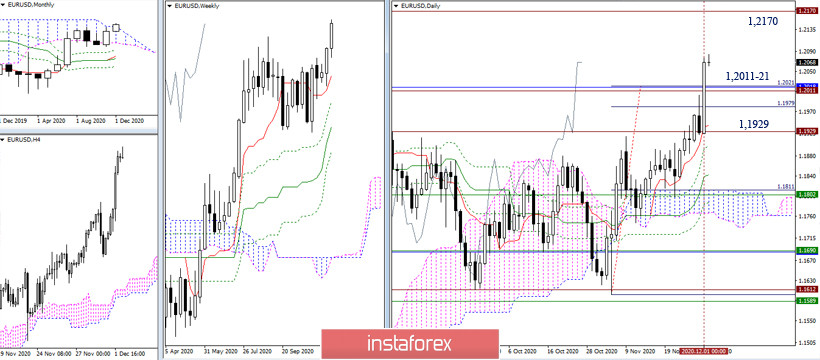

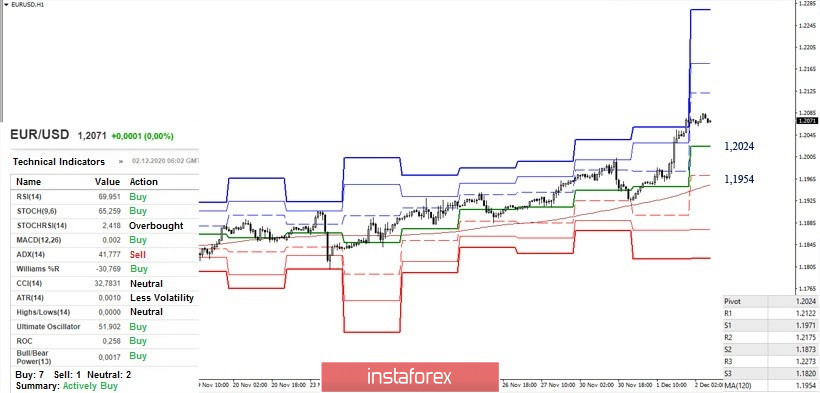

EUR / USD

This month started off good. The bulls have no intention to stop yet, who actively overcame the level of 1.2011-21 (daily target for the breakout of the cloud + the high extremum of the upward trend + the upper limit of the monthly cloud) yesterday on a large scale, after failing to do so last Monday. As a result, the former resistances in the smaller time frames were transformed into strengthened supports. Now, it is important to maintain the situation and consolidate in the reached levels. The all-time level of 1.2170, which has been repeatedly tested in the past and has been designated for a long time by the monthly Senkou Span B, can serve as a further pivot point and a resistance.

The effectiveness of yesterday's movement expanded the possibilities of the classic pivot levels. Today, their resistances, which are the intraday upward targets, can be noted at 1.2122 (R1) - 1.2175 (R2) - 1.2273 (R3). On the other hand, the key supports are currently at 1.2024 (central pivot level) and 1.1954 (weekly long-term trend). A consolidation below which will change the current balance of power on smaller time frames, while the short-term trend (1.1942) will be lost on the daily time frame. Thus, it is necessary for a new assessment of the situation.

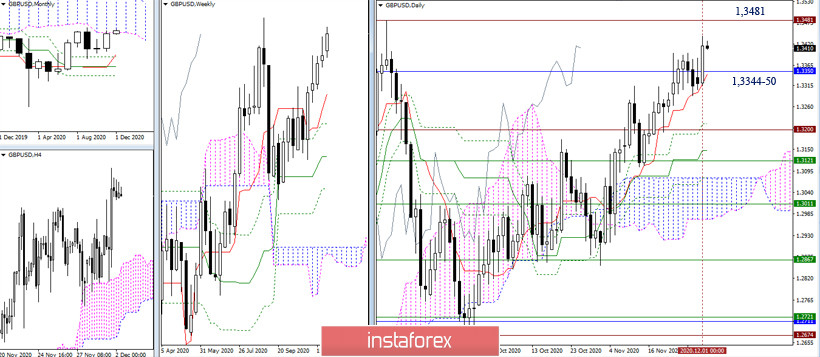

GBP / USD

Yesterday, the bulls successfully went beyond the daily consolidation and recently returned to the monthly cloud. Their main task now is to consolidate the achieved result, hold positions and restore the weekly and monthly upward trend (1.3481). In turn, the bears need to return the situation below 1.3344-50 (daily short-term trend + lower border of the monthly cloud), in order for plans and opportunities to appear in the current conditions.

The bulls currently have the main advantages in the smaller time frames. At the same time, despite the fact that the analyzed technical indicators have adjusted to support bears due to a long correction, it will only be possible to talk about a change in the balance of forces and further strengthening of bears after a reliable consolidation below the key levels. They are currently located at 1.3391 (central pivot level) and 1.3359 (weekly long-term trend), and a reversal of the moving average. In this regard, the intraday upward targets are the resistances 1.3466 (R1) - 1.3517 (R2) - 1.3592 (R3), while the supports of the classic pivot levels are now at 1.3340 (S1) - 1.3260 (S2) - 1.3214 (S3).

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classical), Moving Average (120)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română