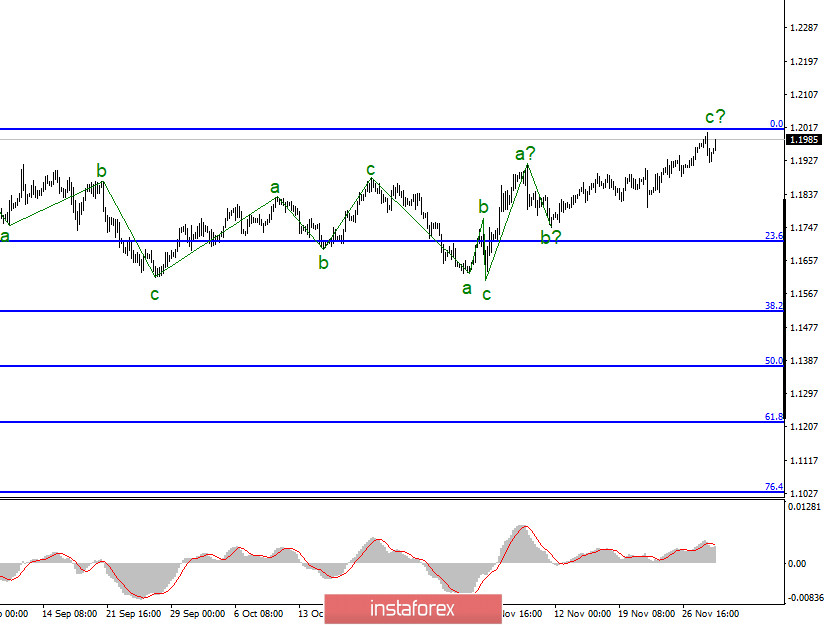

The wave marking of the EUR/USD instrument continues to look quite confusing, but in general, it does not raise any big questions. The upward wave, which is now identified as C, continues its construction and has already made a successful attempt to break the maximum of the previous wave a. Thus, the construction of the next three up continues and soon the maximum of wave 3 or C may be broken. If this happens, the construction of an upward section of the trend may resume and the dollar may be under market pressure for the next few months, and the wave marking after November 4 may take the form of an impulse upward wave.

A smaller-scale wave marking also indicates that the next three-wave section of the trend is still being built. It is also possible that the upward section of the trend within the global wave 5 has resumed, as I mentioned earlier. However, at this time, the section of the trend that originates on November 4 does not look like an impulse wave 5 at all. Thus, I am inclined to the option with further alternating triples up and down. However, a successful attempt to break through the 0.0% Fibonacci level will indicate that the markets are ready for new purchases of the European currency.

At the beginning of a new trading week, there is almost no news or important events. The US currency seems to have started to increase on Monday, but on Tuesday, demand for it decreased again. Thus, I can not yet conclude that the construction of wave C is complete. However, an unsuccessful attempt to break through the 0.0% Fibonacci level will still indicate that the instrument is ready to build a new downward trend section. The news background is now quite strange. The European Union has accumulated quite a large number of potentially serious problems. From the blocking of the seven-year budget and the recovery fund by Poland and Hungary, which can lead to a conflict within the EU, to the "lockdown", which in itself is disastrous for any economy. But there is almost no news from America recently. Nevertheless, the demand for the European currency remains quite high, which is still surprising, since not only the news background suggests a decrease in the instrument's quotes, but also the wave markup.

Christine Lagarde will deliver a speech in the European Union today. Yesterday, she also made a statement, however, it concerned the blockchain and the digital euro, so the markets did not respond to her speech in any way. Today, the ECB President can also talk about different things, and the reaction of the markets will depend on this. Also in Germany, unemployment figures will be released today, and in the EU – the index of business activity in the production sector. The most important indicator is inflation, which may remain at the "deflationary" level. Thus, I would say that the chances of a decline in the euro currency today are greater than for growth, however, in the morning trading, we see that it is the euro currency that is in demand.

General conclusions and recommendations:

The euro/dollar pair is presumably continuing to build a three-wave upward trend section, however, it may be completed in the near future. So, now I recommend that you be very careful when buying a tool and start looking at its sales. An unsuccessful attempt to break the 0.0% Fibonacci level will indicate that the markets are not ready for further purchases of the euro currency and the possible completion of the three.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română