The White House made a stir yesterday and seriously interfered in the calm and quiet situation of the currency market, which seems to have started getting used to the almost complete absence of any activity. This is in connection with US officials' promise to release the COVID-19 vaccine as early as mid-December, that is, right before Christmas. If this happens, it will truly be a real Christmas present for American society. Most of all, small and medium-sized businesses will be delighted that they can breathe out and forget about the terrible restrictions that turn into massive losses. If all of these work out, then the United States will no longer have to tighten quarantine measures, which everyone somehow forgot during the US elections. Therefore, a gradual easing of restrictive measures should be somewhat expected, which will be extremely pleasant for business. Consequently, the US economy can start the following year with strong growth. So, it is not surprising that the dollar is growing quite noticeably.

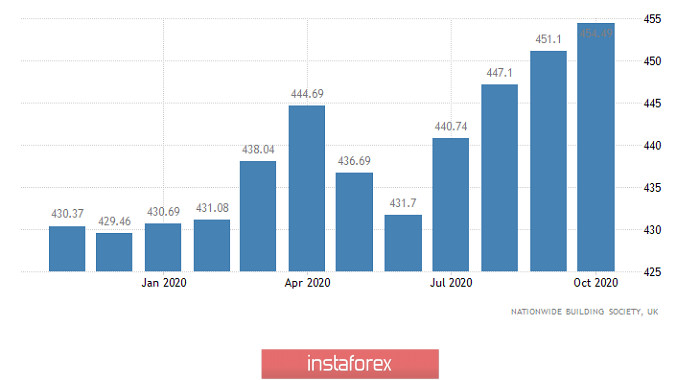

However, we are only talking about intentions and wishes, which cannot guarantee anything yet. So, the pound started to quickly recover its losses and completely regain their positions. It is possible that this is also due to the incoming publication of a number of statistics. In particular, the growth rate in the UK house prices may rise from 5.8% to 6.2%. It should be recalled that the real estate market is one of the main criteria for determining the investment attractiveness of the UK, therefore, it will be an extremely positive factor if there is growth in the house prices.

In addition, the final data on the UK business activity index in the manufacturing sector should confirm its growth from 53.7 to 55.2. To simply put it, the forecasts for British statistics are purely positive. However, any serious growth or any market reaction should not be anticipated, since the pound has already grown enough.

House Price Index (UK):

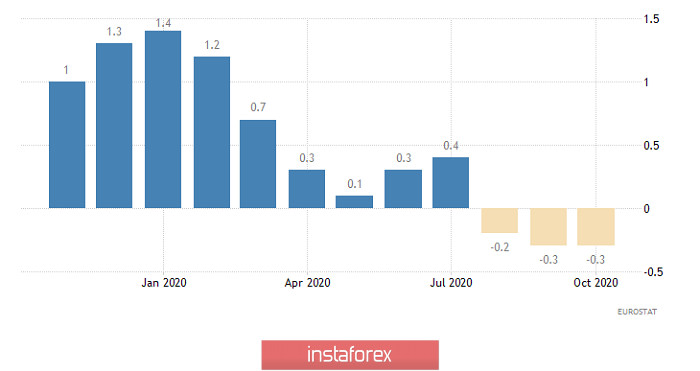

The single European currency is not in a rush to return to its previous values. Investors were apparently alerted by the revision of inflation forecasts, for which a preliminary estimate is published today. Yesterday morning,the deflation rate in Europe was expected to remain unchanged. But now, the decline in consumer prices is expected to slow down from -0.3% to -0.2%. And although we are still talking about deflation, which lasts for almost three months, the very fact of its slowdown may become a great reason for growing optimism of the single European currency. Against this background, the final data on the index of business activity in the manufacturing sector, which should coincide with the preliminary estimate that fell from 54.8 to 53.6, will not influence anything.

Inflation (Europe):

The final data on the business activity index in the manufacturing sector will be released in the US. A preliminary estimate showed an increase in the index from 53.4 to 56.7, so the same is expected to the final data. However, all this was already considered last week, when the preliminary estimates were published. Thus, these data will unlikely affect the currency market, that is, if they really coincide with the preliminary estimate.

Manufacturing PMI (United States):

After rebounding from the psychological level of 1.2000, the EUR/USD pair headed towards the variable support level of 1.1920, where a stop occurred, resulting in a recovery process. If the price is kept above the level of 1.1960, it can lead to another movement towards the coordinate 1.2000; otherwise, the market is expected to rise within the amplitude of 50 points.

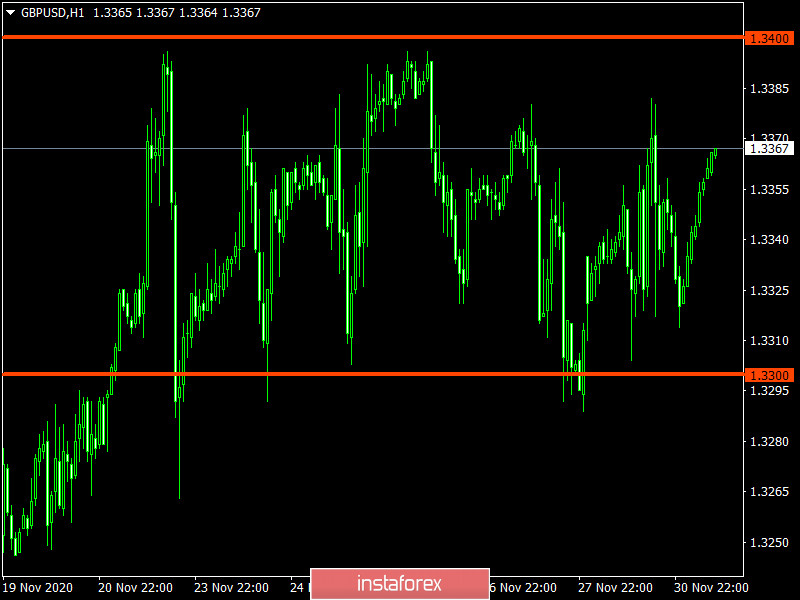

In turn, the GBP/USD pair continues to move between the coordinates 1.3300 and 1.3400 for more than one trading week. We can assume that the specified range will still remain in the market, where there is a great chance to work on the principle of rebounding from the specified boundaries.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română