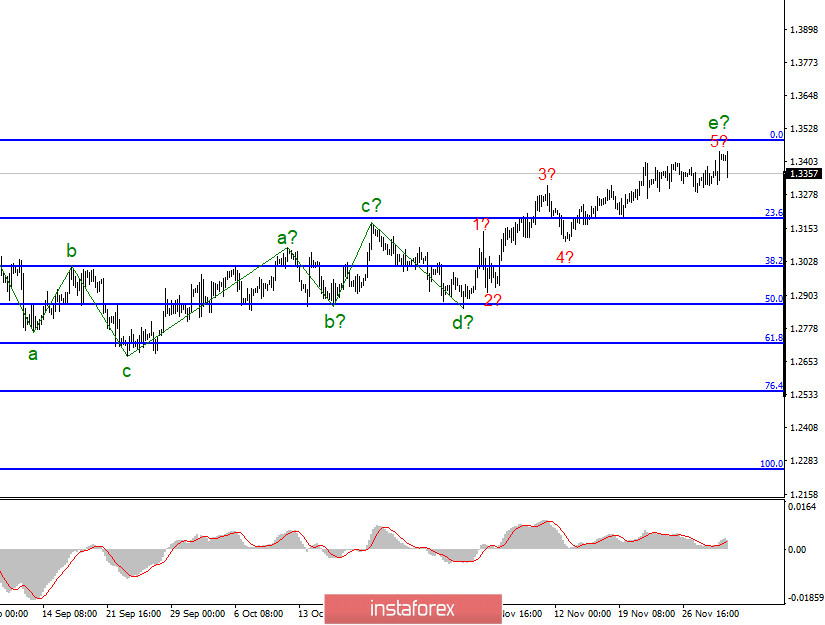

In the most global terms, the construction of the upward section of the trend continues, but the wave marking takes a complex form and may become complicated more than once. The section of the trend that originated on September 23 took a five-wave form, but not an impulse one. A successful attempt to break the previous peak indicates that the markets are ready for further purchases of the British pound. The supposed wave e has also assumed a five-wave form and may be nearing its end. At the same time, the level of demand for the British pound and the news background are now a priority.

The a-b-c-d-e waves of the upward trend section are clearly shown on the lower chart. The assumed wave e took a five-wave form, which is also visible on the chart. But even with this complication, it is nearing completion. Even if the entire upward section of the trend continues its construction and complication, now three waves should be built down, since we clearly see the top five on the chart.

Despite the completed form of the wave e, the pound sterling continues to be in demand in the foreign exchange market. Thus, it seems that the news background supports the British at this time, but this is absolutely not the case in reality. Trade negotiations are ongoing, but there is still no positive information. The British pound continues to increase, although even the wave markings have long indicated the need to build a downward set of waves. But nothing can be done about it. If markets continue to invest in the pound, it will continue to rise.

However, there is a huge amount of negative information. Many analysts believe that negotiations on a trade agreement have once again reached an impasse. The EU has said that the UK will have to adhere to European market rules after the completion of Brexit. London said the EU wants too much. There are still "serious differences" over fishing in British waters. France says it will not give up on the fish issue. Meanwhile, the transition period is less than a month away. Top British officials reiterated that the European Union wants to exert as much influence as possible on their country, while Britain wants to gain full independence and total control over its territories and waters. Therefore, the markets can only wait to see how everything will end.

Yesterday, several economic reports were also released but did not attract the attention of the markets. Business activity in the manufacturing sector in Britain was almost unchanged compared to the value of October. In America, a similar report showed a deterioration, but it still remained at a very high level, which does not cause concerns for the US manufacturing sector. Today, markets can pay attention to the ADP report in America, as well as Jerome Powell's speech to Congress. Although his second speech is unlikely to differ much in content from the first. Also, the markets are still not too interested in all this news and events.

General conclusions and recommendations:

The pound-dollar instrument continues to build an upward trend, but its last wave is nearing completion. Thus, now I recommend looking closely at the sales of the instrument, however, there are still no clear signals about the end of the upward section of the trend from the British. Considering the uncertainty associated with the trade deal and the current wave markup, purchases of the instrument are now quite dangerous.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română