Since the fortnight of March, Ethereum (ETH/USD) continues its trend when it traded around 2,500 and now the price is 3,310. The Ether has an accumulated gain of more than 33% which is leading it to reach an area of extreme overbought.

The last two weeks, ETH recorded good gains supported by the bullish trend of bitcoin, but this could change if the market sentiment turns negative.

The price of Bitcoin, Ethereum and other cryptocurrencies are enjoying a positive week and accumulating good percentage gains, free from negative news about Ukraine or Russia.

We expect to see more rallies in the cryptocurrency market, but most risky assets are overbought and could drag ETH.

If the EU decides not to buy from Russian gas supplies, which opens the possibility of further Russian retaliation in Ukraine. That would send global markets back into risk aversion mode, and Bitcoin price will fall to the support level of 37,500 and ETH could drop to the bottom of 2,500.

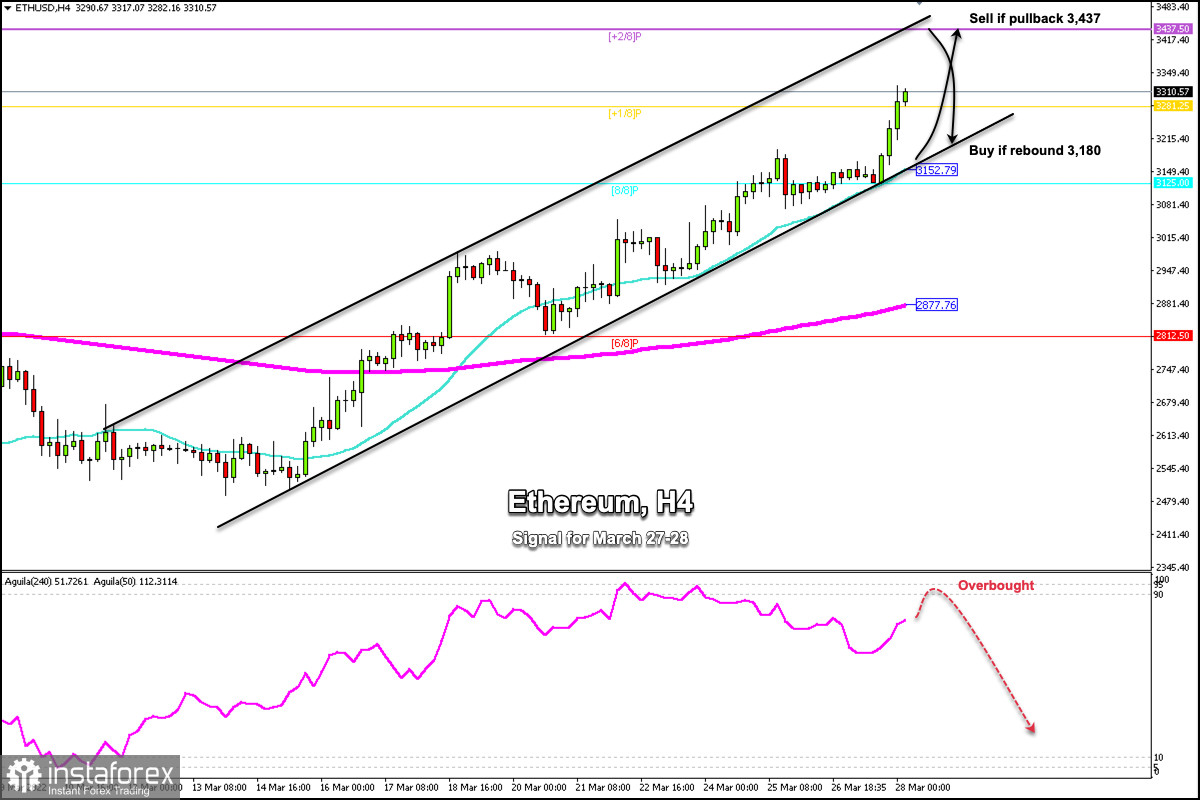

According to the 4-hour chart, we can see that Ether is trading within a strong uptrend. It is likely that any technical bounce towards the trend channel will be an opportunity to continue buying with targets at 2/8 Murray at 3,437.

ETH is preparing to reach the psychological level of 3,500. This level could offer strong resistance. A break and consolidation below 2/8 Murray (3,125) could entail a technical correction towards the downtrend channel support.

On the other hand, a sharp break below the 21 SMA located at 3,152 could accelerate the bearish move and we could expect ETH to fall towards the 200 EMA located at 2,877 and could even reach 6/8 Murray around 2,812.

The markets are taking advantage of a climate seemingly calm. However, if the Russian invasion increases risk aversion, Ethereum could quickly reach the support level of 2,500 again.

Our trading plan for the next few hours is to wait for a bounce at 3,180 to buy or wait for a pullback at 3,437 to sell. Conversely, a break below 8/8 Murray at 3,125 will enable the bearish move and could signal a change in trend. The eagle indicator is giving an overbought signal and a correction could occur in the next few days.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română