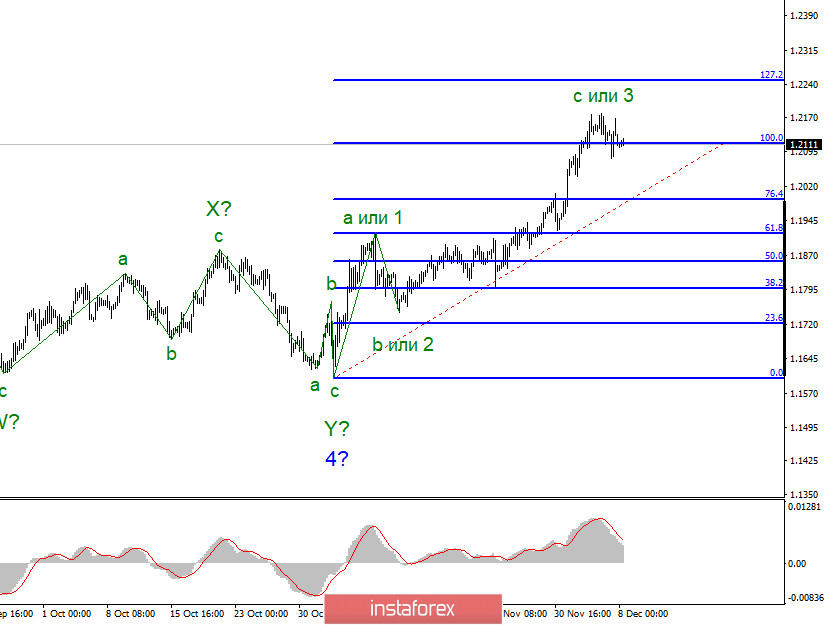

The wave pattern for the EUR/USD pair still looks rather complicated due to several three distinctive sections of the trend, indicated by the number 3. The upward wave identified as C has made a successful attempt to break through the high of the wave 3, or C. Thus, the formation of the next three ascending waves continues. Also, the current ascending section can now be identified as a new global wave 5.

The wave pattern on a lower time frame also indicates the continued formation of the next three-wave section of the trend. Besides, the wave pattern of the trend section, initiated on November 4, has a chance to transform into a five-wave structure. The successful attempt to break through the high of the wave 3, or C, indicates the euro's bullish movement. At the same time, the trend may be completed by the formation of the wave C, followed by the formation of new three descending waves.

The year of 2020 is nearing its end. The demand for the US currency remains low, while the demand for the common European currency is high. The current wave pattern allows for a formation of another upward wave. The macroecocoic calendar for the remaining three weeks of this year includes two rather important events in the EU that may affect market sentment.

The first important event is the ECB meeting. Let me remind you that the European Union does not regard the euro's growth as positive. Both Christine Lagarde and ECB chief economist Philip Lane note that the euro is currently too high, which has a negative impact on trade balance, import-export businesses, as well as inflation, which has been below zero over the past four months. Thus, the ECB is likely to try to lower the euro exchange rate using interventions. Of course, the bank will hardly announce it as other central banks of the world might react negatively and carry out their own interventions. Also, the ECB is likely to announce the expanded asset purchase programme (QE) or the pandemic emergency purchase programme (PEPP). Stronger incentives are expected to put some downward pressure on the national currency. Thus, the demand for the euro may decrease slightly this week, with a view to building a corrective wave.

The second major event is the EU summit. EU leaders will meet in Brussels to discuss core issues for the bloc, including the 1.1 trillion euros EU's regular seven-year budget and a €750 billion recovery fund. Notably, Hungary and Poland blocked approval of the EU's long-term budget and the recovery fund. However, the EU countries may well accept the budget and the fund without them. In this case, Poland and Hungary risk losing access to tens of billions of euros in EU funds. At the same time, the growing discord between the European countries increases tensions, which may continue to develop in 2021. Moreover, nobody knows where the conflict is going to end up. In any case, the EU countries need to agree, otherwise serious problems may arise.

Recommendations and conclusions:

The euro/dollar pair is currently trading in a three-wave uptrend. However, its bullish run is likley to come to an end. Thus, I recommend that you be extremely careful when buying the pair and focus on short positions. Despite the fact that the wave 5 is currently being formed, it will be completed soon. Nevertheless, it is still possible to buy the pair following each of the new MACD buy signals with the targets set near 1.2250, which corresponds to the 127.2% Fibonacci extension level.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română