The USD/JPY pair dropped as low as 127.51 yesterday where it has found support. Now, it is trading at 128.91 at the time of writing. The price rebounded as the USD was boosted by the DXY's rally, while the JPY was weakened by the Japanese Yen Futures' drop.

Yesterday, the Japanese and the US economic data came in mixed. Today, the Japanese M2 Money Stock rose by 3.6% versus the 3.4% expected. Later, the Prelim UoM Consumer Sentiment could be decisive in the short term. The economic indicator could drop from 65.2 points to 64.1 points.

USD/JPY Downside Pressure!

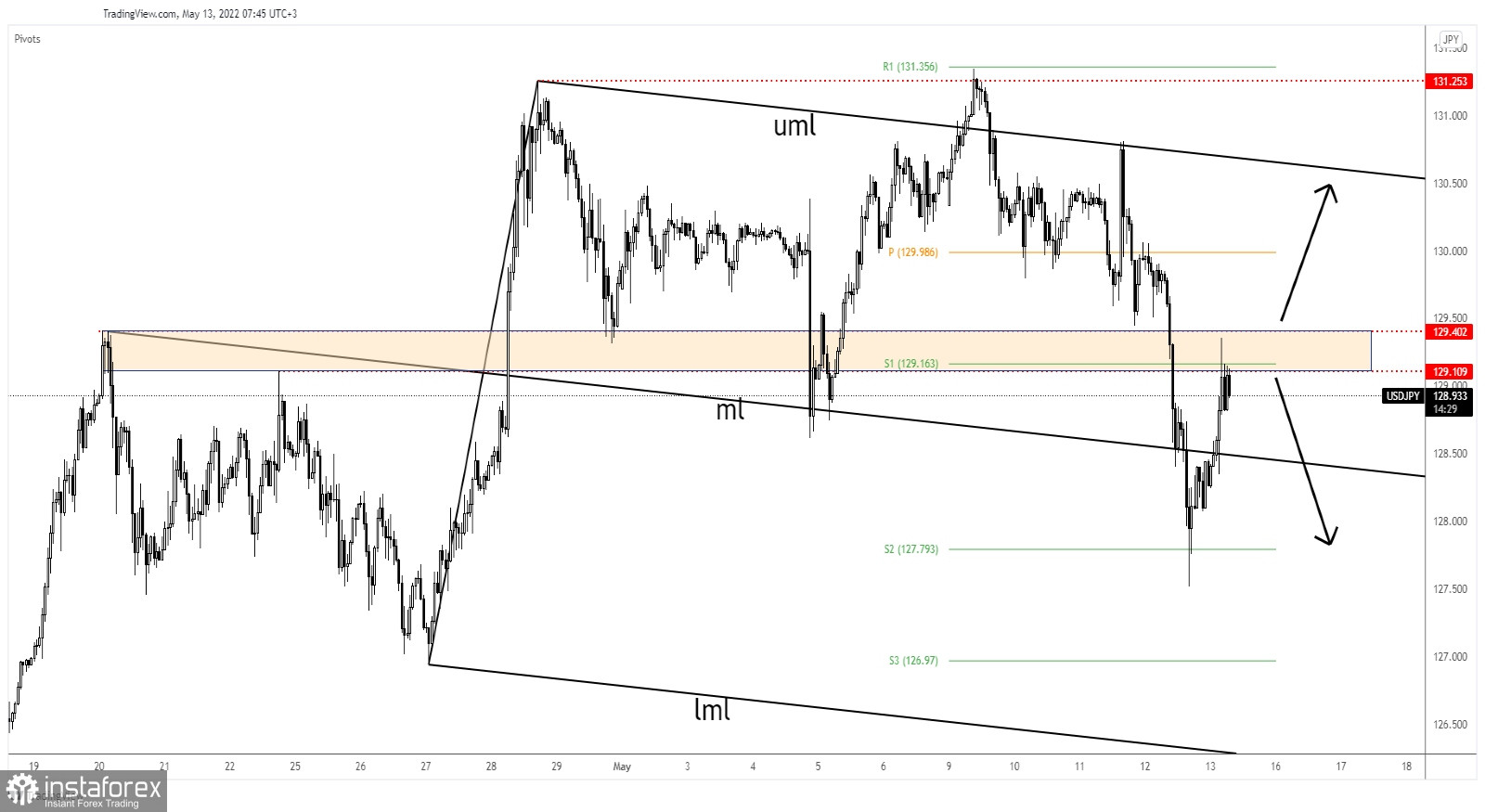

As you can see on the H4 chart, the price found support in the weekly S2 (127.79). Actually, it has registered a false breakdown with great separation through this static support. Unfortunately, it has failed to stabilize under the descending pitchfork's median line (ml) signalling that the sell-off could be over.

129.10 - 129.40 represented a strong support area (support turned into resistance). It remains to see how it will react here. False breakouts could signal a new sell-off, while a valid breakout may signal further growth towards the upper median line (uml).

USD/JPY Prediction!

Staying above the median line (ml) and making a valid breakout above the 129.40 could signal further growth and could bring long opportunities.

On the other hand, testing and retesting the resistance area, registering only false breakouts followed by a valid breakdown below the median line (ml) may signal a downside continuation. Dropping and stabilizing below the median line (ml) could announce a larger drop and could bring short signals.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română