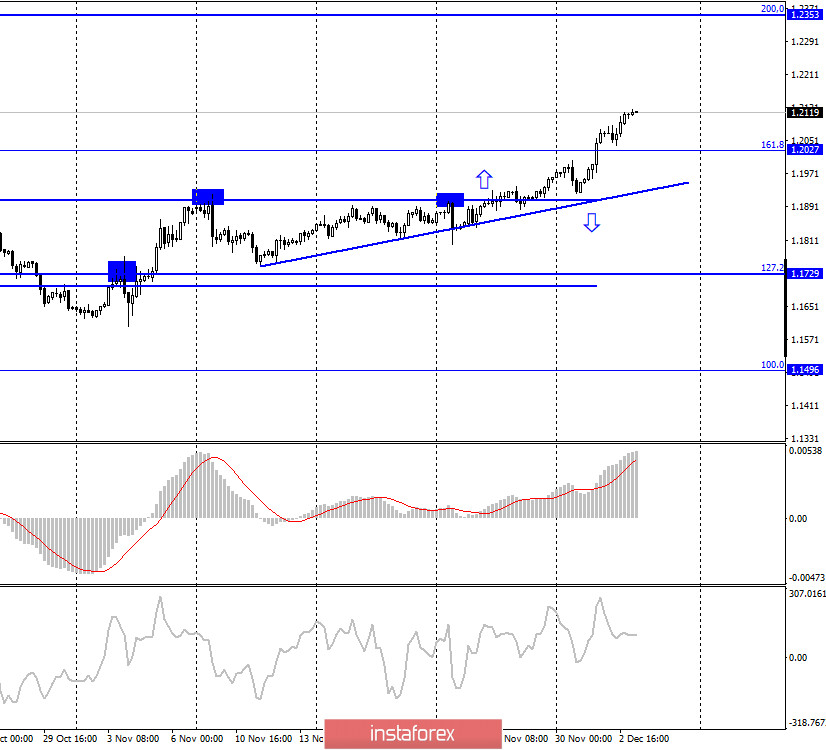

EUR/USD – 1H.

On December 2, the EUR/USD pair continued the growth process and consolidated above the corrective level of 200.0% (1.2094). Thus, now traders can expect the pair to continue growing in the direction of the next corrective level of 261.8% (1.2202). Meanwhile, it is still impossible to say that the current growth of the euro was caused by certain events. There is a lot of interesting news right now, but not all of them support the growth of the euro. Nevertheless, it is the euro that is growing almost without pullbacks and without stopping. If traders look at the usual picture of the movement of the euro currency, then only this factor will be able to conclude that the current movement is unusual. Yesterday, for example, it became known that Donald Trump is going to run for President in 2024. Interesting? It is interesting, however, this news does not make any sense for the euro or the dollar right now. It became known that Joe Biden will not start his work immediately with the abolition of all duties against China. This was stated by the future President of the United States. Jerome Powell, in two speeches to the US Congress, called for the approval of a new package of assistance to the economy as soon as possible. It is especially important to help the unemployed and small businesses, says Powell. This time, it is proposed to allocate about $ 908 billion. Let me remind you that past negotiations between Democrats and Republicans ended with a figure of about $ 1.8 trillion, which in the end did not suit the Republicans. However, traders have been aware of all this for a long time. And Europe has its problems with accepting financial packages. Poland and Hungary have blocked the adoption of a budget for the next seven years, as well as a 750 billion euro recovery fund. In the near future, Germany will try to untie this "Gordian knot".

EUR/ USD – 4H.

On the 4-hour chart, the pair's quotes were fixed above the corrective level of 161.8% (1.2027), which now allows traders to expect growth in the direction of the next corrective level of 200.0% (1.2353). Today, the divergence is not observed in any indicator. Given the nature of the growth of the euro currency (recoilless), I would say that any technical signals now have a small value.

EUR/USD – Daily.

On the daily chart, the quotes of the EUR/USD pair performed a consolidation above the Fibo level of 323.6% (1.2079). Thus, the probability of continuing growth in the direction of the next corrective level of 423.6% (1.2495) is increased. However, more attention should now be paid to the lower charts.

EUR/USD – Weekly.

On the weekly chart, the EUR/USD pair performed a consolidation above the "narrowing triangle", which preserves the prospects for further growth of the pair in the long term.

Overview of fundamentals:

On December 2, the European Union released an unemployment report (8.4%), and in the US – a report on changes in the number of employed from ADP (weaker than forecasts and expectations). Thus, the information background was not in favor of the dollar, but not so bad that the US currency fell by almost 200 points.

The news calendar for the United States and the European Union:

EU - index of business activity in the service sector (09:00 GMT).

EU - change of volume of retail trade (10:00 GMT).

US - number of initial applications for unemployment benefits (13:30 GMT).

US - ISM composite index for the non-manufacturing sector (15:00 GMT).

On December 3, there will be several reports in the EU and the US. Special attention should be paid to the US ISM index.

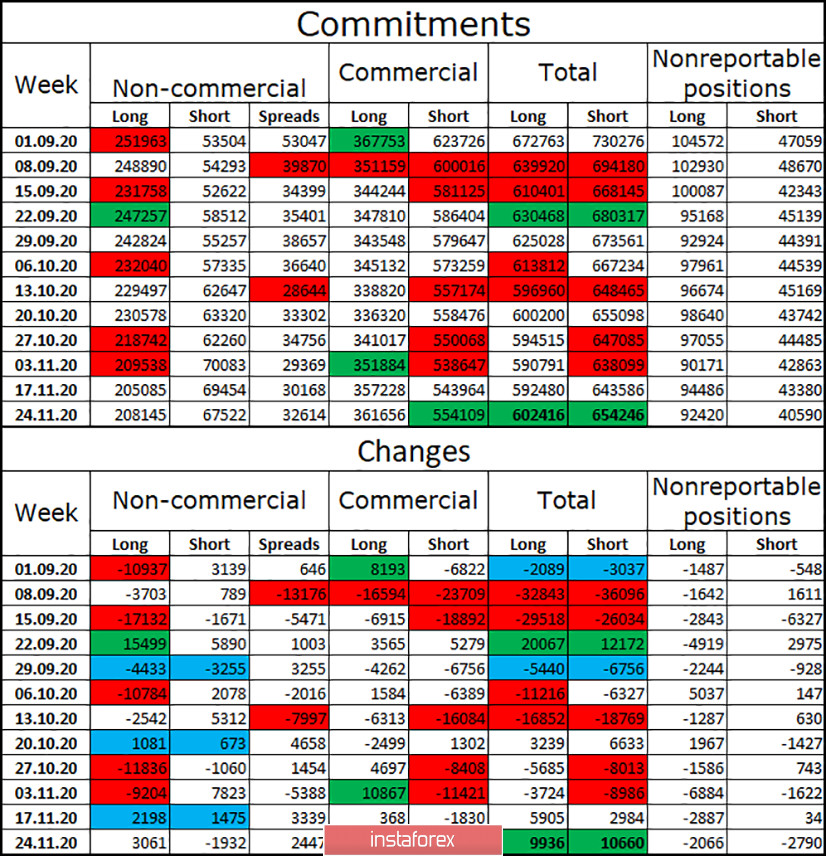

COT (Commitments of Traders) report:

The new COT report was released again late, and again there were few changes in it. The "Non-commercial" category of traders, which is the most important, opened 3,061 new long contracts during the reporting week and closed 1,932 short contracts. Thus, quite unexpectedly, the mood of the major players became more "bullish" after it had become more "bearish" for several months. Perhaps this is an isolated moment and the next report will show a new desire of speculators to get rid of the European currency. However, this is the case now. The total number of Long contracts held by speculators is still extremely high, however, the euro currency has grown quite significantly over the past 9 months.

EUR/USD forecast and recommendations for traders:

Today, I do not recommend selling the euro currency as the pair does not have a single level near the top from which it would be possible to perform a rebound. In purchases, the pair can continue to stay with the target near the Fibo level of 261.8% (1.2202), as it was fixed above the level of 200.0% on the hourly chart.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency not for speculative profit, but for current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română