To open long positions on EUR/USD, you need:

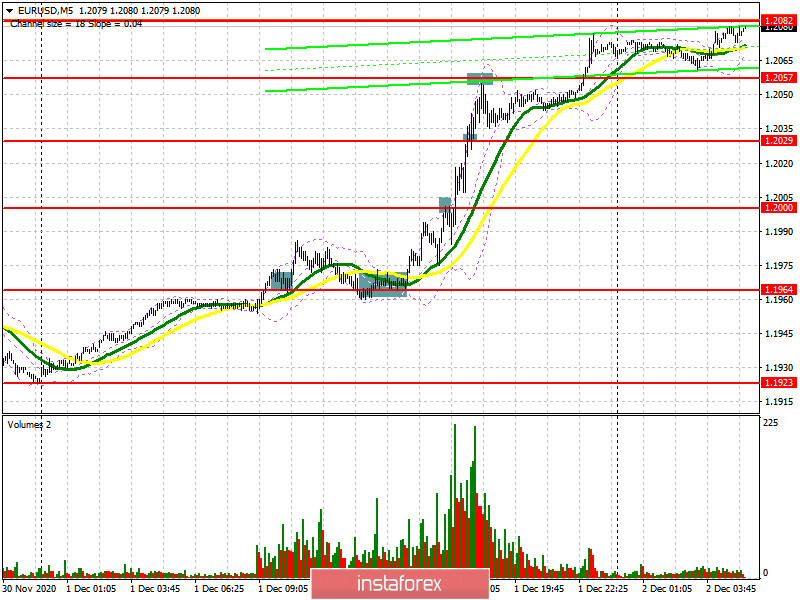

In yesterday's forecast, I paid attention to the 1.1964 level, which is what happened. The 5-minute chart clearly shows how a breakout and consolidation above the 1.1964 resistance along with its test from top to bottom (I highlighted the entry zone on the chart) provided a convenient entry point to long positions, which resulted in the euro's recovery. The second false break at 1.1964 only strengthened the confidence that the market would continue to rise. Afterwards, a test of a large resistance at 1.2000 took place, from which the pair rebounded by 15 points. However, a breakdown occurred after returning to this range, which led to removing a number of sell stop orders and also caused the euro to rise to a high of 1.2029, which the bulls passed without problems. Then the resistance at 1.2057 was also updated, where I recommended opening short positions immediately on a rebound. The correction from the 1.2057 level was about 20 points.

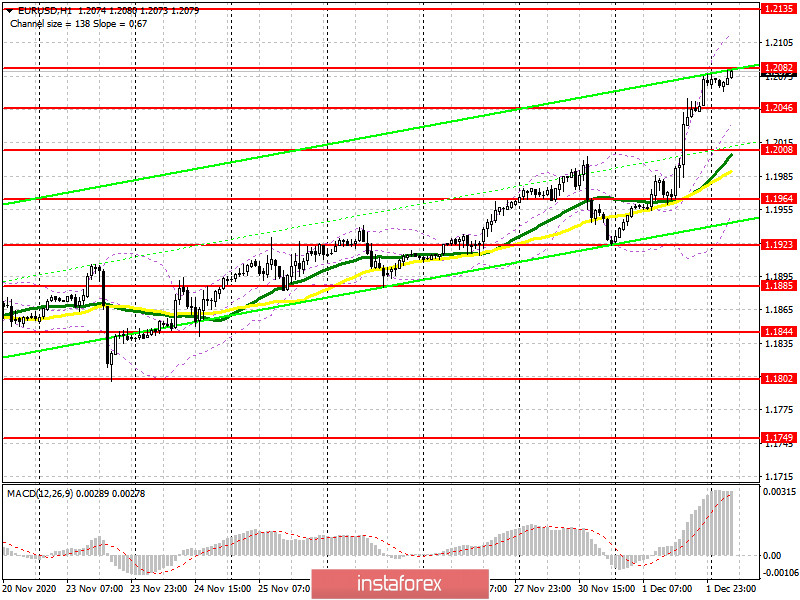

Euro buyers are currently in control of the market. Yesterday's fundamental statistics helped them maintain their advantage over the market. At the moment, the bulls must go beyond and settle above resistance at 1.2082. Testing this level from top to bottom will be another signal to open long positions in order to sustain the bull market and the main goal is to update the high of 1.2135, where I recommend taking profits. A succeeding target at the end of the week will be resistance at 1.2194. If today's eurozone data disappoints the market, and we are also expecting a report on the unemployment rate and producer prices, then in this case we can expect a downward correction to the support area of 1.2046. You can, of course, try to open long positions from this area immediately on a rebound, but a more correct solution would be to form a false breakout in order to sustain the upward trend. If bulls are not active in the 1.2046 area, this may push the euro back to the support of 1.2008, from which one can definitely buy EUR/USD immediately on a rebound, counting on a correction of 15-20 points within the day. Moving averages also pass there, which play on the side of buyers.

To open short positions on EUR/USD, you need:

Bears' heads flew across the market. Their initial task for today is to stop the upward trend, which will happen only if they protect resistance at 1.2082. Forming a false breakout there will be a signal to open short positions as they aim for a downward correction to the area of the first intermediate support at 1.2046, for which an active struggle will begin. Getting the pair to settle below this level and testing it from the bottom up will be a good sell signal with EUR/USD returning to a large low of 1.2008, where I recommend taking profit. A succeeding goal is to close the trading week at 1.1964, which will completely cancel out all the bullish momentum. However, it is best not to rush to sell while the US dollar is under pressure due to the regular stimulus programs for the American economy that was proposed yesterday. The breakout of 1.2082 will lead to a new wave of euro growth. In this case, you can count on short positions on a rebound after the resistance test of 1.2135, or sell EUR/USD from a new high in the 1.2194 area, counting on a correction of 15-20 points within the day. It is best not to rush to sell while the market is bullish.

The Commitment of Traders (COT) report for November 24 showed an increase in long positions and a decrease in short positions. Buyers of risky assets believe that the bull market will continue and also see a breakout of the psychological mark in the area of the 20th figure, which was tested already on November 30. Long non-commercial positions increased from 203,551 to 206,354, while short non-commercial positions decreased from 69,591 to 68,104. The total non-commercial net position rose to 138,250, against 133,960 a week earlier. Take note of the delta's growth after its 8-week decline, which indicates a clear advantage of buyers and a possible resumption of the medium-term upward trend for the euro. We can only talk about an even bigger recovery when European leaders have negotiated a new trade deal with Britain. Otherwise, you will have to wait until restrictive measures that were introduced due to the second wave of coronavirus in many EU countries have finally been lifted and count on the fact that the ECB will not introduce negative interest rates already at the December meeting.

Indicator signals:

Moving averages

Trading is carried out above 30 and 50 moving averages, which indicates continued growth in the euro in the short term.

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

Growth will be limited in the area of the upper border of the indicator 1.2115. In case the euro falls, support will be provided by the average border of the indicator in the 1.2035. area

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română