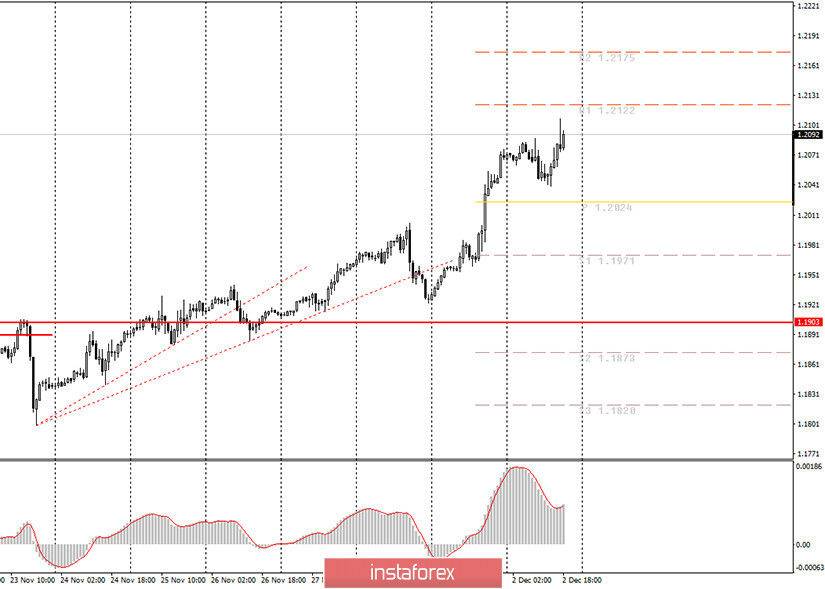

Hourly chart of the EUR/USD pair

The EUR/USD pair corrected by 40 points on Wednesday morning, which is very small compared to last week's movement, and then it went back to moving up. Naturally, the MACD indicator failed to discharge to the zero level and, as a result, it did not react in time to the resumption of the upward trend. Therefore, it took some time for the buy signal to appear. However, in any case, we did not advise novice traders to enter the market. There is an upward trend, one that is clearly visible, but is extremely difficult to work out, especially for beginners. At this time, there is neither a trend line nor an upward channel, which would provide guidance for the pair's movement. Moreover, the quotes of the euro/dollar pair have already crossed two ascending trend lines over the past few days, after which the upward movement resumed anyway. Therefore, most of the technical signals are now false. It is especially not recommended to sell the pair on a strong upward trend.

Only one report that deserved attention was released on December 2, Wednesday. This is the ADP report on changes in the number of employed Americans in the private sector. Their number increased by 307,000, but forecasts predicted an increase of 410,000, so the US dollar could not have gotten support thanks to this data. It did not get support and not because of this reason either. The problem is that the euro is much more expensive now and it grows without any statistics or news, and so the ADP report could have just simply coincided with this. No global news during the day. We do not consider Federal Reserve Chairman Jerome Powell's speech to be an important event, since he has already spoken in Congress several days earlier and we are well acquainted with his speech. He, like European Central Bank President Christine Lagarde, is very concerned about the high number of cases of coronavirus, the prospects for the economy and calls on Congress to allocate funds to help unemployed Americans and small businesses. However, the same situation is now in the EU, which is also in lockdown, which means that the consequences of the second wave of the pandemic will be even tougher for it.

The United States and the European Union will publish indexes of business activity in the service sectors for November. Business activity is expected to remain below the 50.0 level in the EU, but on the other hand, it should be higher in the US. Let us remind you that any value of this indicator below 50 is considered negative. However, in the current environment, these reports are unlikely to affect the course of trading. This also applies to the report on retail sales in the EU for October and the report on claims for unemployment benefits in the United States.

Possible scenarios for December 3:

1) Long positions remain relevant at the moment, but only because the upward trend is still present, which is clearly visible. However, it is extremely difficult to work out this trend now, since there is neither a trend line nor a channel to support it. Formally, you need to wait for a new round of correction and the MACD indicator to discharge to the zero level, and then look for new buy signals.

2) Trading down is not recommended at this time. Although the price crossed the ascending trend lines twice, the upward movement resumed and is still present. So far there is no reason to sell the euro, although the current levels may seem very attractive for selling.

On the chart:

Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now.

Up/down arrows show where you should sell or buy after reaching or breaking through particular levels.

The MACD indicator (14,22,3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines).

Important announcements and economic reports that you can always find in the news calendar can seriously influence the trajectory of a currency pair. Therefore, at the time of their release, we recommended trading as carefully as possible or exit the market in order to avoid a sharp price reversal.

Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română