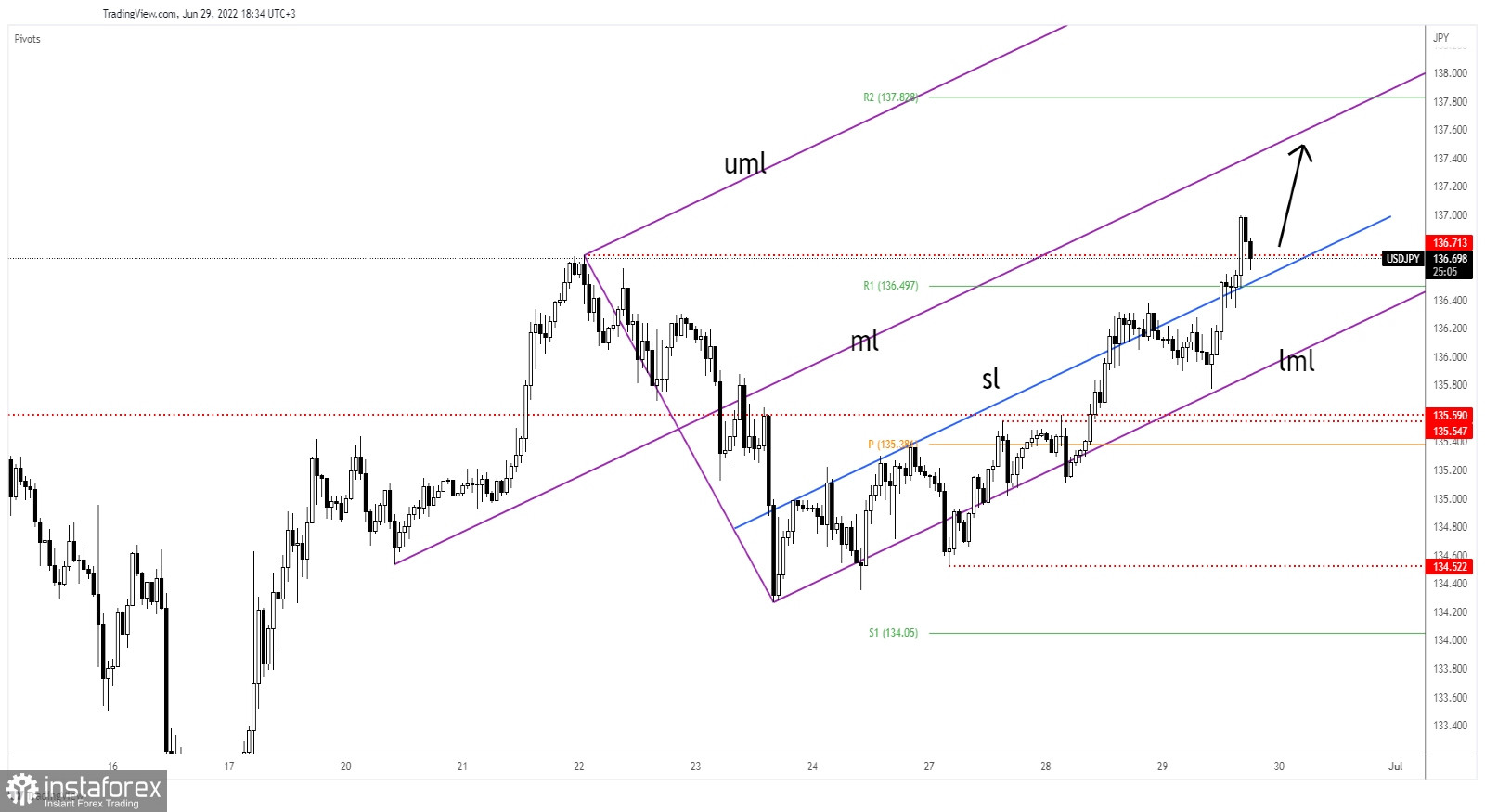

The USD/JPY pair drops at the time of writing on the H1 chart. Still, this could be only a temporary retreat as the bias remains bullish. It was traded at 136.69 below 136.99 today's high. In the short term, it comes back to test and retest the broken levels before resuming its growth.

DXY's rally and the Japanese Yen Futures' drop boosted the currency pair. Today, the Japanese Yen took a hit from the Japanese Retail Sales which surged by 3.6% versus 4.0% expected, while the Consumer Confidence dropped from 34.1 points to 32.1. The US data came in mixed but the USD is strongly bullish as the FED is expected to continue hiking rates.

USD/JPY Retests The Buyers!

USD/JPY extended its growth after failing to stabilize below the pitchfork's lower median line (lml). Its breakout above the 135.59 followed by a minor retreat signaled potential upside continuation at least towards the 136.71 higher high.

It has climbed as much as 136.99 where it has found resistance. Now, it has dropped and it could reach and retest the R1 (136.49) and the inside sliding line (sl) which represents downside obstacles (resistance levels turned into support).

USD/JPY Forecast!

Testing and retesting the sliding line (sl) and the R1, registering false breakdowns may signal new bullish momentum. A new higher high, jumping and closing above 136.99 could activate further growth towards the median line (ml) and could bring new long opportunities.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română