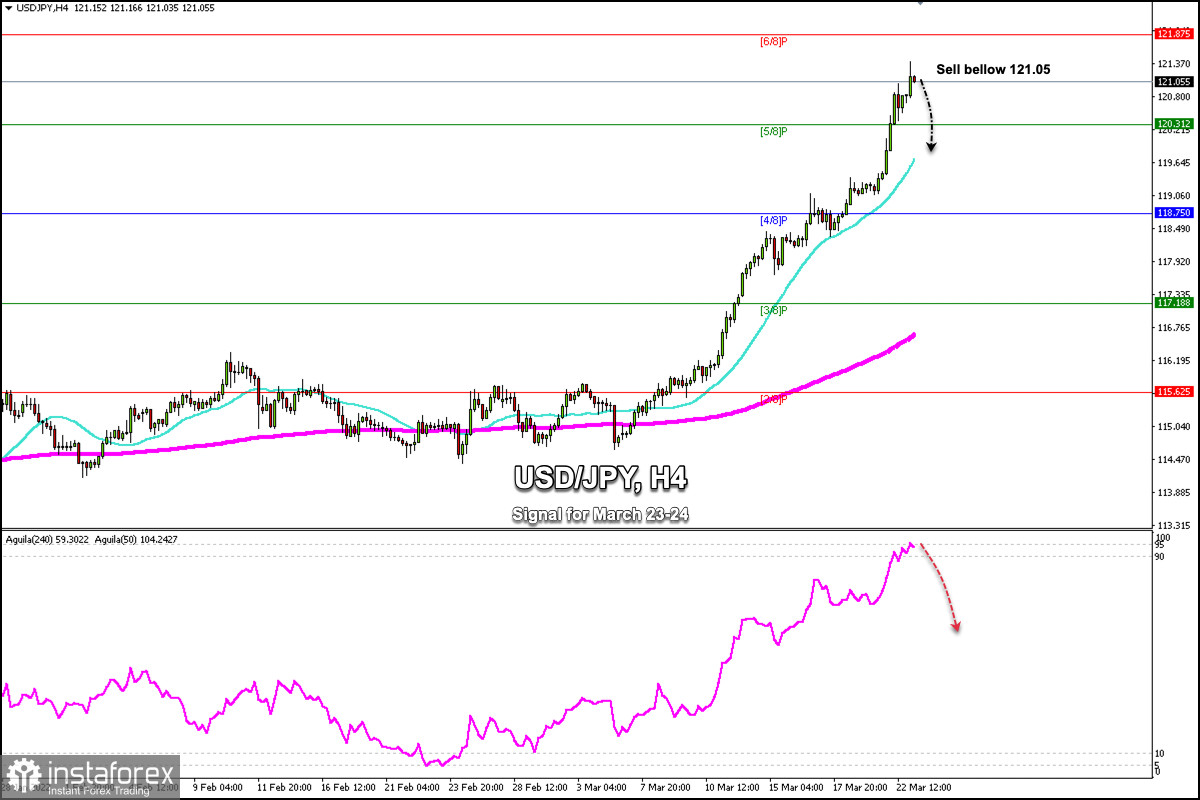

Earlier in the Asian session, the USD/JPY pair reached a high of 121.40. This upward movement of the yen is due in part to the Fed's aggressive change in its monetary policy.

The extent of the move higher in USD/JPY makes some traders concerned that conditions are becoming overbought, but a failure to break above 6/8 at 121.87 could start a technical correction.

Since the beginning of March, the Japanese yen began a strong upward movement from the area 114.40 and reached the level of 121.40 a few hours ago. USD/JPY has risen approximately 700 pips. A technical correction is likely in the coming days as technical indicators have reached overbought levels.

The likely corrective move could have its first target at the 21 SMA located at 119.64. A daily close below the moving average of 21 could accelerate the bearish move towards 4/8 Murray at 118.75 and the price could reach the 200 EMA level at 116.80.

Conversely, a pullback to the top of resistance at 6/8 Murray at 121.87 will give us an opportunity to sell with targets at 120.31 and 118.75, only if the yen fails to consolidate above this level.

For several days, the eagle indicator has been oscillating in an extremely overbought zone and is giving an imminent signal of a technical correction.

Given that the yen is approaching the 6/8 Murray zone located at 121.87, it is expected that below this level there will be a downward correction and it will be a good opportunity to sell, with targets towards the psychological level of 120.00 and 118.75.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română