GBP/USD

Analysis:

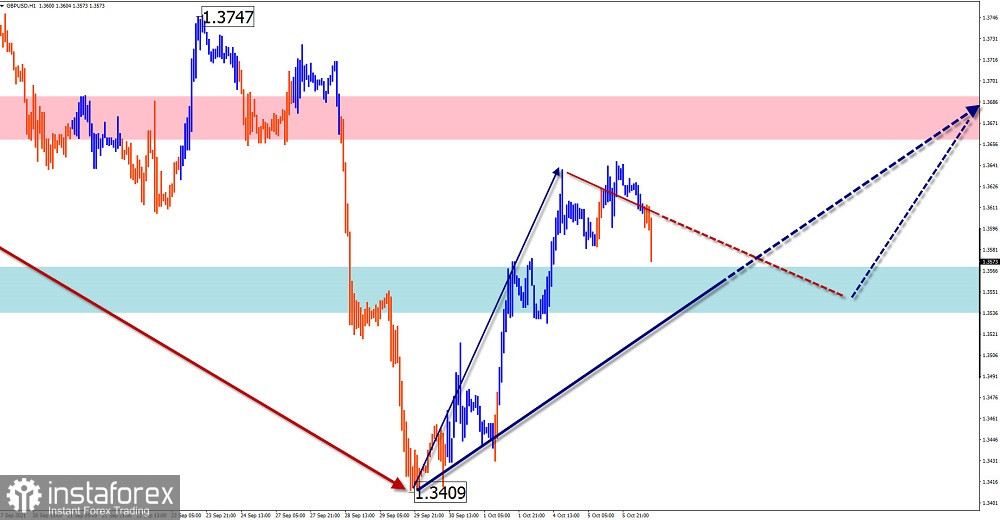

The main direction of price fluctuations of the major pair of the British pound since February has been set by the downward wave algorithm. By now, the wave structure looks complete. The price rise that began on September 29 has a reversal potential and may be the beginning of a new upward trend wave.

Forecast:

In the first half of the current day, a lateral vector is expected, with a decrease in the price in the area of the support zone. At the end of the day, the probability of activation and growth of the exchange rate to the calculated resistance increases.

Potential reversal zones

Resistance:

- 1.3660/1.3690

Support:

- 1.3570/1.3540

Recommendations:

Today, there are no conditions for the sale of the pound on the major market. It is recommended to monitor emerging signals for buying a pair in the area of the support zone.

AUD/USD

Analysis:

The main trend direction of the Australian dollar major since the end of winter is set by a bearish wave. The next section in the main direction started on September 3. Within its framework, an intermediate correction has been developing in the form of a stretched plane in recent days.

Forecast:

Today, we can expect quotes to move between the nearest oncoming zones. A downward course is likely in the first half of the day. The beginning of price growth is expected at the end of the day. A break above the upper limit of the zone with the calculated resistance is unlikely today.

Potential reversal zones

Resistance:

- 0.7310/0.7340

Support:

- 0.7230/0.7200

Recommendations:

Today, trading on the Australian dollar market is riskier and can become unprofitable. Short-term purchases from the support zone are possible.

USD/CHF

Analysis:

The daily scale of the Swiss franc chart demonstrates the general flat mood. An incomplete wave of a smaller TF has been forming a downward stretched plane since August 11. Its structure lacks the final part. The price has reached the boundaries of a large-scale resistance zone.

Forecast:

The general upward movement vector is expected to continue today. A short-term decline to the support zone is not excluded at the European session. A break above the calculated resistance in the current day is unlikely.

Potential reversal zones

Resistance:

- 0.9350/0.9380

Support:

- 0.9280/0.9250

Recommendations:

In the coming sessions, short-term purchases of the instrument from the support zone with a fractional lot are possible. It is worth considering the limited price growth potential of this pair.

USD/CAD

Analysis:

A downward wave has been forming on the chart of the main pair of the Canadian currency since mid-July. By the current time, its structure looks like a shifting plane, which may eventually develop into a stretched one. At the time of analysis, the final part (C) has not been formed in it.

Forecast:

In the next day, a smooth movement of the pair's price from the resistance zone to the settlement support area is expected.

Potential reversal zones

Resistance:

- 1.2640/1.2670

Support:

- 1.2560/1.2530

Recommendations:

There are no conditions for "Canadian" purchases today. After the appearance of reversal signals in the area of the resistance zone, short-term sales of the pair will become possible.

Explanations: In the simplified wave analysis (UVA), waves consist of 3 parts (A-B-C). The last incomplete wave is analyzed. The solid background of the arrows shows the formed structure, and the dotted one shows the expected movements.

Attention: The wave algorithm does not take into account the duration of the movements of the instrument in time!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română