Crypto Industry News:

Tesla CEO Elon Musk has distanced himself from another fabricated video promoting cryptocurrency scam.

Originally posted on Twitter, the video in question featured Musk promoting a cryptocurrency platform that boasts a 30% return on cryptocurrency deposits. The scammers used the original tapes of TED Talk starring Musk and curator Chris Anderson at the TED conference in Vancouver in April this year.

The tweet and video caught the attention of Musk himself, who has been increasingly active since acquiring an approximately $ 44 billion social media platform. Tesla CEO and SpaceEx founder responded to the video in his signature comic style.

Musk's worldwide reputation as a pioneer in technology has made him the target of scammers looking to take advantage of ignorant social media users and investors. Users who are not so tech savvy are exposed to scams promoting unrealistic returns.

Cryptocurrency scams of this kind were common in 2020 and 2021, and the United States Federal Trade Commission (FTC) released a report estimating that cryptocurrencies worth over $ 80 million were stolen from unsuspecting victims within six months.

Given Musk's affection for the cryptocurrency space and his pro-Dogecoin stance, fraudulent YouTube live streaming has become the weapon of choice for fraudsters. Musk's now-famous appearance on America's TV show Saturday Night Live has turned out to be a cash cow for fraudsters - the FTC announced new fake addresses that received an estimated $ 9.7 million worth of Dogecoins worth $ 5 million last May.

Technical Market Outlook:

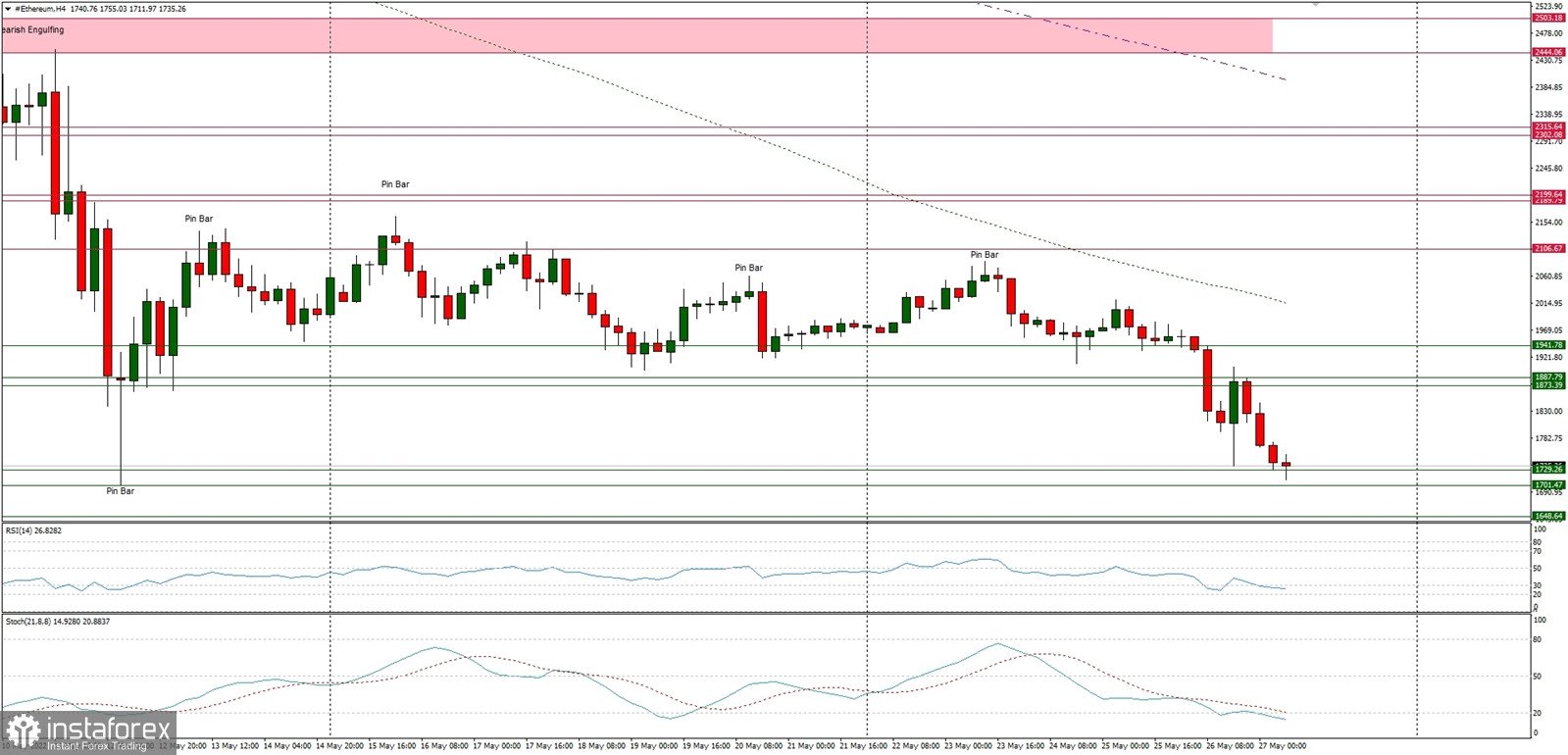

The ETH/USD pair has finally broken out of the consolidation range and is currently testing the swing low located at the level of $1,701. The nearest technical resistance is seen at $2,106 and $2,199, but the weak and negative momentum still supports the short-term bearish outlook. In a case of a breakout lower, the next target for bears is seen at the level of $1,420. The market keeps making lower lows and lower highs on the H4 time frame chart, so the down trend intact.

Weekly Pivot Points:

WR3 - $2,386

WR2 - $2,268

WR1 - $2,122

Weekly Pivot - $2,009

WS1 - $1,865

WS2 - $1,755

WS3 - $1,597

Trading Outlook:

The down trend on the H4, Daily and Weekly time frames had broken below the key long term technical support seen at the level of $2,000 and continues to make new lower lows with no problems whatsoever. So far every bounce and attempt to rally is being used to sell Ethereum for a better price by the market participants, so the bearish pressure is still high. The next target for bears is located at the level of $1,420.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română