Reason for the trading strategy (technically):

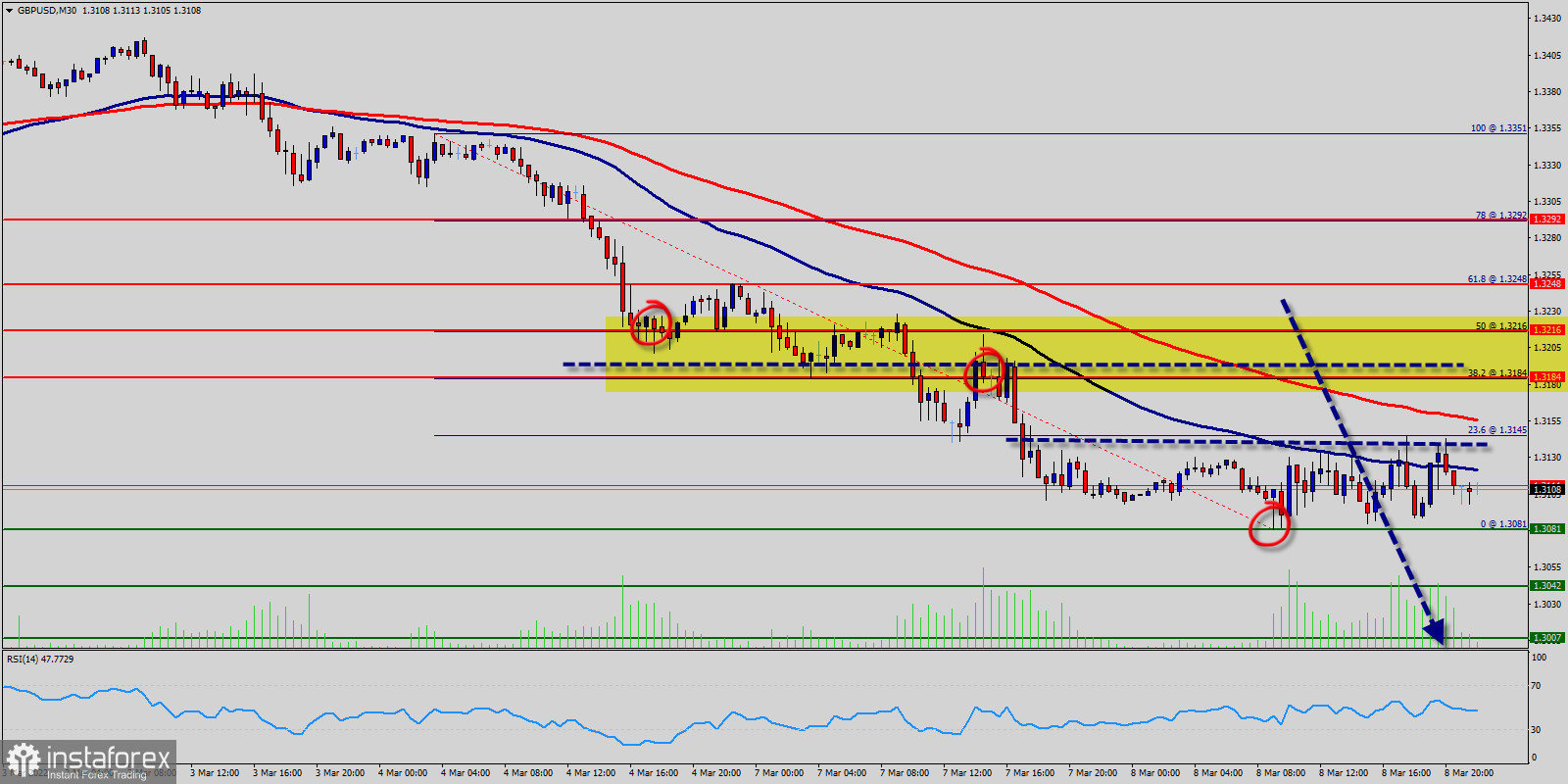

The GBP/USD price extended losses and tested the 1.3081 support. Perhaps, the Cable price surged to 1.3081 before correcting higher. Today, in the M30 chart, the current rise will remain within a framework of correction.

However, if the pair fails to pass through the level of 1.3081 , the market will indicate a bearish opportunity below the strong resistance level of 1.3081 (the level of 1.3081 coincides with the last bullish wave - 32.8% of Fibonacci - daily pivot point).

Since there is nothing new in this market, it is not bullish yet. The GBP/USD pair might continue to move down below the 1.3081 support zone. The next key support is near 1.3081 level, below which there is a risk of a move towards the 1.3081 handle.

The EUR/USD pair has been trading in a downward inclined channel since February 2022. The pair has been moving lower since. After testing and failing to hold below the bottom trendline of the channel - Last top price 1.3351.

RSI is seeing major resistance below 60% and a bearish divergence vs price also signals that a reversal is not impending.

If the trend breaks the support level of 1.3081, the pair is likely to move downwards continuing the development of a bearish trend to the level 1.3042 in order to test the daily support 2 (horizontal green line). Support 3 sets at the price of 1.0307.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română