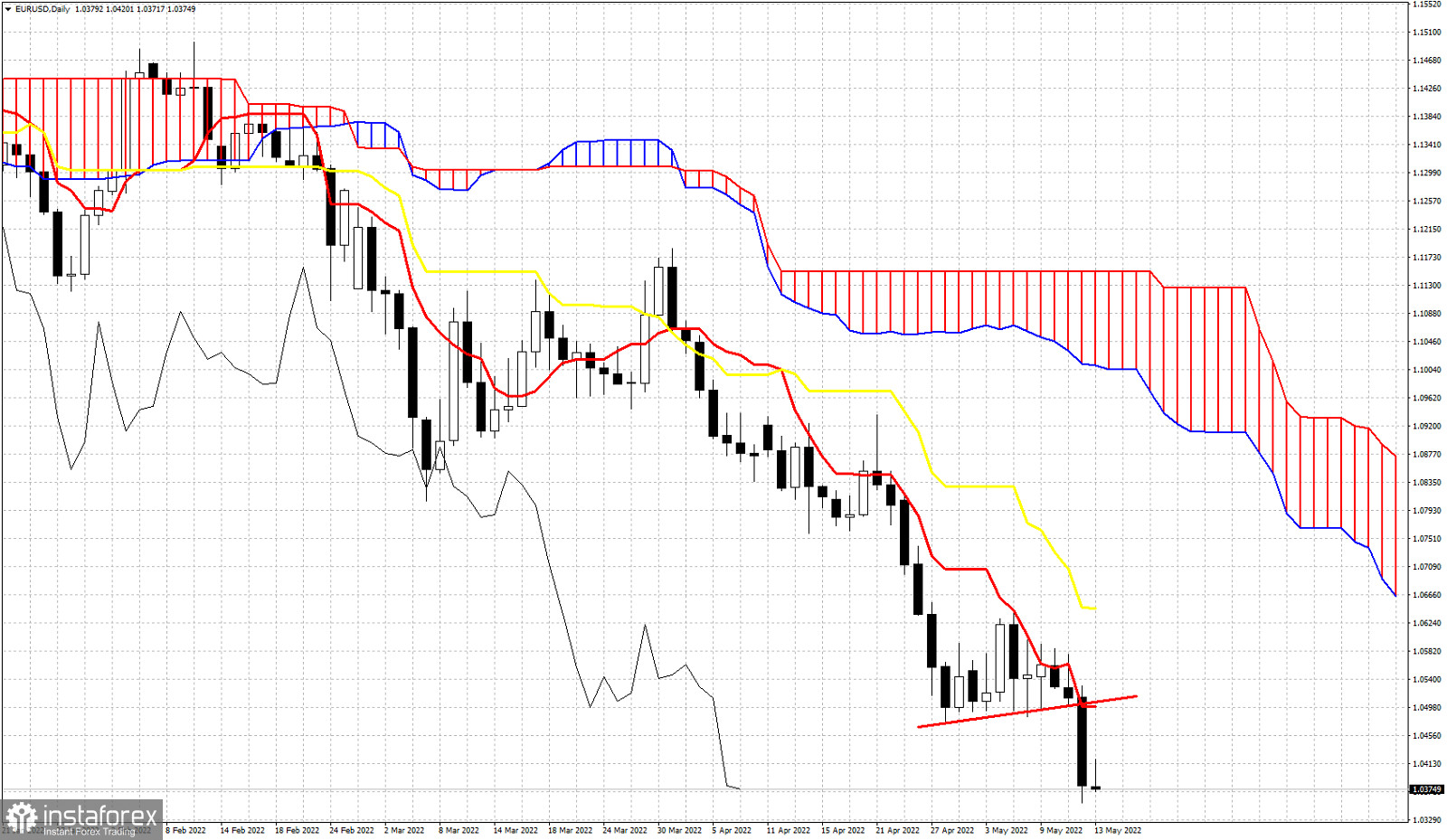

EURUSD remains in a bearish trend. Price continues making lower lows and lower highs as price is still below the cloud. In Ichimoku cloud terms, trend remains bearish with no sign of a reversal.

We use the Ichimoku cloud indicator to identify trend on a daily basis and the key resistance levels. First important short-term resistance level is at 1.0498 where we find the tenkan-sen (red line indicator). Bulls will need at least to break above this level in order to get the first sign of a possible reversal. Until then any upward bounce is considered as a short-term relief to the bearish trend. Next upside target and key resistance is at 1.0645 where we find the kijun-sen (yellow line indicator). If price breaks above this indicator, then we should expect EURUSD to move higher towards the Kumo (cloud).

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română