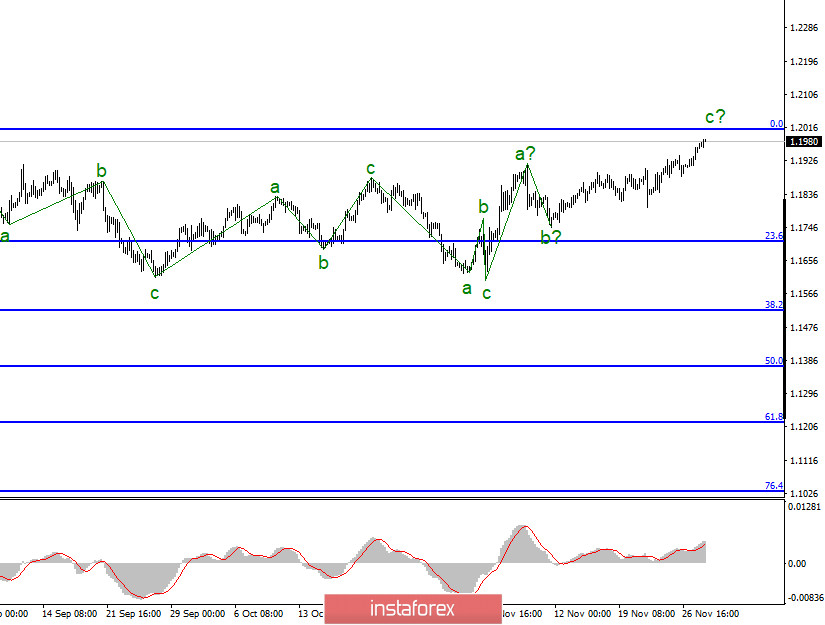

The wave marking of the EUR/USD instrument continues to look quite confusing. However, in general, it does not raise any big questions. The upward wave, which is now identified as C, continues its construction and has already made a successful attempt to break the maximum of the previous wave a. Thus, the construction of the next three up continues and soon the maximum of wave 3 or C may be broken. If this happens, the construction of an upward trend section may resume and the next few months will be difficult for the dollar.

A smaller-scale wave marking also indicates that the next three-wave section of the trend is still being built. It is also possible that the upward section of the trend within the global wave 5 has resumed, as I mentioned earlier. However, at this time, the section of the trend that begins on November 4 does not look at all like an impulse wave 5. Thus, I am inclined to the option with further alternating triples up and down. However, a successful attempt to break through the 0.0% Fibonacci level will indicate that the markets are ready for new purchases of the European currency.

During the last two days of last week, there were no economic reports in America or Europe. Nevertheless, these days, markets continued to increase demand for the euro (or lower for the dollar). Thus, we need to figure out why this is happening and what to expect from the tool next. It's no secret that the news background from America is quite calm now. In other words, there is practically no news. Donald Trump seems to have accepted defeat in the election, and Joe Biden is just getting ready to take on a new post. Therefore, no important decisions are being made now. In the Eurozone, Poland and Hungary have come into conflict with the European Commission, which wants to be able to cut funding for countries that do not comply with the rule of law. And Poland and Hungary do not agree with this, so the budget and the recovery fund are still blocked. However, experts believe that the opposing countries will not win in this confrontation with the EU. Nevertheless, the European economy also has problems. Last week, we learned about a strong drop in business activity indices in the EU services sector. From my point of view, this will not affect the economy in the best way. We observed approximately the same pattern in the spring. There was a record drop in the business activity then, but it is certainly not as strong now. However, this means that the economy's decline will simply not be as strong as in the second quarter. However, it is possible. In America, a second "lockdown" is also possible, however, it is unlikely in the next two months, before Joe Biden takes office. Thus, there are no visible reasons for the growth of the euro currency now.

General conclusions and recommendations:

The euro/dollar pair presumably continues to build a three-wave upward trend section, however, it may be completed in the near future. Thus, now I recommend that you be very careful when buying a tool and start looking at its sales. An unsuccessful attempt to break through the 0.0% Fibonacci level will indicate that the markets are not ready for further purchases of the euro currency and the possible completion of the triple.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română