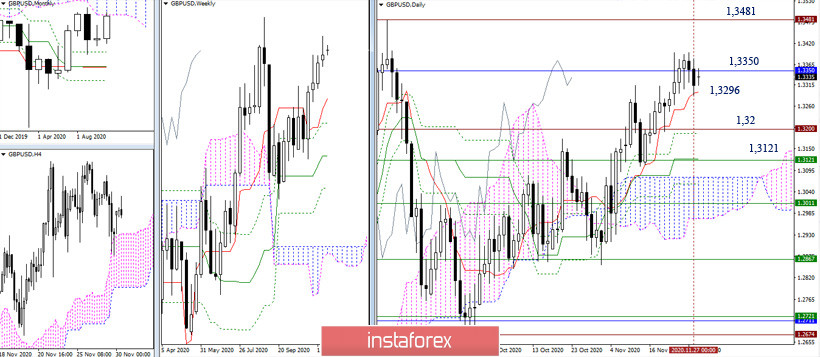

GBP / USD

Just like the previous week, the weekly candlestick still has a long upper shadow despite the upward gap at the opening of the week. The weekly time frame is very doubtful about the bullish outlook. Today, the pair reopened with an upward gap before closing the month, whose result is important.

It is very important for the bulls to enter into the monthly cloud (1.3350) and restore the weekly and monthly upward trend (1.3481) in the near future. Meanwhile, bears plan to recover the support of 1.3296 (daily short-term trend) - 1.3189-1.32 (daily Fibo Kijun + historical level) - 1.3121 (daily Kijun + weekly short-term trend). Gaining these levels will allow them to make their long-term plans.

The interaction and struggle for key levels continues in the smaller time frames, which have united today in the area of 1.3327-48 (central pivot level + weekly long-term trend). Long-term presence in the attraction zone of these levels and their horizontal location indicate uncertainty. If you consolidate higher and break through from the levels, a bullish advantage will be formed. Today's intraday upside targets are located at 1.3367 - 1.3420 - 1.3460 (resistances of classic pivot levels). On the contrary, if you work below the key levels (1.3327-48) and break through them, bearish mood and advantages will increase. The support for classic pivot levels is currently noted at 1.3274 - 1.3234 - 1.3181.

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classical), Moving Average (120)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română