Yesterday, the foreign exchange market was pretty much leaving from side to side, and it can be said with all confidence that it was the busiest trading day recently. In addition to a whole heap of macroeconomic data, which, by the way, went largely unnoticed, there is also the meeting of the Federal Commission on Open Market Operations, and new statements regarding Brexit. It is worth starting, as the day began with the growth of European currencies, the reason for which was the next loud statements of various officials. If you believe the representatives of London and Brussels, the parties seem to have already reached agreements on all possible issues, and it remains only to solve the problem with fishing. All major disagreements have already been resolved. It is clear that this gave everyone confidence that there will be no unregulated Brexit, and the UK and the European Union will not experience an economic shock on January 1. The alarming thing is that since that fateful referendum, such statements have been made more than once. If I remember correctly, it is at least twice a year. Only time after time, after such loud statements, the parties suddenly suspended negotiations, and mutual accusations of all mortal sins poured in. They say that one or the other side puts up some unexpected requirements and conditions that are simply cannot be accepted. But in fact, from time to time, from one round of negotiations to another, the same unsolvable issue always creeps over - the norms of state regulation and measures of state support for the economy. As a matter of fact, it is around this topic that everyone has been trampling for several years. But at the moment, everyone is optimistic about the future, as some kind of breakthrough is once again announced.

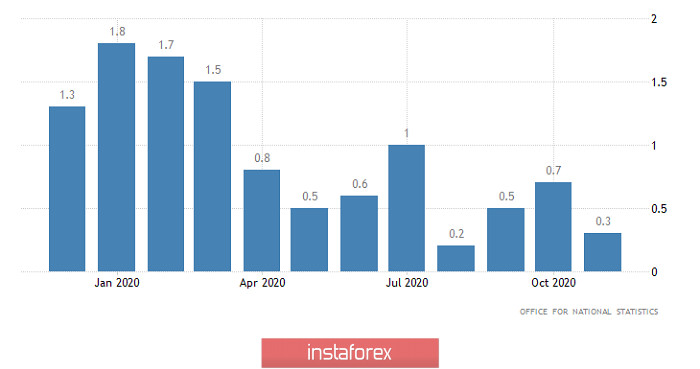

Meanwhile, things in the British economy are really not in the best condition, although preliminary estimates of business activity indices suggest the opposite. In particular, the index of business activity in the service sector increased from 47.6 points to 49.9 points. The manufacturing index rose from 55.6 points to 57.3 points. As a result of all of this, the composite index rose from 49.0 points to 50.7 points. However, we expected a slightly larger growth. In addition, the business activity index largely reflects the sentiment of business, and if you tell them that the trade agreement is about to be signed and everything will be fine, then this very business will look to the future with optimism. However, inflation clearly suggests that everything is not doing good, as the growth rate of consumer prices slowed from 0.7% to 0.3%. The growth was expected to 0.8%.

Inflation (UK):

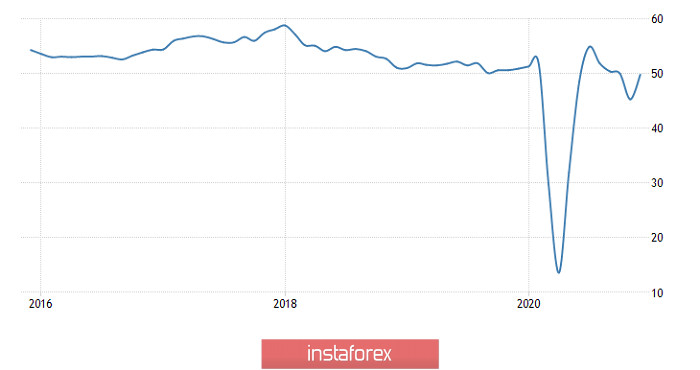

European business activity indices actually exceeded even the wildest expectations. In particular, the index of business activity in the service sector increased from 41.7 points to 47.3 points. The index of business activity in the manufacturing sector increased from 53.8 points to 55.5 points. Well, the composite index of business activity rose from 45.3 points to 49.8 points. The most interesting thing about all this is that all business activity indices were predicted to decline. But the trick is that these measurements were made even before Germany announced the introduction of a strict quarantine, the same as it was in effect this spring. So then, the business was still hoping for Christmas holidays and the like. Now, Europe has no time for Christmas. Brexit has nothing to do with it, because in the long run, if London and Brussels can not sign a trade agreement, Europe only benefits.

Composite Purchasing Managers' Index (Europe):

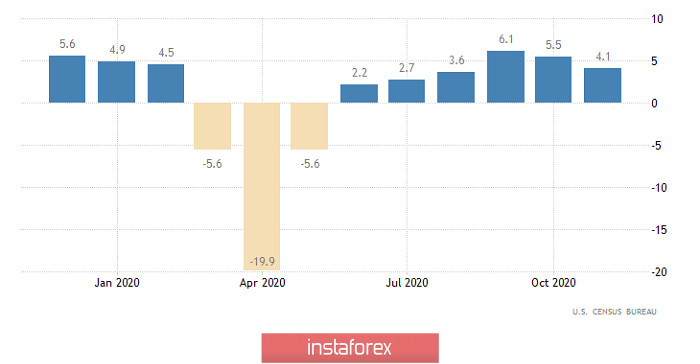

However, if European currencies were growing before the opening of the American session, then as soon as American traders started working, the direction of movement changed dramatically. We can not say that it's all about macroeconomic statistics, which turned out to be simply horrific. Therefore, the growth rate of retail sales slowed from 5.5% to 4.1%, although a slowdown to 5.4% was forecasted. Ergo, sales literally collapsed. In addition, the index of business activity in the service sector fell from 58.4 points to 55.3 points. The manufacturing PMI fell from 56.7 points to 56.5 points. As a result, the composite PMI fell from 58.6 points to 55.7 points. Of course, the decline was expected, but not so significant.

Retail Sales (United States):

It's all about the Federal Open Market Commission meeting—or rather, its highly-anticipated results. Virtually, no one doubted that the Federal Reserve would further ease monetary policy by expanding its quantitative easing program. Well, since everyone anticipating such a decision, then as usually happens, the market goes in the opposite direction until the event itself. But at the most crucial moment, the unthinkable happened, and the dollar began to strengthen at an incredible speed. It turned out that the Federal Reserve left everything as it is, and no one expected this. But the situation was corrected by Jerome Powell. During his press conference, the head of the Federal Reserve System noted that both quantitative easing programs will operate as long as necessary. In fact, they are extended indefinitely. This can only be called as another expansion of the quantitative easing program. At the same time, the Federal Reserve System did not even bother to indicate at least some terms of validity of these programs, which means that it is completely unclear how much more money will be additionally poured into the American economy. But in general, such a step was quite expected. The epidemiological situation in the United States is simply terrifying, and it is at the time to call it apocalyptic, and the Congress and the Senate can not decide on measures to support the economy. Therefore, the Federal Reserve is forced to take over the function of saving the American economy.

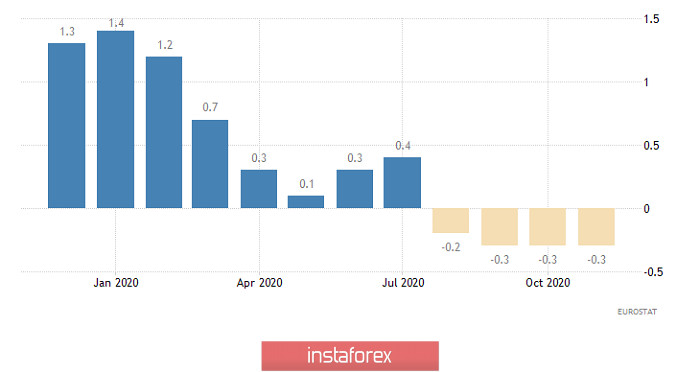

Only a slightly less busy day awaits us today, and the first thing we can probably pay attention to is the inflation in Europe. However, these data will not affect the foreign exchange market at all. First, the rate of decline in consumer prices should remain at the same level of -0.3%. Deflation in Europe has been going on for four months in a row. Secondly, this is the final data, and they are already considered by the market at the time of publication of the preliminary assessment.

Inflation (Europe):

The main event of today will be the meeting of the Board of the Bank of England, which may well present unexpected surprises, and seriously stir up the foreign exchange market. Formally, the Bank of England has no choice but to ease its monetary policy whether it is an expansion of the quantitative easing program, or a reduction in the refinancing rate. After all, the European Central Bank and the Federal Reserve have done just that. And since the world's largest central banks are taking such measures, the others have no choice but to follow their example. Otherwise, significant economic losses could be incurred. With Brexit, everything is not so clear, and there is still no trade agreement, just rumors and optimistic forecasts. But the timing is tight, and if no agreement is signed, then from January 1, the British economy will experience a real shock. And of course, the coronavirus pandemic should not be forgotten, which is still going on, although everyone is only doing that, shouting about the vaccine and the like. However, quarantine measures only tighten. In general, there are plenty of reasons for some easing of monetary policy. But just because of the uncertainty regarding Brexit, the Bank of England may decide to leave everything as it is for now, and wait for the final resolution of the situation. The British regulator has done this more than once. The trouble is that there are enough reasons for easing monetary policy, and delaying the adoption of this decision can play a bad joke with the Bank of England. Nevertheless, if the parameters of monetary policy remain unchanged, the pound may well overcome the highs of the last couple of years. Well, if the Bank of England still decides to take emergency measures, then its rapid decline is worth waiting for.

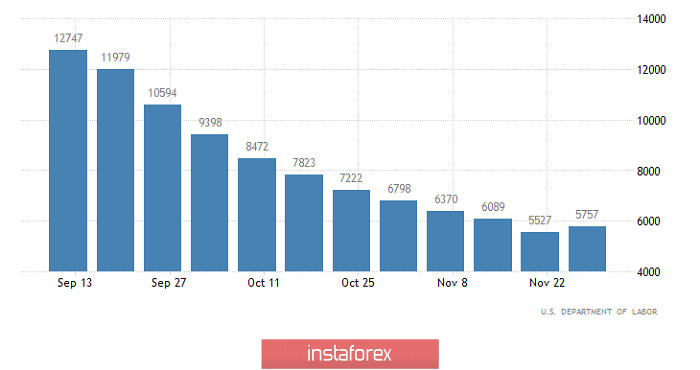

It is clear that against this background, no one will pay attention to applications for unemployment benefits in the United States. Although they are of some interest, since after the growth last week, their number may again go down. Thus, the number of initial applications should be reduced from 853 thousand to 815 thousand. The number of repeated applications may decrease from 5,757 thousand to 5,650 thousand. This means that it is still too early to panic. Yes, the labor market recovery has certainly slowed down considerably, although unemployment is still extremely high. But the most important thing is that this very recovery is still ongoing, which means that there is still hope that the economy will soon recover from the blow caused by the coronavirus pandemic.

Number of repeated applications for unemployment benefits (United States):

The euro/dollar currency pair, consistently updating local highs, reached 1.2235, where the resistance area of 1.2250/1.2300 is located in the immediate vicinity. It can be assumed that the resistance area will try to restrain buyers, which can lead to stagnation and, as a result, to a correction.

The pound/dollar currency pair has once again updated the local maximum of the medium-term upward trend, touching the area of interaction of trading forces of 1.3550/1.3650 as a result. It can be assumed that the 1.3550/1.3650 area will try to restrain buyers and direct trading forces to a pullback or stop. In the condition that the speculative hype does not decrease, and the quote manages to be fixed above 1.3650 in the four-hour period, then further moves in the direction of 1.3750-1.3800 are not excluded.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română