Demand for the euro dropped amid weak inflation data from Germany. The report said it decreased sharply for the second month in a row, which indicates the growth of deflationary pressures that the Central Bank will have to deal with to recoup the economy.

Because of this, at the moment, the technical picture of the EUR / USD pair is in favor of the bears. However, the bulls can quickly regain control of the market if the quote consolidates at the level of 1.1965. Such may come after the publication of Manufacturing PMI for the euro area, provided that the data indicates a stable state during the second wave of COVID-19. But if the report comes out worse than the forecasts, the GDP of the eurozone could collapse more this 4th quarter.

Inflation reports for the euro area will also be of great importance, the slowdown of which will again hit the positions of euro bulls. A consolidation above 1.1965 will bring the quote towards this month's high, on the breakdown of which the further direction of the EUR / USD pair towards the levels 1.2055 and 1.2090 will depend. If the pressure on risky assets persists, the quote may break below the level of 1.1920, which will quickly push the euro down to lows 1.1880 and 1.1840.

In another note, yesterday, the US Federal Reserve announced that it is extending the duration of four emergency lending programs that helped stabilize the situation during the first wave of coronavirus. Many market participants already expected this decision, since these programs do not include the lending programs that US Treasury Secretary Stephen Mnuchin previously refused to renew.

In his speech yesterday, Fed Chairman Jerome Powell said the central bank's actions amid the coronavirus pandemic have provided the economy with $ 2 trillion of support. However, now, the pace of economic recovery has slowed. In his opinion, spending on goods is strong and exceeded the levels observed before the pandemic, but spending on services is low, as the sector is weakened by the virus. The economic outlook remains extremely uncertain, and Powell believes the rise in COVID-19 cases is worrisome and could pose problems. According to him, a full economic recovery is unlikely to happen until people feel safe.

Yesterday, the Eurogroup also held a meeting, which ended with the signing of an agreement and amendment of the European Stability Mechanism (ESM). According to the new regulation, the ESM can assist the Single Resolution Fund (SRF) in winding down failing banks if, in a banking crisis, the fund runs out of its own money.

At its financial stability report last week, the European Central Bank already indicated the need to build up defensive assets for leading banks in the eurozone. This is because after the completion of state support programs, the population and companies may have large debt burdens, which will lead to losses on the balance sheets of banks. Even if the credit losses on borrowing are much lower than during previous crises, and also lower than in the US, banks need to consider the likelihood of a deterioration in the financial situation of households and companies. The ECB said the moment of completion of emergency assistance is of particular concern, since some companies that have just survived the coronavirus crisis, especially in the service sector, will not be able to resume full work so quickly to fully cover loan payments. Over time,

The changes made to the ESM were most likely to address these issues.

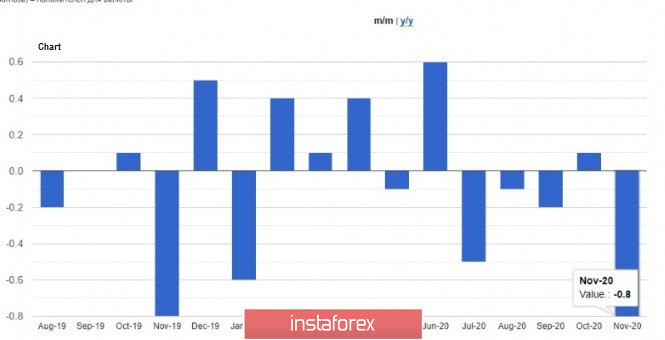

As mentioned above, the pressure on the euro increased after consumer prices in Germany fell sharply in November. According to the report, inflation fell 0.3% y / y after decreasing by 0.2% in October, and dropping by 0.8% m / m after rising by 0.1%. Economists expected the figures to drop by 0.1% y / y and 0.7% m / m. As for the harmonized index according to EU standards, preliminary estimates reveal prices fell by 0.7% y / y and by 1% m / m in November.

Another report that was published yesterday was data on signed contracts in the US housing market, which decreased immediately by 1.1% in October compared to the previous month, amounting to 128.9 points. Due to strong summer growth rates, the indicator has declined for the second month in a row. Economists had expected the index to rise 2% in October.

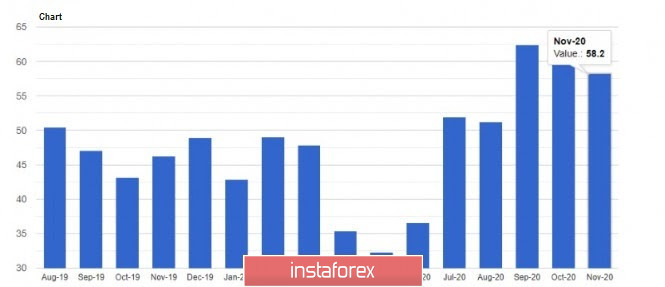

Meanwhile, Chicago's PMI continued to rise, but due to the pandemic, it's figure was a bit worse than in October. The report said the index came out at 58.2 points in November, against 61.1 points in October. Economists had expected the index to reach 59.1. Nonetheless, index readings above 50 indicate increased activity.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română