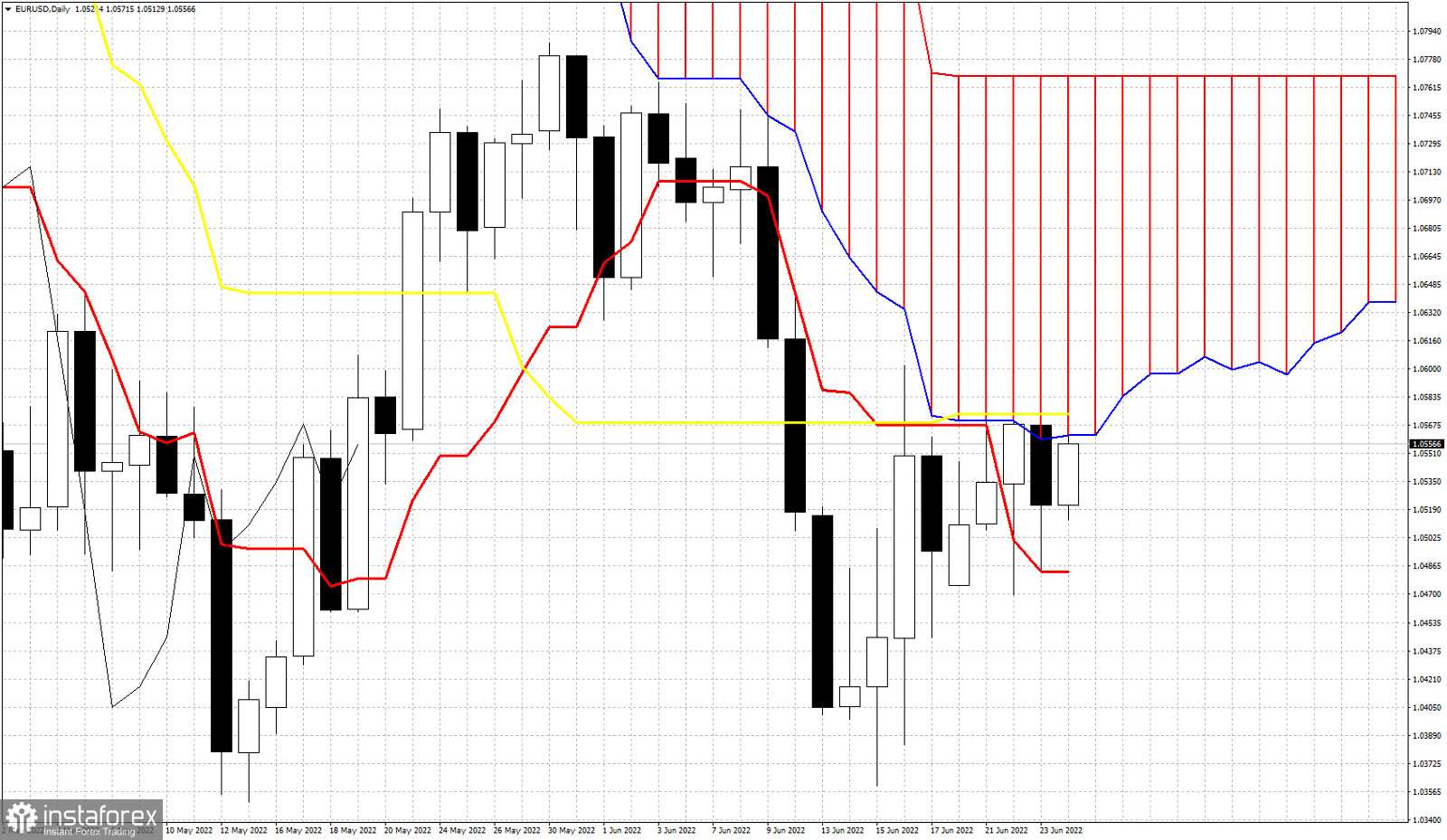

EURUSD tried this past week to rally as Eurozone inflation remains high and the European Central Bank is getting forced to act. We use the Ichimoku cloud indicator in order to identify key resistance levels in order for trend to change to bullish. Trend remains bearish as price is still below the Daily Kumo (cloud). The tenkan-sen (red line indicator) provides support at 1.0480. As long as price is above this level, bulls have hopes for more upside. Last week bulls tried to penetrate inside the cloud, but their success was short lived. Price got rejected but the pull back did not push price below the tenkan-sen. 1.0570 remains a key resistance level on a daily closing basis. This is the first obstacle bulls need to overcome for a trend change to occur. Until then price is vulnerable to more downside.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română