Crypto Industry News:

The Central Bank of the Russian Federation will develop a plan to introduce the digital ruble by the end of 2023, First Vice President Olga Skorobogatova said in an interview with the Tass news agency.

She also noted that the regulator intends to start testing operations on the digital currency of the Central Bank of Russia (CBDC) with the participation of real customers as early as April 2023. Skorobogatova stressed that next year will be very important for the project:

"Testing real operations will give us the opportunity to understand what needs to be improved and remind us what to improve, what to change. We want to develop an action plan for the introduction of the digital ruble at the end of next year," she said.

The vice president pointed out that 12 banks are currently participating in the pilot project. Another three banks want to start the tests, and the monetary authorities have also received applications from several organizations outside the financial sector.

Olga Skorobogatova noted that it is too early to talk about the results of the current stage, as the participants work at different speeds.

Technical Market Outlook:

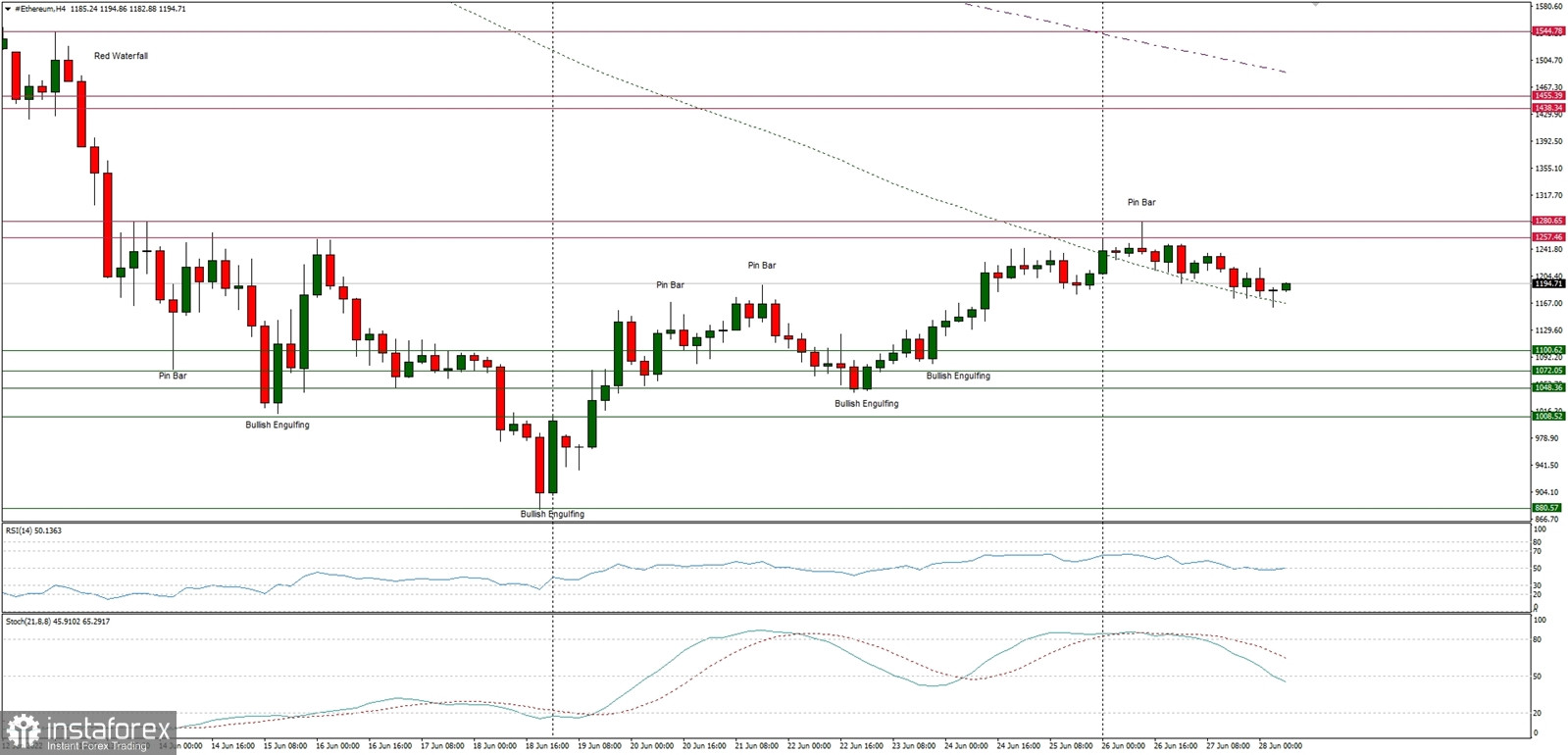

The ETH/USD pair has been rejected from the level or $1,280 after the Pin Bar candlestick was made at the top of the move and is getting away from this level. The next target for bulls is seen at the level of $1,438, which is the technical resistance. The intraday technical supports are seen on the levels of $1,178, $1,100 and $1,072. The larger time frame chart trend remains down and as long as the key short-term technical resistance is not clearly violated, the outlook remains bearish.

Weekly Pivot Points:

WR3 - $1,602

WR2 - $1,421

WR1 - $1,352

Weekly Pivot - $1,194

WS1 - $1,119

WS2 - $951

WS3 - $891

Trading Outlook:

The down trend on the H4, Daily and Weekly time frames had broken below the key long term technical support seen at the level of $1,420 and bears continue to make new lower lows with no problem whatsoever. So far every bounce and attempt to rally is being used to sell Ethereum for a better price by the market participants, so the bearish pressure is still high. The next target for bears is located at the level of $1,000. Please notice, the down trend is being continued for the 11th consecutive week now.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română