USD/JPY

Yesterday, the USD/JPY pair fell 13 points against the background of a 1.30% drop in the US S&P 500 stock index. Japan's Nikkei 225 fell 3.25% this morning, but the yen is holding on in a paradoxical way, blocking yesterday's fall.

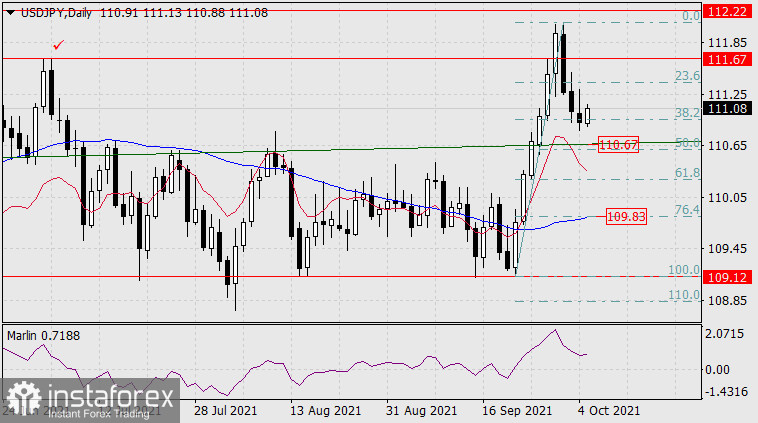

And yet we do not think that the "near panic" on the stock markets will allow the USD/JPY pair to grow further. Probably, today's growth was caused by purely technical reasons - a correction after a strong previous three-day fall. The closest target of the yen at 110.67 is the price channel line, slightly below which is the 50.0% Fibonacci level. Consolidation below the level opens the second target - the MACD line near the retracement level of 76.4% (109.83).

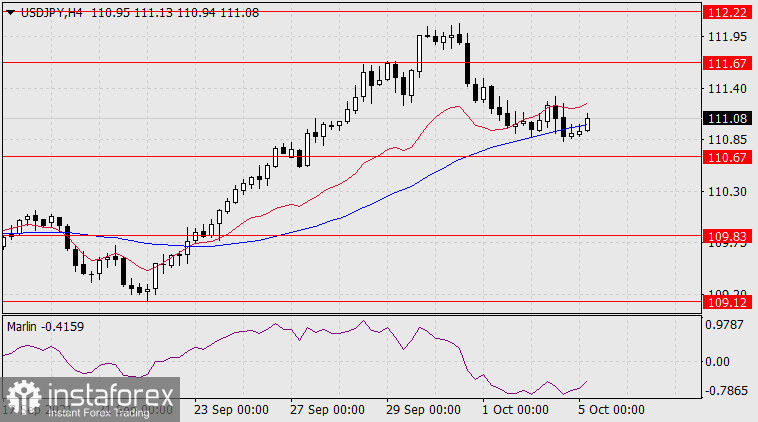

On the four-hour chart, the price is consolidating directly on the MACD indicator line, but below the balance line, which means consolidation with the intention to continue moving down. The Marlin Oscillator is turning up, but it also occurs in the negative trend zone. We are waiting for the completion of the correction and further movement of the price down to new targets.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română