EUR/USD

The euro surprises more and more. While the pound lost 48 points since Brexit talks came to a standstill yesterday, the euro gained 45 points. With this rise, the euro tried to show that progress in achieving a second stimulus package in the US, worth $908 billion, is more important to it than the UK's presence in the EU. But, we believe, this is a short-term sense of the single currency. Macroeconomic reports also played up to the euro; The unemployment rate in the eurozone fell from 8.5% to 8.4% in October, and in the US, the rate of hiring in the private sector from ADP in November reached 307,000 against an expectation of 433,000.

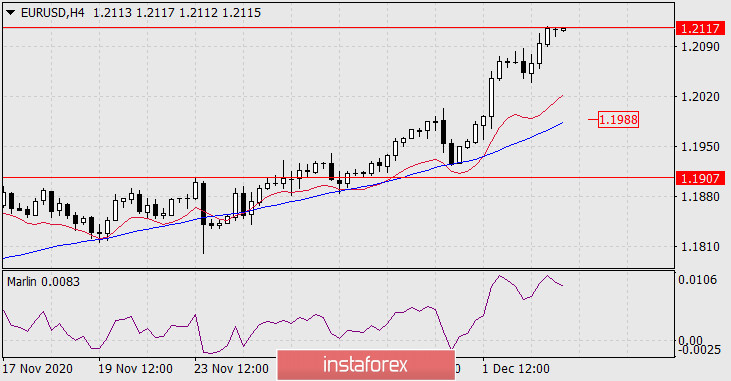

The euro reached the target level of 1.2117 yesterday. Getting the pair to settle above it may lead it to the second target level of 1.2230, but it has almost no time left for that. Today (as announced on Monday) is the last day of the Brexit negotiations.

The Marlin oscillator indicates a sharp downward reversal. Getting the price to settle below yesterday's low at 1.2040 may mean the first act of falling to 1.1620 with intermediate targets at 1.1907 along the MACD line and the price level of 1.1750. We should wait for the development of events.

The four-hour chart shows that the signal line of the Marlin oscillator is forming a double top pattern, but this does not matter in the current global political situation. We just have to wait for the outcome of the Brexit negotiations. The MACD line at 1.1988 also provides support in this scale.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română