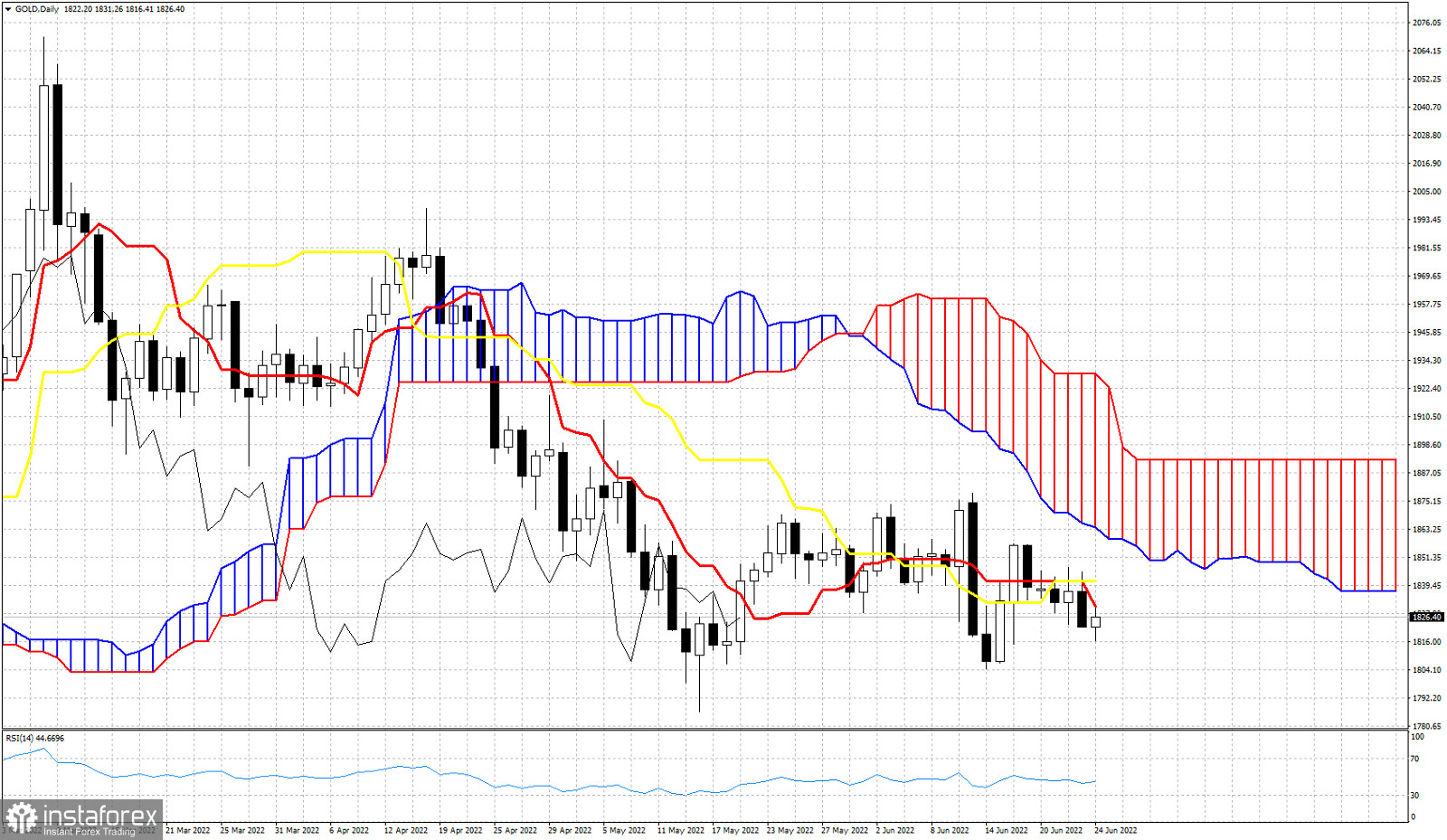

Gold price continues to trade under pressure and despite Dollar weakness, it underperformed relative to equities. We use the Ichimoku cloud indicator to identify key resistance and support levels and the potential direction we should expect this week starting June 27th, 2022. Gold remains in a bearish trend as price is below the Daily Kumo (cloud). Price is also below the tenkan-sen (red line indicator) and the kijun-sen (yellow line indicator). Resistance by these two indicators is at $1,830-40 area. Price is vulnerable to more downside this coming week as long as price is below this resistance area. Support is found at $1,800 area and bulls need to defend it. A bullish signal will come when and if price breaks above the Daily Kumo. Until then we remain pessimistic.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română