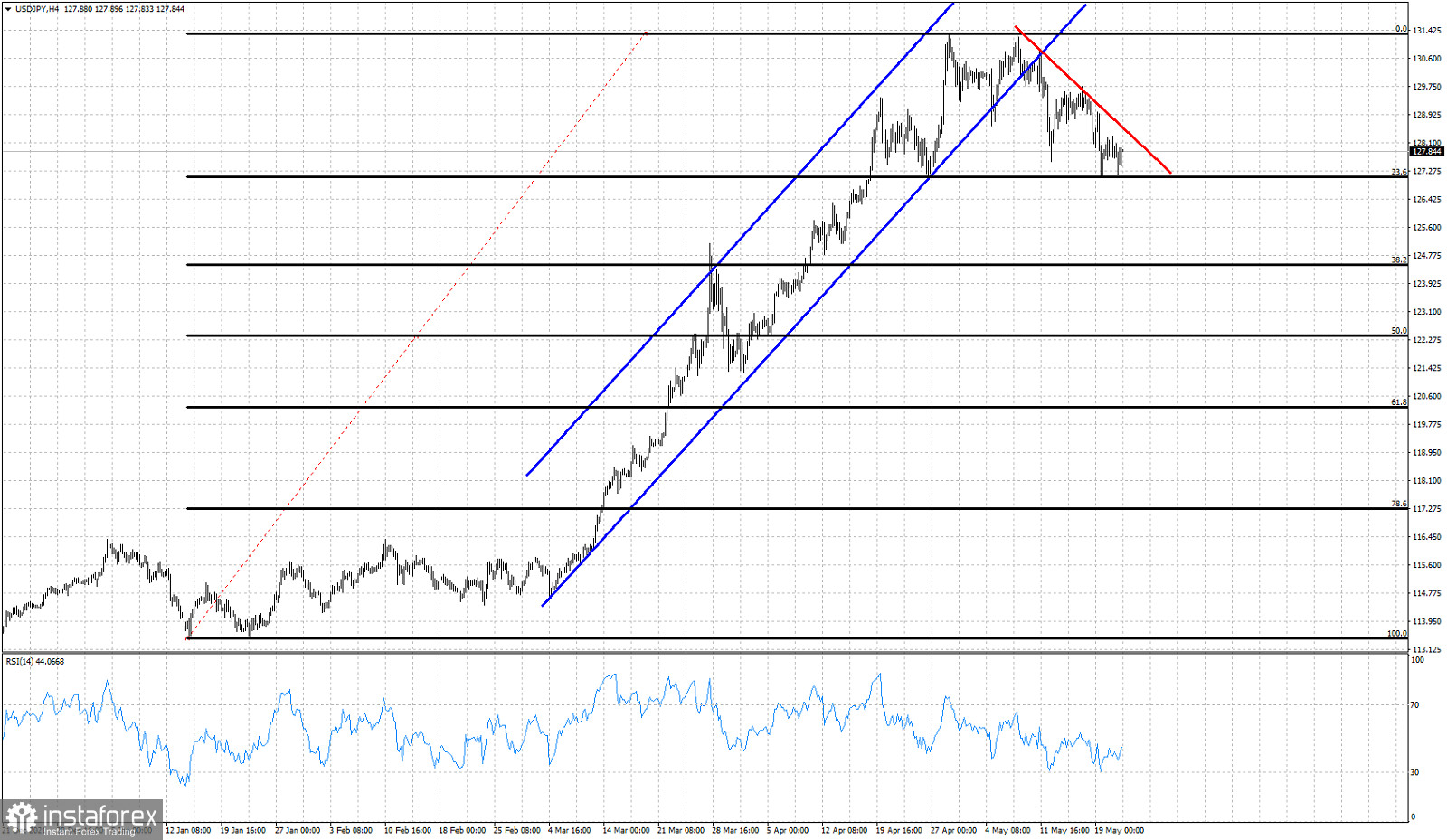

USDJPY is in a short-term bearish trend. Price has recently broken out of an upward sloping channel and has started forming lower lows and lower highs in the 4 hour chart. Price has retraced 23.6% of the upward move so far and chances continue to favor a deeper pull back.

Red line- resistance

Black lines- Fibonacci retracements

USDJPY is making lower lows and lower highs after breaking out of the bullish channel. Price is below the short-term resistance trend line and as long as this is the case, we expect price to move even lower at least towards the 38% Fibonacci retracement. So far price has retraced only 23.6% of the entire upward move. This is a very shallow pull back but price has tested it so far twice and both times support did not break. Bears need to break below the short-term support at 127.10. Resistance by the red trend line is at 128.47. Bulls need to break above this resistance level in order to hope for a continuation of the up trend to new higher highs above 131.40.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română