Markets continue to rely on the ideas of a new stimulus package in the US and the actual start of the European Aid Fund, which pushed the EUR/USD pair to the levels of April 2018.

Congress Democratic leader, N. Pelosi, as well as Senate's minority head, C. Schumer, called out Senate's majority head, M. McConnell to use a bipartisan plan to stimulate the US economy in the amount of 900 billion dollars. This news shocked the financial markets again and supported the demand for company shares. In addition, Mr. Powell's speech, who supported the idea of low interest rates and the need for measures to support the economy by all means, turned out to be positive.

On the other hand, the topic of using the European Aid Fund in the amount of 750 billion euros, which is expected this month, continues to be discussed in Europe. This also includes speculation about the start of vaccine production at the beginning of the new year, followed by vaccinating the population of Western countries.

However, the markets are still attacked by the steady growth in the number of COVID-19 cases and deaths in both Europe and the United States. According to the latest reports, the number of cases per day has reached 100,000 in the US.

Amid all these events, stock markets continue to rise, but there is no clear growth. Indexes are pulling up to recent highs and are being blamed on profit-taking in company stocks and then it all starts again. And although these declines occur sharply, they are also actively bought back. In turn, the pandemic on Western economies is continued to be ignored by investors. They hope that the invention of effective vaccines will flatten the effect of the pandemic, and then stop it altogether. In view of this, investors who were late to buy earlier shares of companies at attractive prices continue to virtually buy everything that is available.

Markets are also ignoring weak signals about labor markets that remain under pressure from limited quarantine measures. Yesterday's publication of the November employment data in the non-agricultural sector of the US economy from the ADP company turned out to be significantly lower than expected, showing growth in new jobs by only 307,000, against the forecasted 410,000 and the previous October value of 404,000. These figures clearly fit into the previously presented weak values of production indicators in America. However, the market continues to firmly ignore this. The situation with the emergency problems in the US economy as well as in Europe also remains terrible.

The US dollar remains under pressure amid the expected stimulus measures. Its notable decline is based on these expectations and continued demand for company shares. Its growing weakness is due to the demand for company shares, which is associated with euro's growth for a long time, as well as the hopes for the European Aid Fund.

The pair has recently grown sharply, which concerns the ECB. This is because euro's growth is clearly not beneficial for the European economy, which may lead to the regulator's decision to take measures to put pressure on it. In addition, if investors realize that vaccination measures will not quickly solve the problems of COVID-19, this could lead to the euro's collapse in the currency market.

Market's attention today will be focused on the publication of data on the number of applications for unemployment benefits, which is expected to be 775,000 against 778,000 a week earlier. The data from the ISM purchasing managers' index for the US non-manufacturing sector in November will also be released, with an expected decline from 56.6 points to 56.0 points.

Forecast of the day:

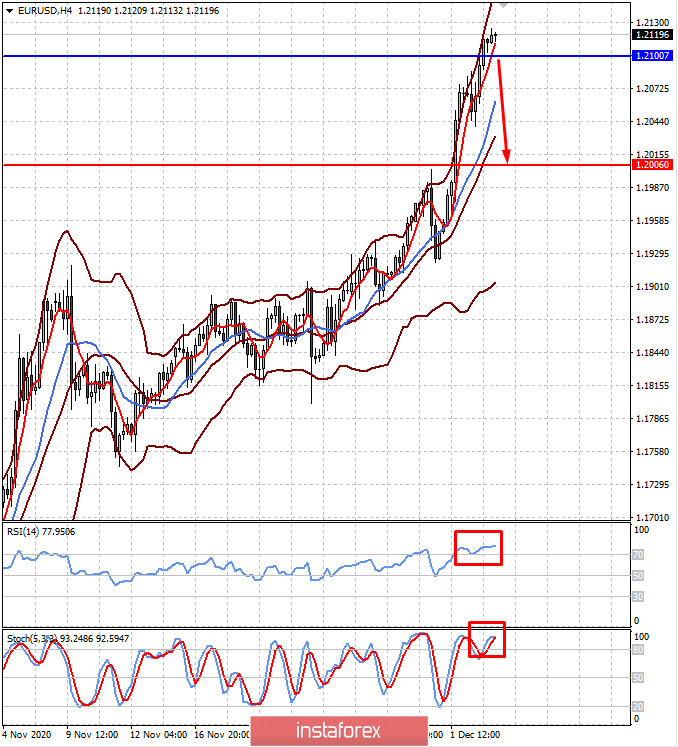

The EUR/USD pair is trading above 1.2100. If it does not stay above this level amid negative data from the US, a 23% Fibonacci correction to 1.2000 is likely. Technically, the pair is strongly overbought.

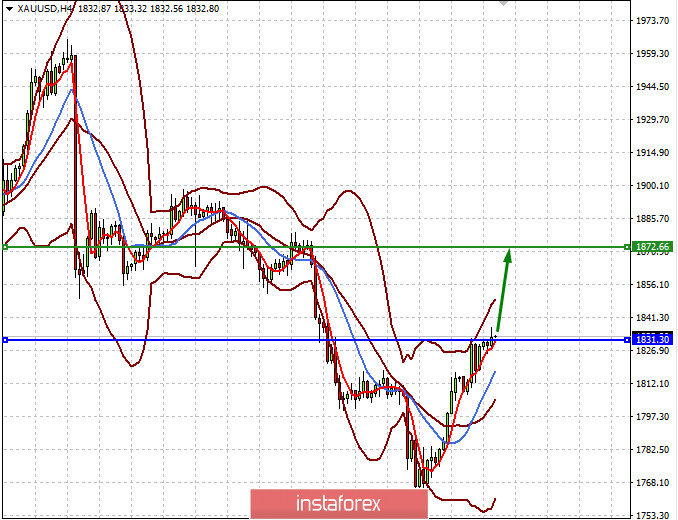

The XAU/USD pair is trading above the level of 1831.30 and is expected to further rise to the level of 1872.66.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română