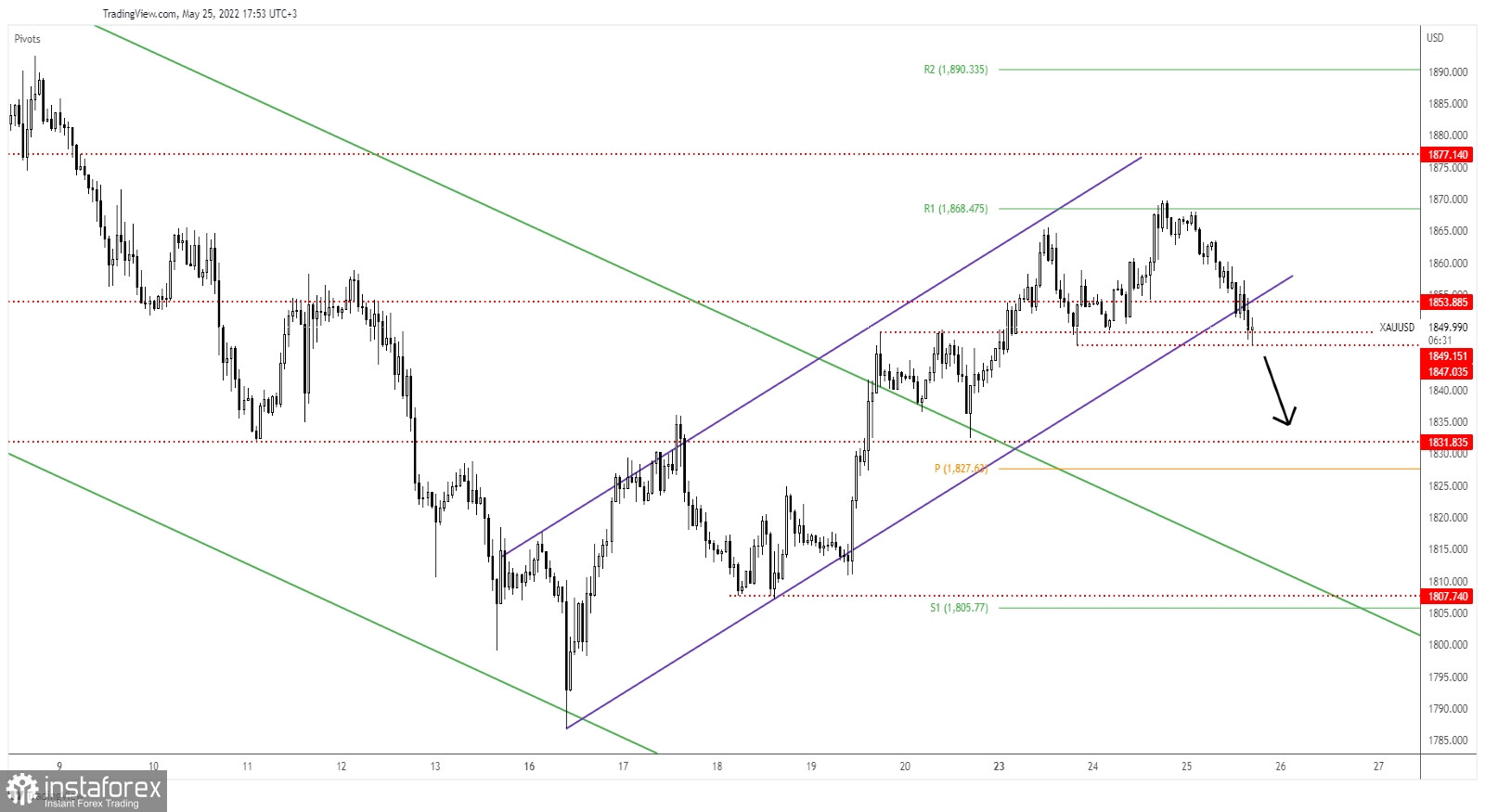

The price of gold plunged in the short term as the Dollar Index has managed to rebound. The yellow metal was trading at 1,850 at the time of writing above the 1,847 key support. Technically, the price action signaled that the upside movement ended and that we may have a larger drop.

Fundamentally, the US data came in worse than expected today, that's why XAU/USD could still rebound. The Durable Goods Orders rose by 0.4% versus 0.6% expected, while the Core Durable Goods Orders surged by 0.3% compared to 0.5% estimates. Tonight, the FOMC Meeting Minutes could bring high volatility and sharp movements.

XAU/USD New Sell-Off!

As you can see on the h4 chart, the price found resistance at the weekly R1 (1,868) and now it has dropped below the uptrend line which represented dynamic support. 1,849 and 1,847 levels are seen as static downside obstacles.

A valid breakdown through these levels may signal more declines. On the other hand, staying above 1,847 and coming back above 1,853 may signal that the retreat ended and that XAU/USD could try to come back higher.

XAU/USD Outlook!

A new lower low, dropping and closing below 1,847 could activate more declines towards the 1,831 key level.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română