Following the results of Tuesday's trading, the stock markets in Europe and the United States showed positive dynamics, which was more like a local rebound, rather than a change in the direction of the market before the publication of the most important employment data this week.

Today, markets' attention is focused on the publication of the number of new jobs from the ADP company. According to the forecast, the US economy is expected to receive 428,000 new jobs in September after a drop of 374,000 in August. Obviously, this will be good if the values are in line with expectations, but in general, such numbers will continue to indicate a greater weakness in the labor market, which means the Fed will likely have to think about when it will actually begin the process of normalizing the monetary policy by raising interest rates.

Earlier, it was repeatedly pointed out that the Central Bank is in an extremely delicate situation. On the one hand, the principles of monetary policy require the start of an increase in interest rates amid high inflation, but on the other, the government's social policy stimulates inflationary pressure through measures of social support for the population, which are not working largely due to this. The weakness of the labor market calls on the Fed to leave stimulus measures. It is not yet clear how the regulator will really solve this issue.

Negativity hit investors again, causing a sell-off in the markets. This is a confrontation between Republicans and Democrats in Congress on the need to raise the level of public debt once again. Biden urged representatives of the Republican Party not to ignore this problem, which threatens to result in a government default with all the ensuing negative consequences for the US economy and financial markets.

In view of this, there is a decline in the US stock indices and, under their influence, a decline in the European one. If the decline in the value of shares of companies from the NASDAQ 100 index is due to the deflation of the financial bubble inflated during the acute phase of the coronavirus pandemic, which is stimulated by the Fed's decision to reduce QE volumes and growth in Treasury yields, then other DOW 30 and S&P 500 indices are largely declining due to general negative market mood and fears of a government default.

As for the currency market, the ICE dollar index is receiving support for two consecutive days, being above the level of 94.00 points. Its growth is largely due to the EUR/USD pair decline, which has huge pressure on the index. But in general, major currencies are trading in ranges with the US dollar while waiting for the US employment data to be published this week, followed by the inflation data.

Crude oil prices continue to rally for two main reasons. The first is high demand ahead of the expected cold winter in the Earth's Northern Hemisphere. The second reason is the final decision of OPEC + to change its view on oil production, which was the catalyst for the latest rally.

Observing the market situation, we believe that high volatility will continue both this and next week until investors receive new employment data primarily from the US Department of Labor, and secondarily on inflation in the US.

Forecast of the day:

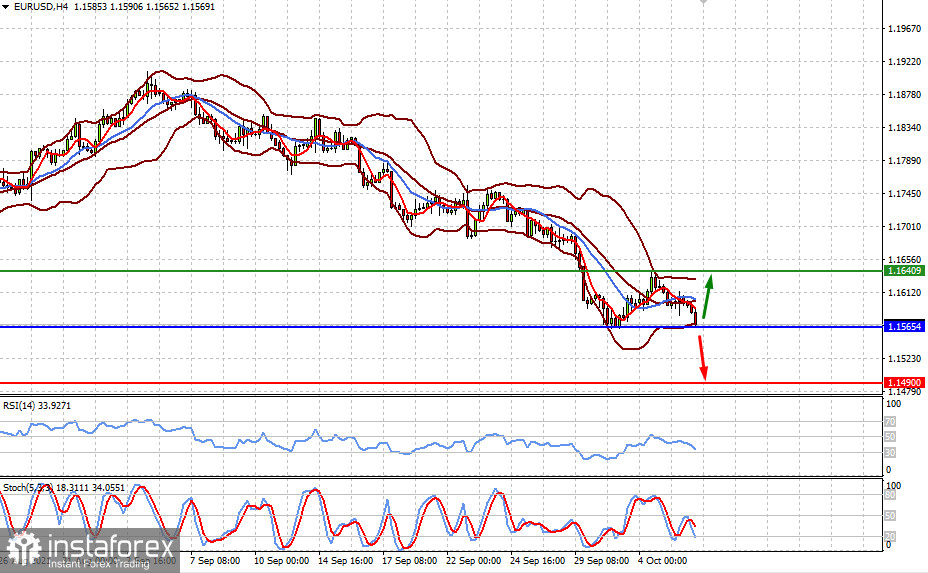

The EUR/USD pair could come under pressure if the ADP's new job data shows a noticeable growth. In this case, the pair will continue to decline to the level of 1.1490. On the contrary, weak values will locally push the pair up.

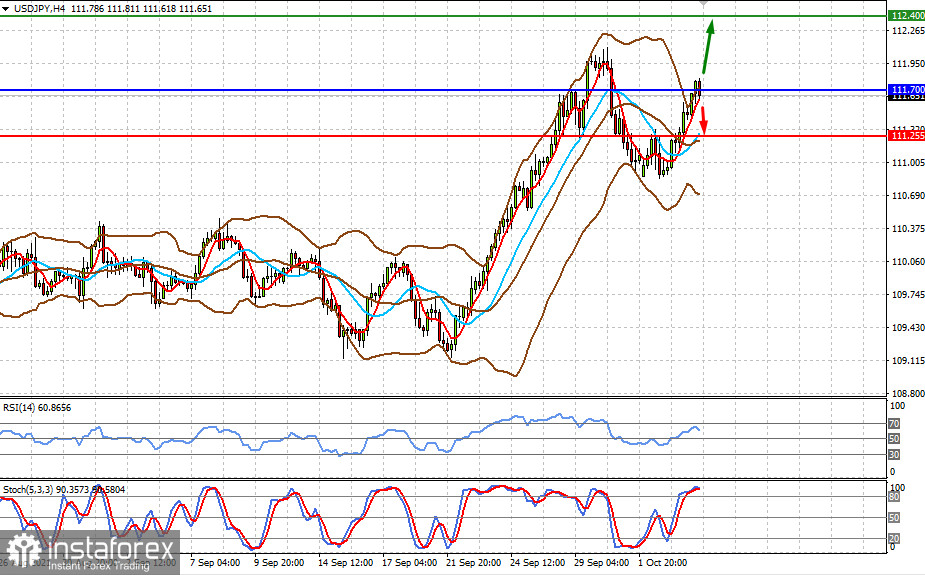

The USD/JPY pair will also react to the current data. An increase in the number of jobs will lead to a local appreciation of the dollar to the level of 112.40, while a decrease will lead to a fall to 111.25.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română