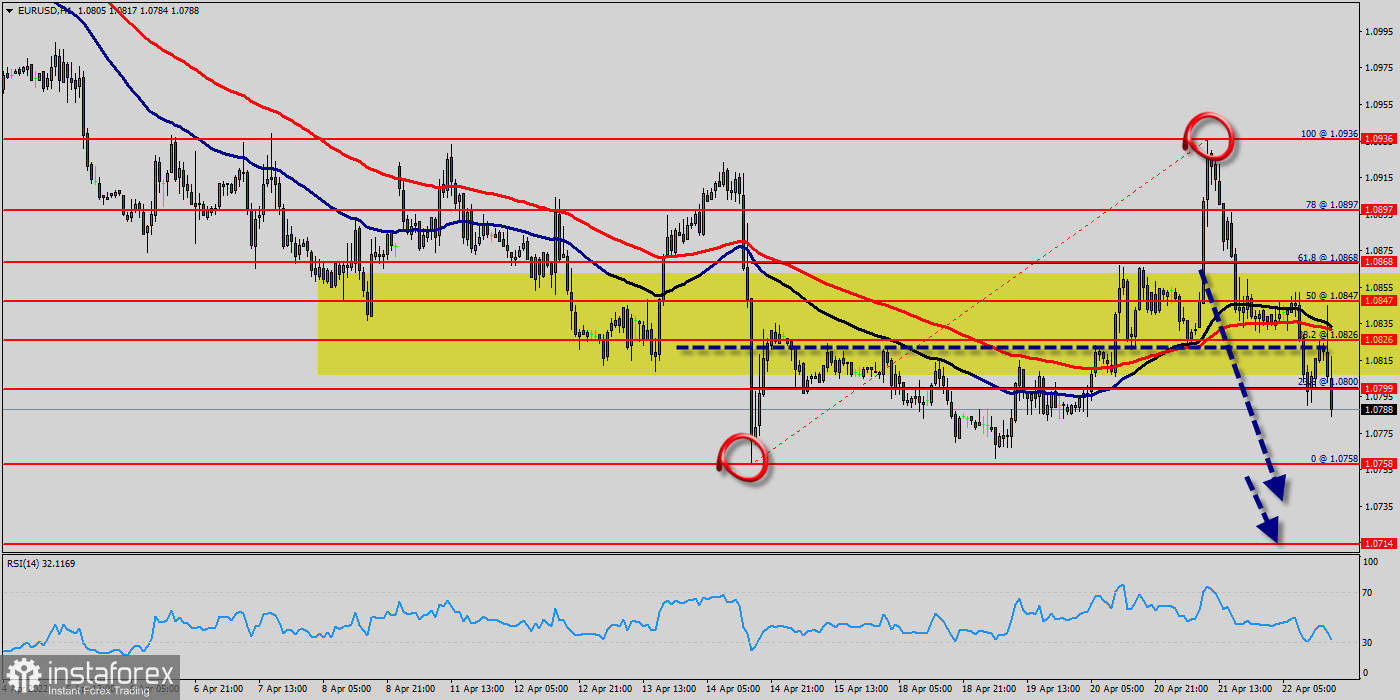

The general trend shows a strong bearish market since three days from the levels of 1.0828, 1.0847 and 1.0868.

The EUR/USD pair price moved into a bearish zone below the prices of 1.0828, 1.0847 and 1.0868. The EUR/USD pair even extended decline below the 1.0828 level before somewhat recovering. It is currently showing bearish signs below 1.0847 and still might extend losses.

Similarly, most major pair such as GBP/USD and AUD/USD are trading in a negative zone. The EUR/USD pair is testing the 1.0800 support zone.

The EUR/USD pair is showing signs of frequency at the bottom lip of a key resistance range between 1.0847 and 1.0714. The pair also - discontinued around these levels in both April of 2022.

However, if the pair fails to pass through the level of 1.0847, the market will indicate a bearish opportunity below the new strong resistance level of 1.0847 (the level of 1.0847 coincides with the ratio of 50% Fibonacci).

Moreover, the RSI is becoming to signal a downward trend, as the trend is still showing strong above the moving average (100) and (50).

Thus, the maket is indicating a bearish opportunity below the 1.0847 level so it will be a good sign to sell at 1.0847 with the first target of 1.0758.

It will also call for a downtrend in order to continue towards 1.0714. The daily strong support is seen at 1.0714.

On the other hand, it is also worth noting that the price at 1.0714will possibly form a strong support. Accordingly, saturation around 1.0714 to rebound the pair is likely to occur. Furthermore, it is possible that the market is going to start showing the signs of bullish market from the area of 1.0714.

However, the stop loss should always be taken into account, for that it will be reasonable to set your stop loss at the price of 1.0936.

----------------------------

Tips

Technical Analysis :

In technical analysis: history usually repeats itself at certain level. So it will be of the wisdom to use historic rates to determine future prices. The technical analysis based only on the technical market data (quotes) with the help of various technical indicators. Moreover, in this book we will be touching on a variety of new techniques for applying numerical strategies, equations, formulas and probabilities. Additionally, we will be sharing some of classical analysis such as breakout strategy and trend indicators.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română