Outlook on December 3:

Analytical overview of major pairs on the H1 TF:

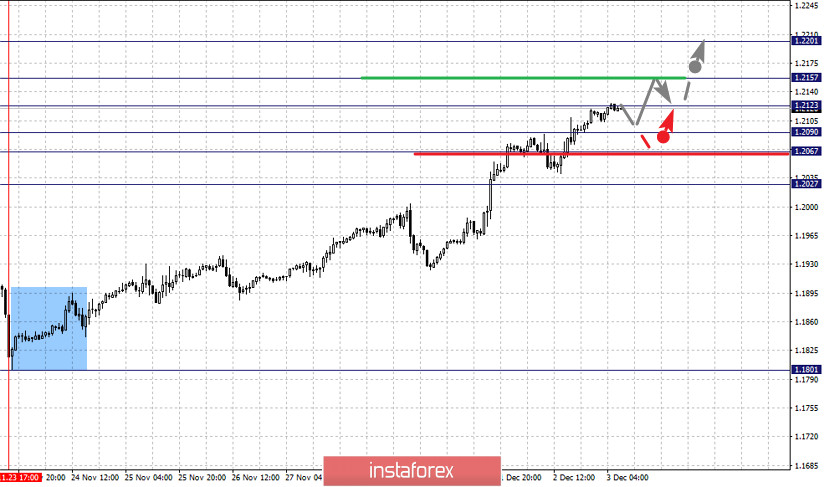

The key levels for the euro/dollar pair are 1.2201, 1.2157, 1.2123, 1.2090, 1.2067 and 1.2027. The ascending trend from November 23 is being followed here. Therefore, a short-term growth is possible in the range of 1.2123 - 1.2157, from which a key reversal into a downward correction is expected. Meanwhile, for the potential target upside, the level of 1.2201 (limit) is considered, however, it is unstable.

A short-term decline, in turn, is possible in the range of 1.2090 - 1.2067. In case that the last value breaks down, a deeper correction may occur. The target here is 1.2027, which is the key support level on the upside.

The main trend is the local upward trend of November 23

Trading recommendations:

Buy: 1.2125 Take profit: 1.2155

Buy: 1.2158 Take profit: 1.2200

Sell: 1.2090 Take profit: 1.2068

Sell: 1.2065 Take profit: 1.2030

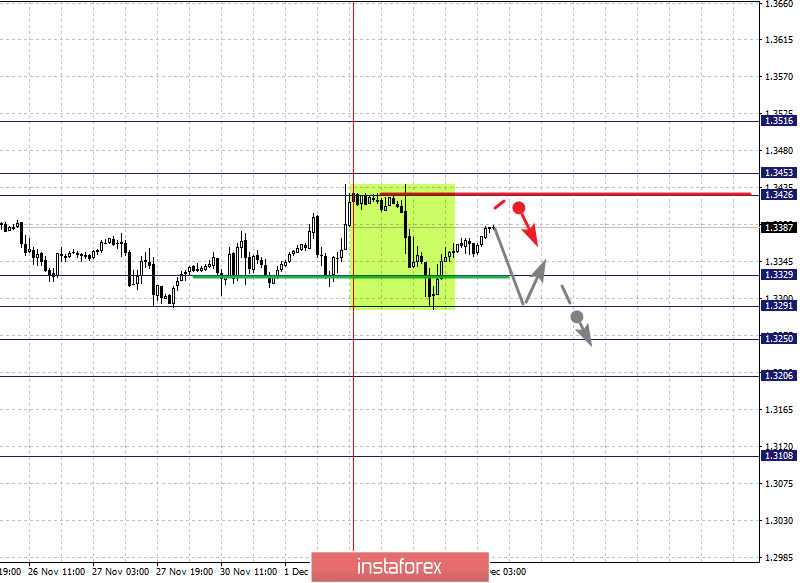

The key levels for the pound/dollar pair are 1.3516, 1.3453, 1.3426, 1.3329, 1.3291, 1.3250 and 1.3206. The price of the pair is in equilibrium and forms a local potential target for the December 1 low. Now, a short-term decline is expected in the range of 1.3329 - 1.3291. In case that the last value breaks down, a deep correction is expected. The target here is 1.3250, which is the upward key support level. If this level breaks down, it will lead to the development of a downward trend. In this case, the potential target is 1.3206.

The upward movement is expected to continue after the price passes the noise range of 1.3426 - 1.3453. In this case, the potential target is 1.3516. But before going to this level, the formation of strong initial conditions for the next development of the upward trend is expected.

The main trend is the local upward trend of November 27

Trading recommendations:

Buy: Take profit:

Buy: 1.3454 Take profit: 1.3516

Sell: 1.3329 Take profit: 1.3292

Sell: 1.3289 Take profit: 1.3250

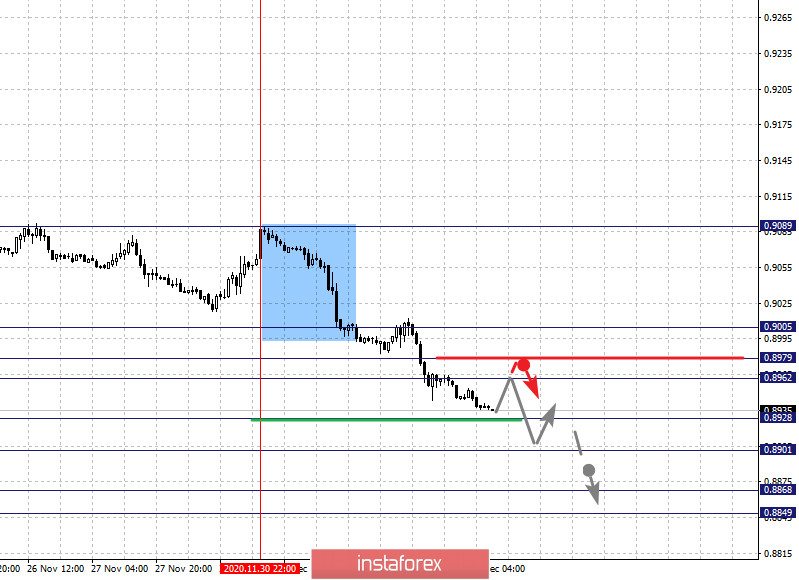

The key levels for the dollar/franc pair are 0.9005, 0.8979, 0.8962, 0.8928, 0.8901, 0.8868 and 0.8849. Here, the resumption of the downward trend from November 30 is being followed. In this regard, a short-term decline is expected in the range of 0.8928 - 0.8901. Considering the breakdown of the last value, there will be a strong decline. Here, the target is 0.8868. The level of 0.8849, in turn, is being considered as a potential target below. Price consolidation and upward pullback are expected after this level is reached.

Meanwhile, short-term growth is possible in the range of 0.8962 - 0.8979. If the last value breaks down, a deep correction is expected. In this case, the target is 0.9005, which is the key support level for the local downward trend from November 30.

The main trend is the local downward trend of November 30

Trading recommendations:

Buy : 0.8962 Take profit: 0.8978

Buy : 0.8980 Take profit: 0.9005

Sell: 0.8928 Take profit: 0.8902

Sell: 0.8900 Take profit: 0.8870

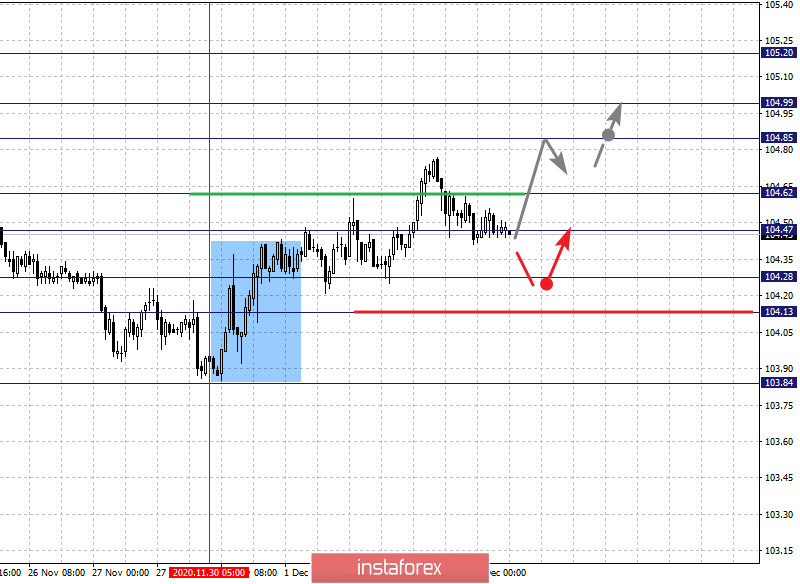

The key levels for the dollar/yen 105.20, 104.99, 104.85, 104.62, 104.47, 104.28, 104.13 and 103.84. The upward trend from November 30 is being followed here. On the other hand, a consolidated movement is expected in the range of 104.47 - 104.62. Breaking through the last level will lead to a strong movement. The target here is 104.85. Meanwhile, short-term growth and consolidation are considered in the range of 104.85 - 104.99. As an upward potential value, the level 105.20 can be considered. Upon reaching which, downward pullback is possible.

In turn, short-term decline is likely in the range of 104.28 - 104.13. In case that the last value breaks down, it will encourage the development of a downward trend. The potential target is 103.84.

The main trend is the upward trend from November 30

Trading recommendations:

Buy: 104.63 Take profit: 104.85

Buy : 104.86 Take profit: 104.97

Sell: 104.28 Take profit: 104.15

Sell: 104.11 Take profit: 103.86

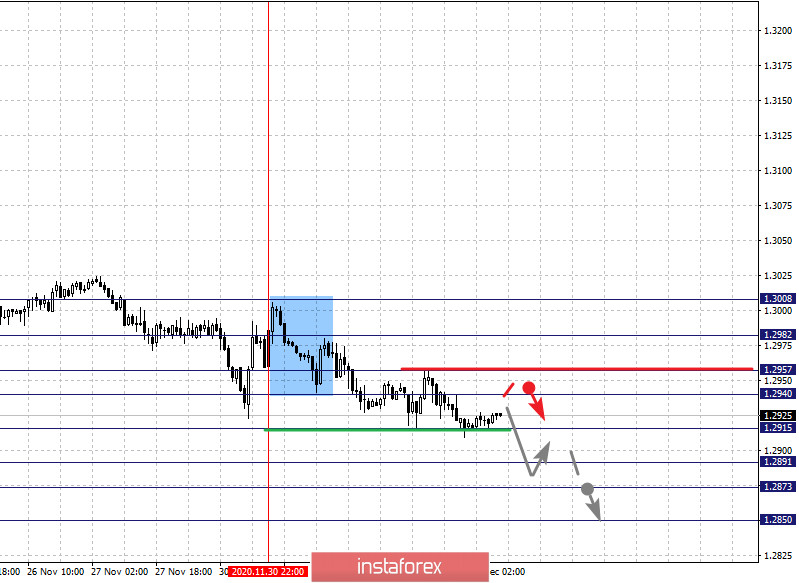

The key levels for the USD/CAD pair are 1.3008, 1.2982, 1.2957, 1.2940, 1.2915, 1.2891, 1.2873 and 1.2850. The price here forms a local downward trend from November 30. Against this background, a downward movement is expected after breaking through the level of 1.2915. In this case, the target is 1.2891. On the other hand, short-term decline and consolidation are observed in the range of 1.2891 - 1.2873. The level of 1.2850, in turn, is considered as a downward potential target. Price consolidation and upward pullback is expected after this level is reached.

A short-term growth is possible in the range of 1.2940 - 1.2957. The breakdown of the last value will lead to the development of a deep correction. Here, the target is 1.2982, which is the key support for the downward trend from November 30.

The main trend is the formation of a local downward trend from November 30

Trading recommendations:

Buy: 1.2940 Take profit: 1.2956

Buy : 1.2958 Take profit: 1.2981

Sell: 1.2915 Take profit: 1.2892

Sell: 1.2890 Take profit: 1.2874

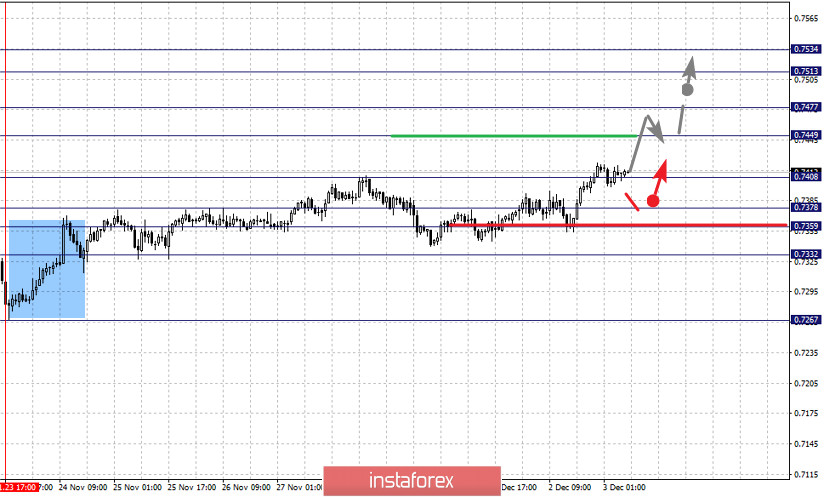

The key levels for the AUD/USD pair are 0.7534, 0.7513, 0.7477, 0.7449, 0.7408, 0.7378, 0.7359 and 0.7332.Here, we are following the local bullish trend from November 23. In this regard, the pair is expected to continue rising after breaking the level of 0.7408. In this case, the target is 0.7449. On the other hand, there is a short-term growth and consolidation in the range of 0.7449 - 0.7477. If the last value breaks down, it will lead to a strong growth. Here, the next target is 0.7513. For the upward potential value, we consider the level of 0.7534. Price consolidation and downward pullback is expected after this level is reached.

In turn, a short-term decline is expected in the range of 0.7378 - 0.7359. The last value being broken will lead to a deep correction. Here, the target is 0.7332, which is a key support level above.

The main trend is the local trend of November 23

Trading recommendations:

Buy: 0.7410 Take profit: 0.7449

Buy: 0.7452 Take profit: 0.7476

Sell : 0.7378 Take profit : 0.7360

Sell: 0.7357 Take profit: 0.7332

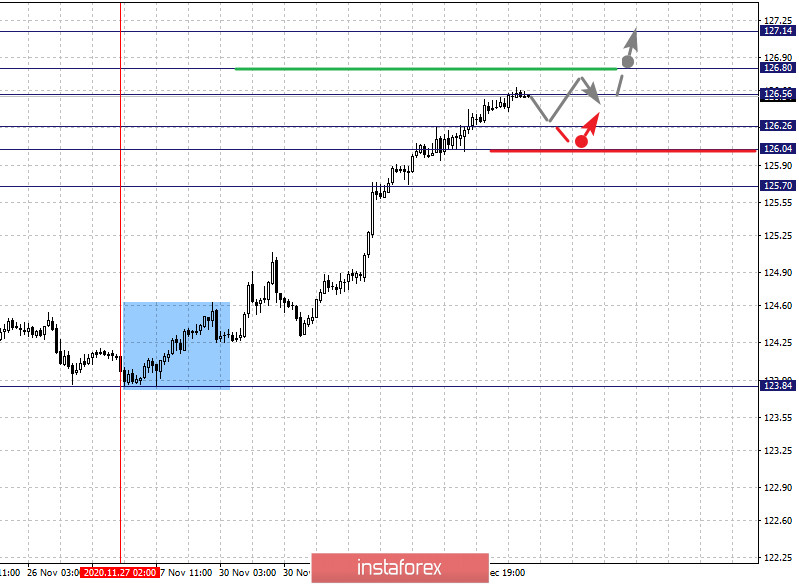

The key levels for the euro/yen pair are 127.14, 126.80, 126.56, 126.26, 126.04 and 125.70. The local upward trend from November 27 is being followed here. In this regard, a short-term rise is expected in the range of 126.56 - 126.80. Given that the last value breaks down, it will allow us to move to the next potential target - 127.14. Upon reaching this level, a downward pullback can be expected.

On the other hand, a short-term decline is possible in the range of 126.26 - 126.04. The breakdown of the last value will lead to a deep correction. The potential target here is 125.70.

The main trend is the local upward trend of November 27

Trading recommendations:

Buy: 126.57 Take profit: 126.80

Buy: 126.82 Take profit: 127.14

Sell: 126.26 Take profit: 126.05

Sell: 126.03 Take profit: 125.72

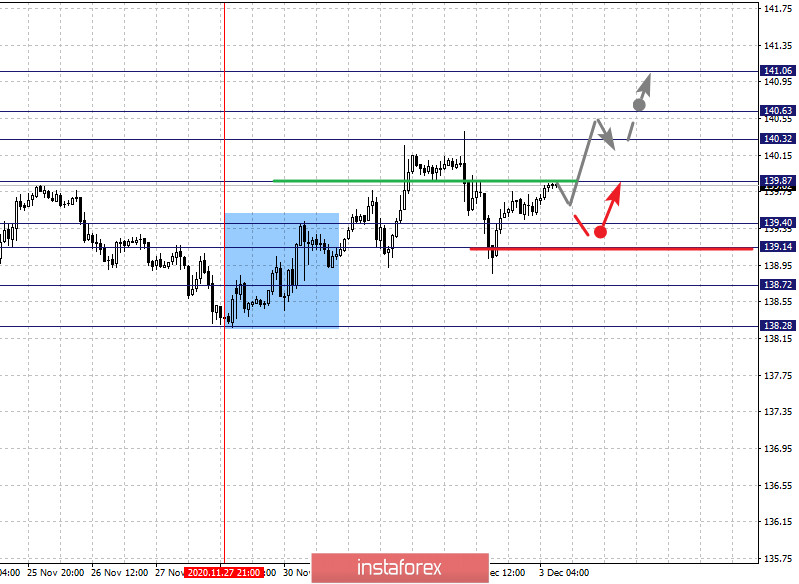

The key levels for the pound/yen pair are 141.06, 140.63, 140.32, 139.87, 139.40, 139.14, 138.72 and 138.28. Here, we are following the upward trend from November 27. In view of this, growth is expected to continue after the breakdown of 139.87. In this case, the target is 140.32. Meanwhile, there is a short-term rise and consolidation in the range of 140.32 - 140.63. For the upward potential value, we consider the level of 141.06. Upon reaching which, a downward pullback is likely.

A short-term decline, in turn, is possible in the range of 139.40 - 139.14. If the last value breaks down, it will lead to a deep correction. The target here is 138.72, which is a key support level for the upward trend.

The main trend is the upward trend for the November 27 high

Trading recommendations:

Buy: 139.88 Take profit: 140.32

Buy: 140.33 Take profit: 140.62

Sell: 139.40 Take profit: 139.15

Sell: 139.10 Take profit: 138.74

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română