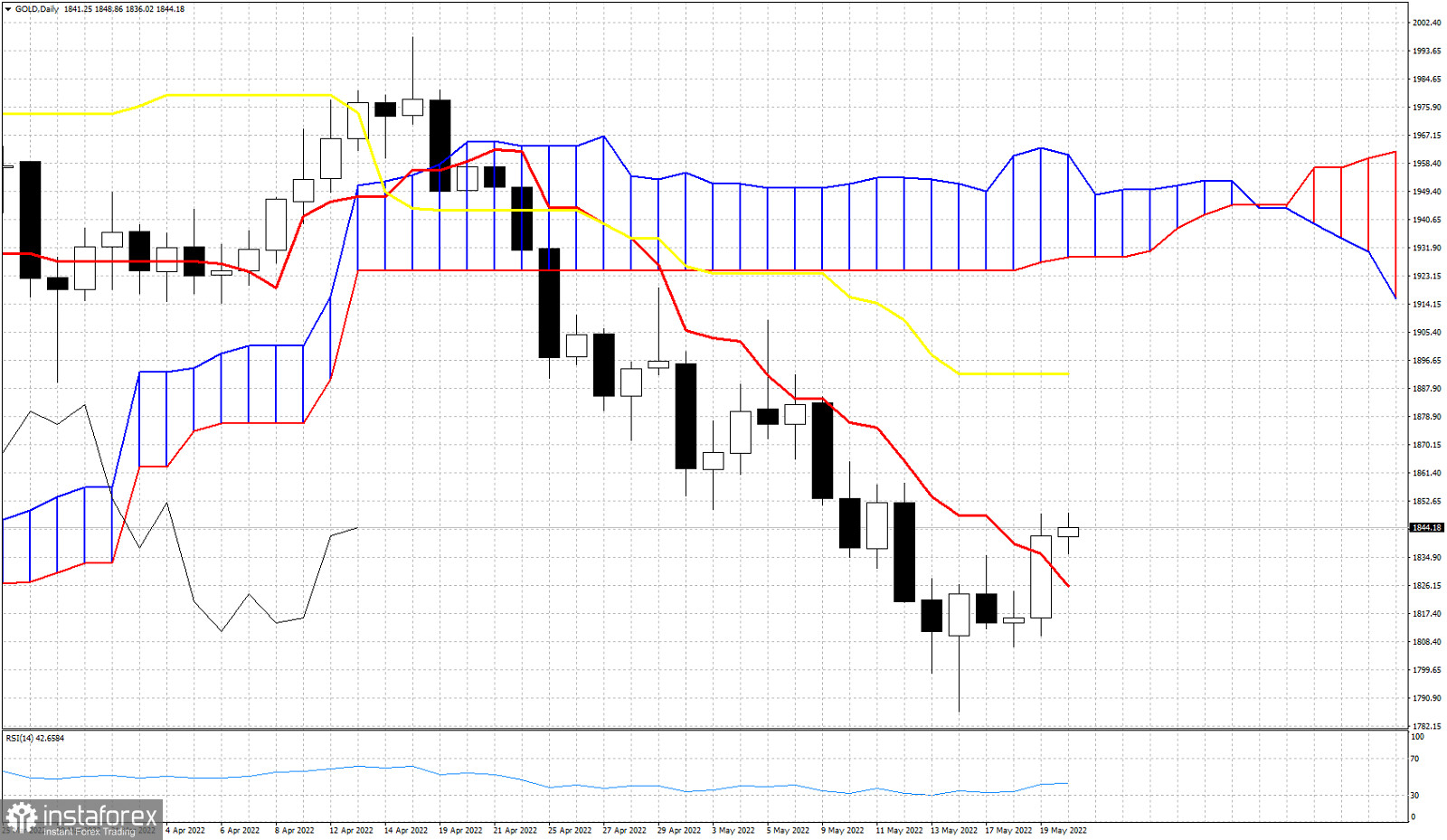

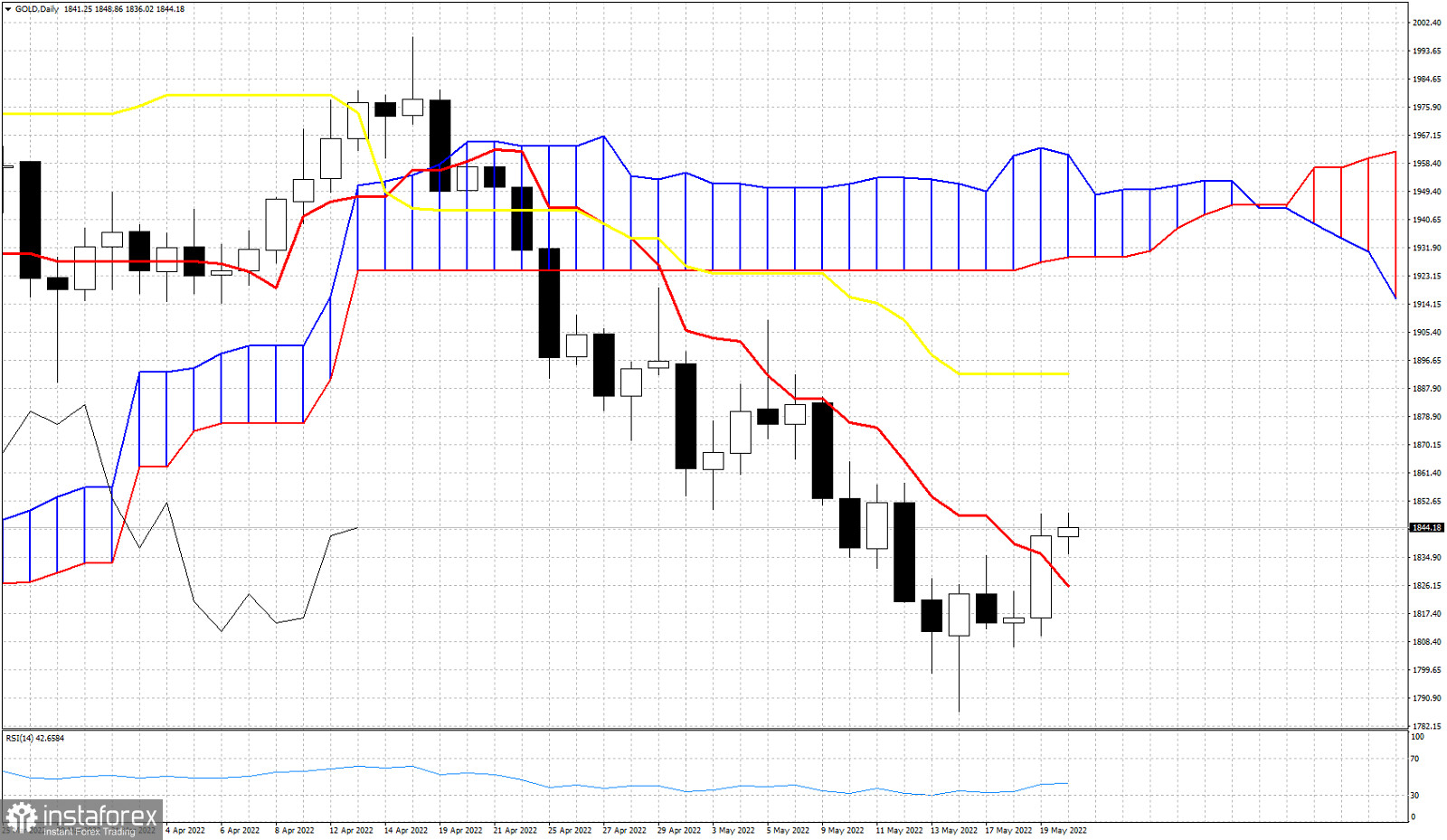

Gold price is bouncing as expected towards $1,850. Short-term resistance at $1,825 was broken and price came very close to our short-term bounce target of $1,850. In Ichimoku cloud terms trend in the Daily chart remains bearish as price is still below the Kumo (cloud).

With price having broken above the tenkan-sen (Red line indicator), Gold price has the potential to continue higher towards the kijun-sen (yellow line indicator) found at $1,892. Support is at the recent low at $1,806 where price formed a higher low. The tenkan-sen is at $1,825. Previous resistance is now support. So we have the key levels to watch out for. In conclusion, although Gold is in a bearish trend, a bounce higher is justified and should be expected over the coming days as long as price is above $1,825.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română