The most interesting thing happened with the pound yesterday. As soon as London finished their morning tea, the pound declined immediately. It was so quick that it has not been seen for a long time. At the same time, all this happened amid London's decision to issue a certificate for the coronavirus vaccine, and the announcement that vaccination could begin as early as next week. So, it seems like everything is fine and wonderful, since Britain has a chance to become the first country to defeat the pandemic. In this regard, the pound was supposed to rapidly move to new levels or rather, to long-forgotten heights, but it was steadily declining.

This is due to the heads of the foreign ministries of the EU countries. In particular, the French Ministry of Foreign Affairs. Yesterday, a briefing was held by the foreign ministers of the European Union countries with Michel Barnier, who is the main negotiator on the conclusion of the divorce agreement with London. So, the French expressed their fears that Mr. Barnier is making too big concessions to London, and that they still have not seen even the draft agreement, which will soon need to be approved or rejected. There is a quite fair statement that EU countries simply will not have time to study in detail the final version of the agreement. Therefore, the French threatened to veto the agreement. France's position was supported by such small countries as Belgium, Denmark, as well as the Netherlands. But nothing new happened, except for one significant moment.

The fact is that the French Ministers asked Michel Barnier to provide them with a draft agreement so that they could study the main provisions. However, the EU's Chief Negotiator refused to do so other than give them assurances that he was acting strictly within the framework of the mandate given to him. It is clear many of those present did not like this. In general, the likelihood of signing a complete trade agreement not only tends to zero, but also has long become ambiguous. Yesterday's scenario only confirmed this. In view of this, the pound's reaction is related to the simple truth that if the parties fail to sign a trade agreement, London will suffer the greatest losses. Moreover, continental Europe itself will actually benefit from this.

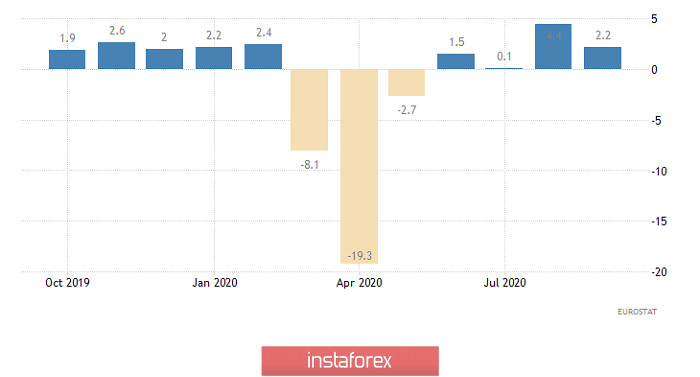

Amid all this event, no one paid attention to the largest revision of the labor market data in the euro area. Formally, September's unemployment rate was revised from 8.3% to 8.5%. But in fact, the data was revised for the previous three months at once, which turned out to be declining all this time, instead of increasing. As of October, the unemployment rate was 8.4%. Therefore, we have to interpret it differently in favor of the single Eurocurrency. To be honest, such a large-scale and fundamental revision of previous statistics were forgotten. It feels like Eurostat just went through a general cleaning and then someone found a folded folder under the table, but in a good way. The European currency should have undergone a serious revaluation due to the revealed information, but investors did not bother, and simply accepted all this information and proceeded. This is a bad thing, as it shows that statistical agencies can pull such tricks, and the markets will not take any action to punish careless officials for their inattention.

In conclusion, it should be noted that the rate of decline in producer prices slowed from -2.3% to -2.0%, which was not revised for the previous month, since it was previously assumed that September's rate of decline in producer prices was -2.4%. However, in this case, the revision was for the better

Unemployment rate (Europe):

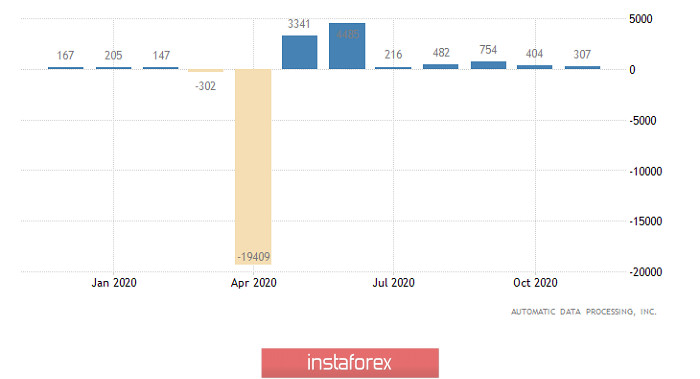

Yesterday turned out to be a kind of data revision day, since the previous employment data was adjusted even in the US, which turned out to have grown not by 365 thousand, but by 404 thousand. However, this was not enough to compensate for the weaker growth employment in the reporting period. The November employment data was expected to rise by 370 thousand, but it only increased by 307 thousand only.

Employment Change (United States):

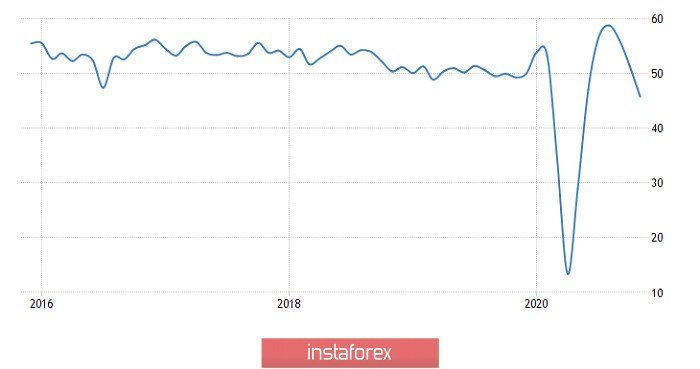

The final results for the remaining PMIs (service sector and the composite index) will be published today. If we talk about the UK, the business activity index in the service sector is expected to drop from 51.4 to 45.8, and the composite from 52.1 to 47.4. However, we must consider that the PMI final data in the manufacturing sector was very different from the preliminary estimate, where the indicator grew instead of a decline. Thus, there is a chance that something similar could happen today.

Services PMI (UK):

The manufacturing index of business activity in the euro area also turned out to be slightly better than the preliminary estimate. There is no growth, but there was a smaller decline than what was expected. Here, the PMI service is expected to decline from 46.9 to 41.3 and the composite index from 50.0 to 45.1, so it is likely that it won't be that bad at all in the end. Moreover, the growth rate of retail sales is likely to sharply rise from 2.2% to 2.6%. This will partly offset the prolonged deflation, which will give the Euro even more confidence.

Retail Sales (Europe):

But if there is a high probability that Europe's business activity indices will turn out to be much better than forecasts, then it is not necessary to count on this in the US. The final index of business activity in the manufacturing sector completely coincided with the preliminary estimate. Thus, there is no reason to doubt that the business activity index in the service sector will rise from 56.9 to 57.7, and the composite index from 56.3 to 57.9. As we can see, these results are very good due to its high values and growth is clear.

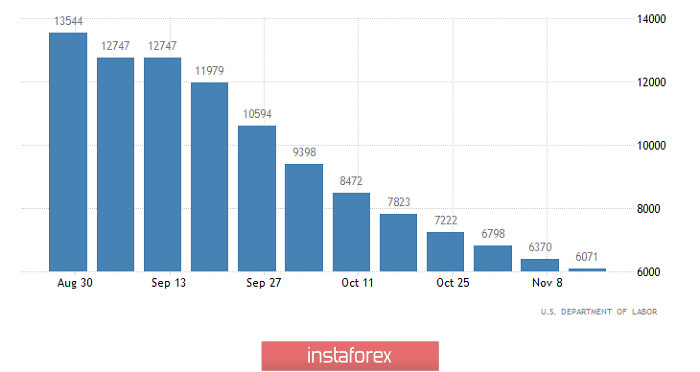

In addition, a further decline in the total number of applications for unemployment benefits is expected. The values of initial applications may decline from 778 thousand to 774 thousand, while the values of repeated applications is expected to decline from 6,071 thousand to 5,890 thousand. In other words, the labor market in the United States continues to recover, which is extremely positive.

Number of re-claims for unemployment benefits (United States):

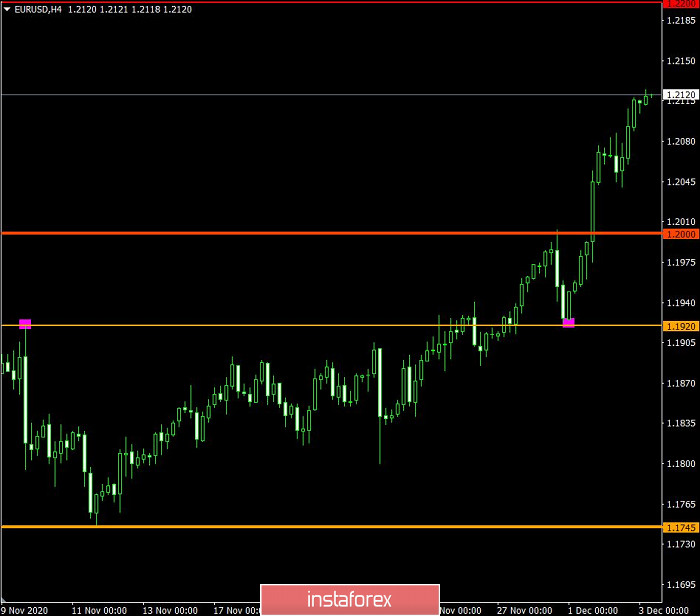

The EUR/USD pair continues to move along an upward course, where the psychological resistance level of 1.2000 is left behind. We can assume that the inertial move can lead us to the next coordinate 1.2200, but it should be noted that a strong price change could develop in the market.

In turn, the GBP/USD pair shows high activity, where the quote managed to locally rise by more than 100 points up/down. The high dynamics did not change the fluctuation pattern, so the quote is still between the levels of 1.3300 and 1.3400. We can assume that the speculative hype will continue in the market, as will the key support and resistance levels.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română