The only practical result from Boris Johnson and Ursula von der Leyen's dinner discussion is that if the issue of a trade agreement between London and Brussels will not be raised at the EU summit, then no decisions will be made for sure. Both the British Prime Minister and the head of the European Commission have recognized again that the positions of the parties are all very far from each other, and there is no mutual understanding on a number of key issues. Therefore, an unexpected and incredibly new decision was made to immediately resume negotiations and extend them right up to Sunday. In short, the deadline for the completion of the negotiations was postponed again to a later date. If a couple of years ago, the final date could have been shifted by a whole year or a few months, then now, it's about days. The deadlines are running out, since the agreement must be signed before the end of this year. However, this date has also been repeatedly moved.

In general, everything remained as before – London and Brussels failing to move forward and find a compromise solution. This can result in prolonged negotiations, which lead to nothing. Thus, it is not surprising that more EU leaders are expressing their readiness for an unregulated Brexit, that is, without a full-fledged trade agreement with the United Kingdom. Given that there is no progress, the pound has clearly declined. However, it is noteworthy that all this happened even before Boris Johnson's meeting with Ursula von der Leyen. Most likely, everyone knew exactly how it would end.

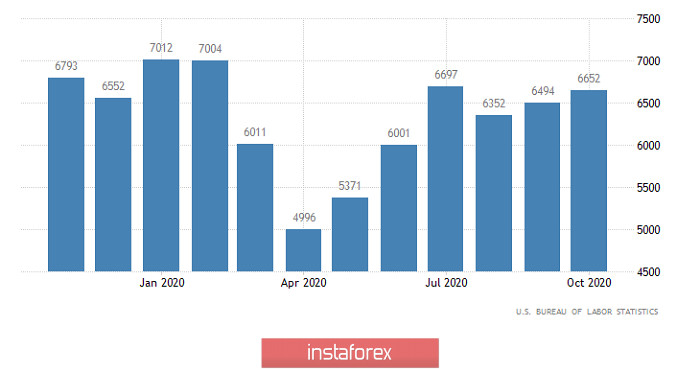

It is quite obvious that while everyone was waiting for the results of Boris Johnson's meeting with Ursula von der Leyen, no one paid any attention to the open vacancies in the United States. Its value did not decline from 6,494,000 to 6,400,000, but rose to 6,652 thousand. In other words, it turns out that it still has reserves to accelerate this process, despite the apparent slowdown in the pace of recovery of the labor market. It can be agreed that this is an extremely positive factor. However, the Brexit situation already has a negative impact on the euro, so the US dollar is still strengthened.

Job Openings (United States):

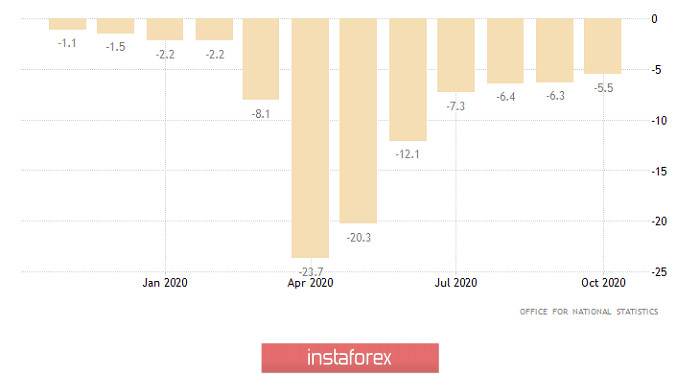

The UK was also pleased with good macroeconomic data. In view of this, data on industrial production published in the morning showed a slowdown in its decline from -6.3% to -5.5%. However, this did not help the pound at all, which is now exclusively worried about the fate of the British economy, which directly depends on whether the EU will sign the trade agreement or not.

Industrial production (UK):

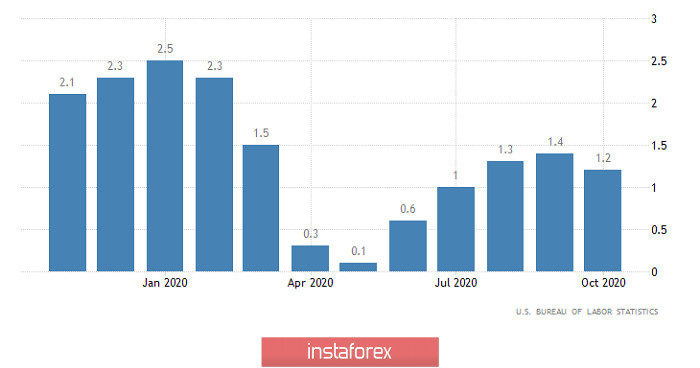

However, the final data on US inflation will be published today, which is always one of the most important events, but not today. First, inflation is expected to remain unchanged, not giving rise to any dramatic changes. Secondly, they will be published exactly at the same time when Christine Lagarde will make a speech.

Inflation (United States):

She will speak at the end of ECB Board's last meeting this year, and her words can really bring down the euro. The fact is that as soon as the COVID-19 pandemic began, the European Central Bank took action and launched an emergency asset repurchase program, in order to support the economies of the euro area countries, which suffered huge losses due to all kinds of quarantine measures. Now, this program had to be somewhat extended and expanded along the way. So, Europe's epidemiological situation has only worsened since then. Germany is planning to almost re-introduce a strict quarantine regime, while similar measures are being discussed in other countries of the European Union.

In general, it is too early to think about full economic recovery. Therefore, it is very likely that Christine Lagarde will announce another expansion of the quantitative easing program today, which is certainly another form of interest rate cuts. So, investors are seriously afraid that the actions of the European Central Bank will simply destroy the government bond market. The consequence of all this will be that investors will look for more attractive assets, somewhere away from Europe, which means they will have to sell the Euro.

The EUR/USD pair has been at the correction stage from the local high of 1.2177 since the current trading week began. Euro's overbought factor has been repeatedly confirmed in the market and the correction stage only slightly smoothen this difficult situation. It can be assumed that sellers still have a chance to direct the quote towards the psychological level of 1.2000. An alternative scenario for the market development is the transition from the correction stage to the side channel 1.2070 /1.2170.

The GBP/USD pair is showing high activity amid Brexit information noise, where speculative market manipulation will occur depending on the nature of the incoming information. The main levels are price coordinates 1.3220; 1.3300; 1.3400; 1.3537.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română