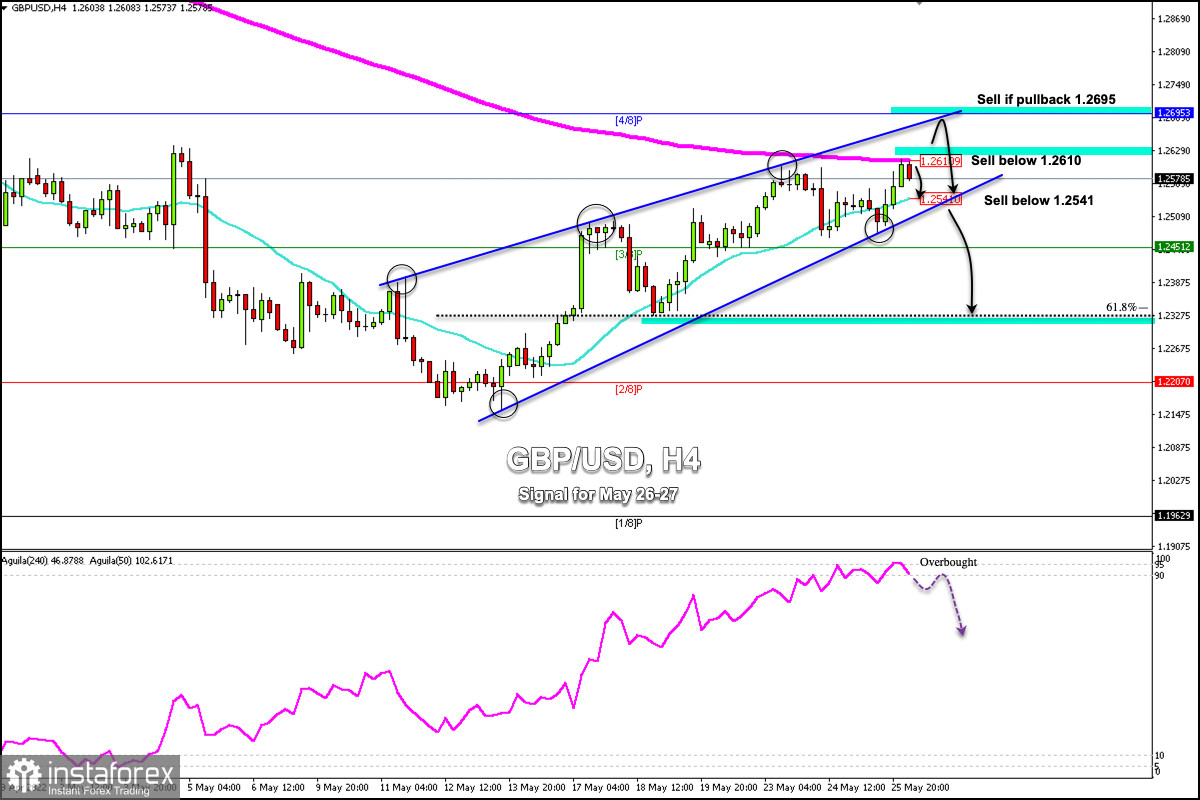

Early in the Asian session, the British pound reached the 200 EMA located at 1.2610. GBP/USD is currently trading below this moving average and is showing overbought levels. So, a technical correction is likely to occur in the next few hours.

According to the 4-hour chart, we can see the formation of a bullish wedge. This pattern could offer a bearish signal if the pound breaks the 21 SMA located at 1.2541.

On the other hand, a pullback towards 4/8 Murray (1.2635) will serve as strong resistance for the British pound, which will cause an imminent correction so that the price could reach the level of 1.2450.

GBP/USD has a bearish bias as long as it trades below the 200 EMA and below the 4/8 Murray. There is solid resistance at 1.2695. In case of a break and a daily close above this level, it could mean an advance and the pair could reach the psychological level of 1.3000.

This barrier of 4/8 Murray will be difficult for the British pound bulls to break, but if it breaks 1.27, the pair could retest the zone 1.3000 in the short term.

Otherwise, a break below 1.2440 would expose the pair to further selling pressure which could lead to a retest of lows around 61.8% Fibonacci and even a fall to 2/8 Murray at 1.2207.

The Eagle indicator has reached the 95-point zone, which represents extremely oversold levels. Our trading plan for the next few hours is to sell below 1.2610 (200 EMA), with targets at 1.2540 and at 1.2351 (3/8). On the other hand, a pullback towards 1.2695 (4/8) will be an opportunity to sell, with targets at 1.2610, 1.2541 and 1.2375 (61.8% Fibonacci).

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română