British pound's pullback was expected and even cannot be avoided to some extent. After such a rapid growth with a gap, the pound could only settle its position on the reached levels, if there is a continuous flow of positive news, which is not only limited to negotiations between London and Brussels. However, there is nothing new, except that there seems to be progress on just one of the two key issues that the market has not heard of. At the same time, no details about the agreements regarding the controversial "level playing field" were reported, that is, it is not clear what exactly it was possible to agree on. There were also countless optimistic statements over the past few years that have been made by the UK and the European Union before, but nothing has changed.

As a result, a pullback is unavoidable after a good growth, which has not received any practical reinforcement. This is what exactly happened, albeit incomplete since the gap between Monday's opening and Friday's closing is still not closed. What's funny is that the pound's growth stopped, followed by a decline not because of the lack of any new details, but the COVID-19 pandemic. Unexpectedly, London announced that quarantine measures could be seriously tightened from Wednesday, despite the beginning of vaccination against the virus. In general, everyone suddenly realized that the appearance of a vaccine is not like a magic wand, which will save the world from the pandemic in a flash. This takes time and also, so that the vaccine is really effective not on trials, but in the field. Thus, everything is not so simple here.

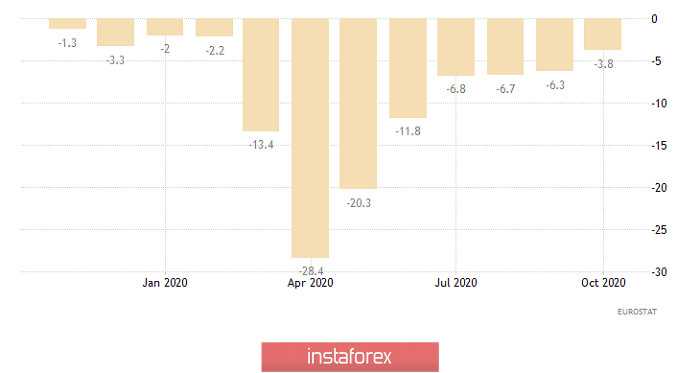

Euro's behavior is extremely interesting again. And although it repeated pound's movements, the scale of its movements is so insignificant that it is rather necessary to talk about inactivity. This is despite the fact that the data on industrial production in Europe were much better than forecasts. The industrial decline slowed down from -6.3% to -3.8%, although a slowdown to -4.4% was expected. Basically, everyone agreed that the rate of decline could slow down to -4.9%. In general, the situation with European industry seems to be recovering quite quickly. However, the single European currency seems to be waiting for something. It may be expecting a Federal Open Market Commission (FOMC) meeting tomorrow.

Industrial production (Europe):

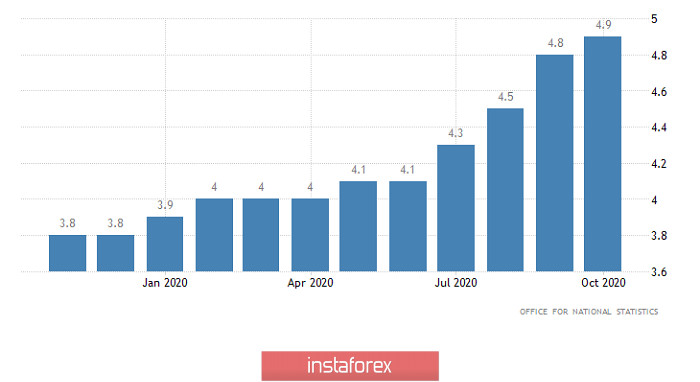

In turn, the pound also ignores macroeconomic statistics. Otherwise, it would have already closed the gap, which is unpleasant to everyone. As expected, the data on the labor market are quite disappointing – unemployment rate rose from 4.8% to 4.9%. It is noteworthy that unemployment in the UK is still rising, while it is slowly declining in Europe and the United States. That alone already suggests that the British economy is in an extremely depressing position. Moreover, there's the prospect of an unregulated Brexit with all sorts of customs duties and benefits.

If we look not only at the unemployment rate, but also at other indicators, then the picture is very gloomy. The employment data declined by 144 thousand, and the number of applications for unemployment benefits by 64.3 thousand. And if employment did not decline as much as expected, then the growth in applications almost doubled expectations. All this is happening amid further acceleration in the rate of wage growth from 1.9% to 2.8%. In other words, it is the least paid workers who are also the least socially protected who are being deprived of their jobs.

Unemployment rate (UK):

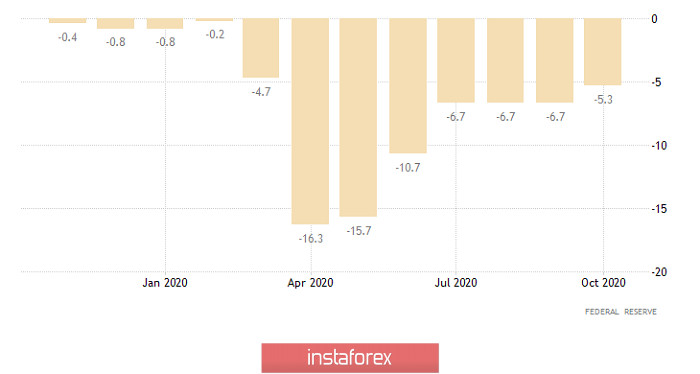

Apparently, the US macroeconomic statistics will not make any influence either, although the rate of decline in industrial production is expected to slow down from -5.3% to -5.0%. In fact, the scale of the slowdown is quite fair and there is no point in making a commotion about it, especially before the FOMC meeting. Therefore, any market activity will only be the result of regular statements and news regarding the progress of London and Brussels' negotiations.

Industrial Manufacturing (United States):

The EUR/USD pair is moving in the area of the local high of the medium-term upward trend of 1.2180, repeatedly slowing down and forming stagnation. It can be assumed that the Euro still has a chance for a correctional movement towards 1.2100, until the quote manages to settle above the level of 1.2180 in the four-hour chart. If this level breaks down, an upward movement to the coordinates 1.2250/1.2300 will be considered.

The GBP/USD pair moved around the range of 1.3310/1.3350, showing extremely low activity after a series of impulsive fluctuations. This kind of stagnation in the market is interpreted as accumulation, which will lead to acceleration as a result. The optimal trading tactic is considered to be the method of breaking one or another border of the 1.3310/1.3350 range.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română