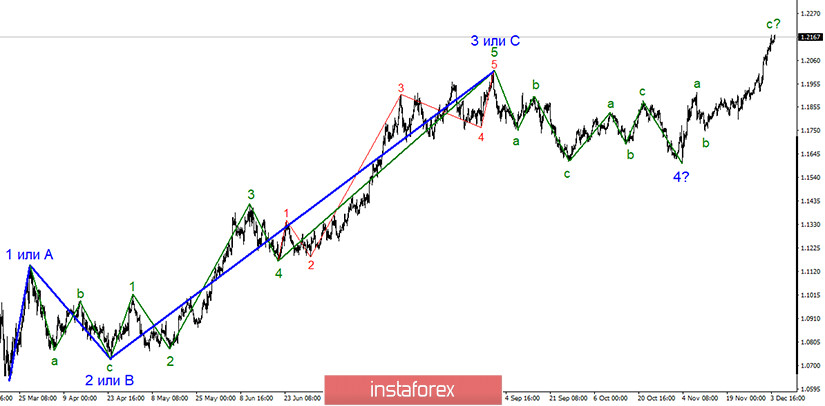

The wave layout of EUR/USD still looks rather complicated, though it doesn't raise big questions. The upward wave which is designated as c is still in progress. It made a successful attempt of breaching a high of wave 3 or C. Thus, another set of three waves is yet to be built. Besides, the ongoing upward trend section could be designated as new global wave 5.

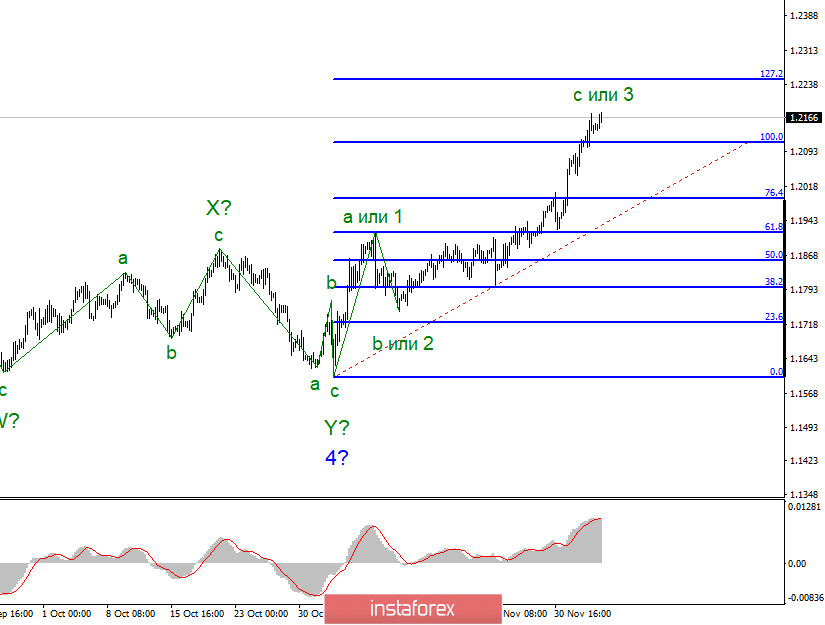

The wave layout of a junior timeframe also indicates a further formation of a new set of three waves. There is another option. An upward section within global wave 5 has emerged again. It began on March 20. The expected wave 3 or C has been breached successfully. It proves that the market is ready for further EUR buying. At the same time, a new Fibonacci grid plotted in line with the size of the first wave means that the expected wave 5 is getting lengthier.

The single European currency is enjoying buoyant demand on Forex, though it is moderating its growth in the latest days. Nevertheless, the US currency is about to enter a free fall. Traders are gladly buying EUR against USD. Such sentiment is likely to last indefinitely. Both the US and EU economies are in dire straits. However, investors are poised to think that the EU economy is more advantageous. Market participants are voicing concerns about a slowdown in the US economy in Q4. From my viewpoint, I doubt a slowdown in the final quarter because an official nationwide lockdown has not been imposed in the US yet. Besides, mass vaccination could be launched before the inauguration of the new President. In his presidential campaign, Joe Biden advocated for tightening restrictions. In case the authorities announce mass vaccination from January 20, they won't have to declare a nationwide lockdown. When it comes to the EU, most countries have already gone through the second lockdown. Some countries are extending such measures for December. So, the EU economy is doomed to incur losses in Q2 2020.

Broad-based weakness of the US dollar comes from expectations of injecting a stimulus package of another $1 trillion in the US economy by Congress or the central bank. During the whole 2020, at least $3 trillion has been already pumped up in the US economy. This amount greatly surpasses the available supply of dollars in the market. Thus, every new trillion will increase the supply but demand remains the same. This could be the main reason behind weakness of the US currency in 2020. The future of the US dollar will depend on how large cash injection will be approved by Congress and how much cash will be printed by the Federal Reserve.

Conclusions and trading tips

EUR/USD is supposed to continue with the formation of a three-wave upward trend section. This section could be over at the near time. Therefore, I would recommend being cautious about buying EUR/USD bearing in mind selling deals. In the meantime, it is possible to buy this trading instrument at every new MACD signal, trading upwards with targets planned at near 1.2250 and 1.2430 that correspond to 127.2% and 161.8% of Fibonacci correction.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română