The market has been living only by rumors, speculation and gossip for too long, which certainly does not add stability. However, what happened yesterday stands out even from the already familiar outlook. Not only did the trading open with a noticeable gap down, but the euro sharply continued to decline. In general, all this was more like a panic collapse or risk aversion. This is caused by only one risk – unregulated Brexit. In particular, London and Brussels could not agree on anything over the weekend. The UK was even more preoccupied with the new quarantine, although it is not throughout the country. But for the majority, London is the whole of Great Britain and the rest of the British Isles are more likely to be perceived as its suburbs. And London did not escape the re-introduction of strict quarantine, just like last spring. However, nothing good happened regarding the trade agreement either, since the officials of the UK and the EU were more likely to say that there was still no progress, and time is running out. In general, Boris Johnson even openly stated that he excludes the very possibility of extending the transition period to 2021. Simply put, if the agreement is not prepared right now, then it will not be at all. So an unregulated Brexit, with all its remarkable consequences in the form of an economic shock to the economies of the United Kingdom and the European Union, has become the most likely scenario once again. However, this could not continue for long, and so, the Euro quickly soared before the opening of the US session. It rose so much that they did not even notice how they closed the gap between Friday's closing and Monday's opening. In fact, this is due to the rumors and not some official statements there.

According to sources close to the negotiations on the trade agreement, London is ready to make concessions on a number of issues if Brussels reduces its requirements for the volume of fishing. Such reasoning was strengthened by the fact that Boris Johnson and Emmanuel Macron during their telephone conversation also discussed Brexit, in addition to the issues of closing the border between Great Britain and France. It seems like they were both pleased with the results of this intimate conversation. In general, it seems that unregulated Brexit is being postponed again. However, all these are just emotions that interfere with a rational understanding of what is happening. After all, the whole trick is that everyone was assured a few days ago that there was only one unresolved issue – fisheries, which means that there are no more complaints on all other issues. But then what concessions is London willing to make? Is it those points that have already been agreed and are not being returned to? Is it a number of already closed issues or some points that were agreed, but everyone was not too happy with it? In other words, we can assume that Brussels made clear concessions in favor of London on a number of issues. Now, it is understandable why Michel Barnier at one time refused to submit even a preliminary draft agreement to the heads of the Ministries of Foreign Affairs of the European Union countries. They would have turned him down at once, since there are such serious concessions to London. After all, the representatives of some major European countries, including France expressed these fears.

Therefore, everything is not so clear with all these reports about some kind of concessions and the like, which includes the fact that all the main issues have supposedly already been resolved. Even the very number of questions that arise as a result of yesterday's reports clearly indicates that the growth of European currencies was exclusively emotional. And, judging by the behavior, emotions overwhelmed some teenagers who still do not even understand what it is and how to control them. In general, common sense was not used in this situation.

Although the euro showed its gradual weakening since the morning, it is too early to say that market participants are using their common sense again. A technical rebound is expected to occur after such an impressive growth, which is apparently happening right now. But more importantly, all these emotions were obscured by real macroeconomic data, which strangely turned out to be pretty good.

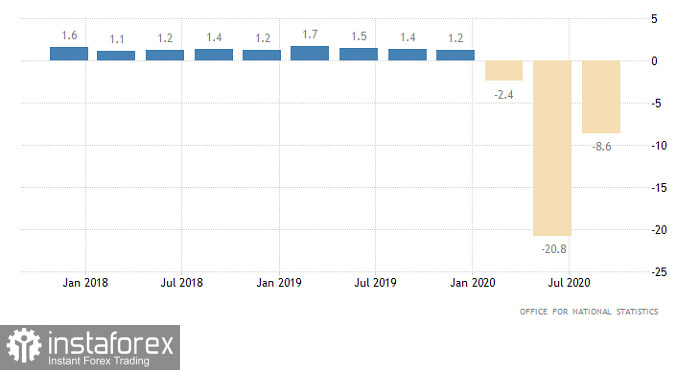

We are talking about the final data on the UK GDP for the third quarter that turned out to be much better than the preliminary estimates. Previously, it was assumed that the pace of economic decline would slow down from -21.5% to -9.6%, but the final data showed that the rate of economic decline slowed down to -8.6% and that's not entirely bad. Moreover, the previous results were also revised for the better. GDP for the second quarter declined by -20.8%. Therefore, we can say that the data is actually pretty encouraging. It turns out that things are not as bad as intended. More precisely, everything is bad, but not terrible.

GDP growth rate (UK):

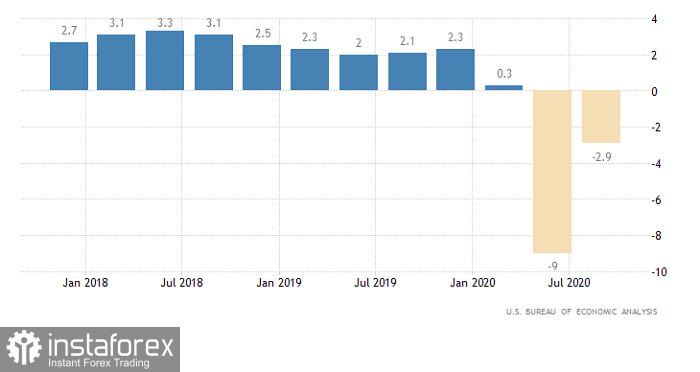

The final data on US GDP will be published today, which should coincide with the preliminary estimate. And judging by which, the rate of economic decline is expected to slow down from -9.0% to -2.9%. Thus, if the forecasts are confirmed, no reaction is expected to follow, since all this has already been considered. However, even if the data turns out to be somewhat different, there will be no effect, since the market is currently occupied with Brexit issues. In other words, European politicians will decide the fate of the currency market, depending on what kind of statements they will make.

GDP Growth Rate (United States):

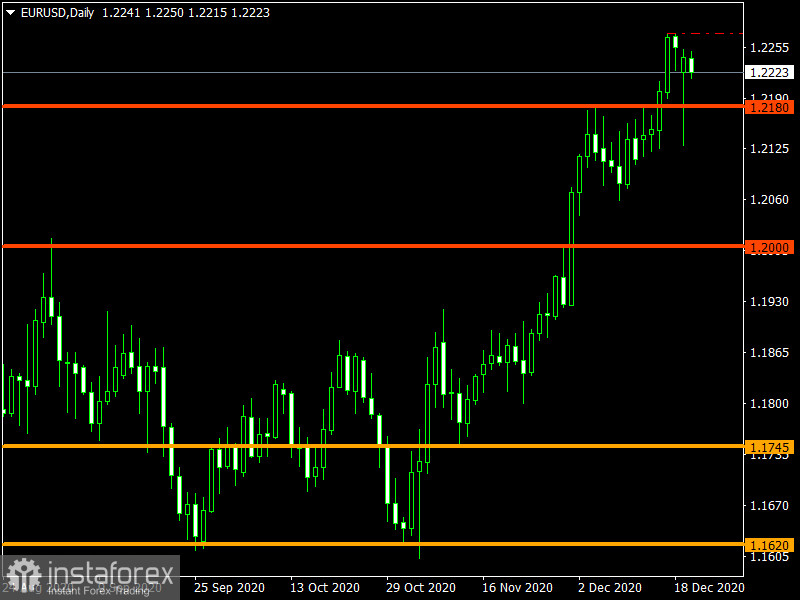

The EUR/USD pair returned to the area of the conditional high of the medium-term upward trend after strong price fluctuation. The overbought factor of the euro has been repeatedly confirmed in the market, but the strong speculative hype does not give sellers the opportunity to deploy a full-scale correction. We can assume a temporary price fluctuation between the levels of 1.2180 and 1.2275, where the method of breaking through a particular border is the best trading tactic.

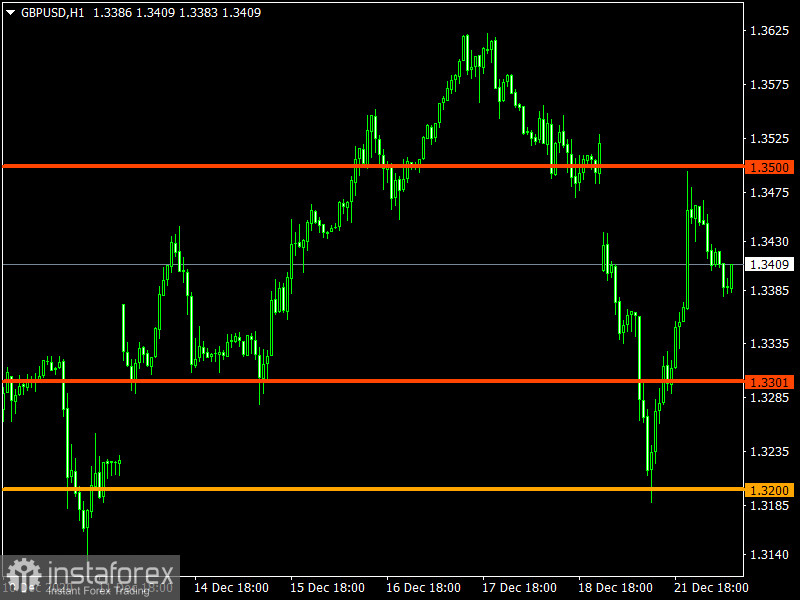

The GBP/USD pair showed a high speculative hype amid information flow, where the quote initially declined to the level of 1.3200, and then recovered to its previous levels. We can assume that speculators will continue to move based on the information flow, creating more and new impulses depending on the nature of the incoming information.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română