The global currency markets continue to sway in conditions of high volatility, which is already expected before the release of important data such as America's employment and inflation.

Given the existing real risk of default in the States due to the existing confrontation between Republicans and Democrats in Congress, investors are showing a high degree of caution. Although there was tension under previous presidents, it was not as strong as now. The American society is actually divided, roughly in half. Some support the current President J. Biden, while others support the previous President D. Trump. In the conditions of irreconcilable political struggle, there is a high probability of not reaching a compromise and, as a result, a default on government debts, which will have a strong negative impact on world markets, including the American one.

In addition to this problem, two topics continue to guide the markets – the expectation of the publication of important employment data from the Ministry of Labor and updated inflation values next week.

On Wednesday, figures on the number of new jobs in the private sector from ADP were presented, and they showed a larger number of new jobs than expected – 568,000 against 428,000 and the August number of 340,000, which was revised downward. This data somewhat calmed the markets but did not completely resolve the dilemma with the real prospects of the interest rate hike process. If everything is clear with the decision to gradually end the stimulus measures - QE, then if the employment data turns out to be higher than forecasts, and the consumer inflation figures show growth, the Fed will act more decisively, which will undoubtedly lead the markets to despondency and to sales in company stocks again, while the US dollar will receive limited support.

In our opinion, an important result of the published data on employment and inflation might be the Fed's statement either about a more decisive adherence to the course of monetary policy normalization, or, conversely, the manifestation of notes of weakening of these sentiments. In fact, we view the results of the next Fed meeting as important in the context of turbulence in the markets and the publication of updated figures on unemployment and inflation. We believe that high volatility in the markets will dominate before this meeting.

From today's economic statistics, we will highlight the publication of the number of initial applications for unemployment benefits in the United States and the publication of the minutes of the ECB's last monetary policy meeting.

Forecast of the day:

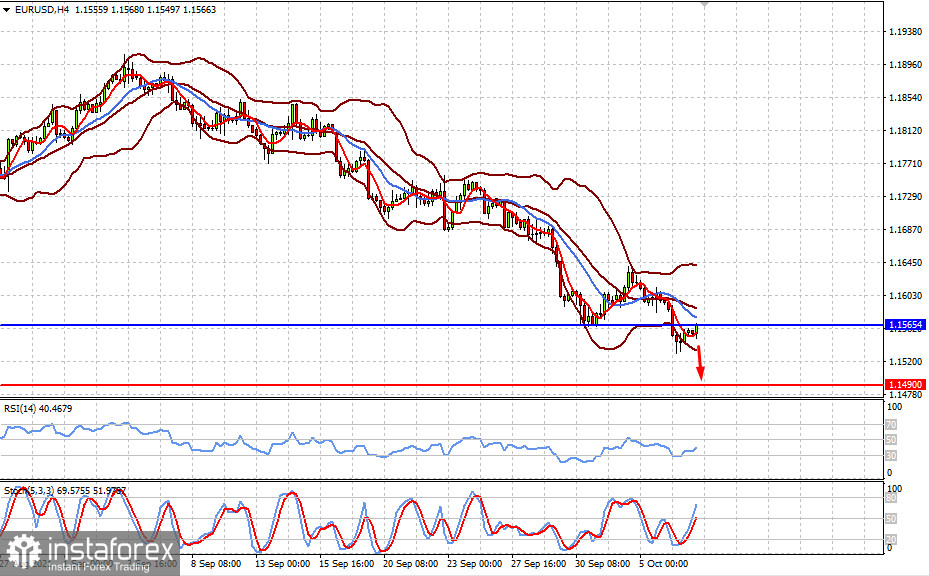

The EUR/USD pair has every chance to further decline if the minutes of the last ECB meeting on monetary policy published today show that the regulator will continue to maintain a soft monetary exchange rate. In this case, the pair will rush to the level of 1.1490.

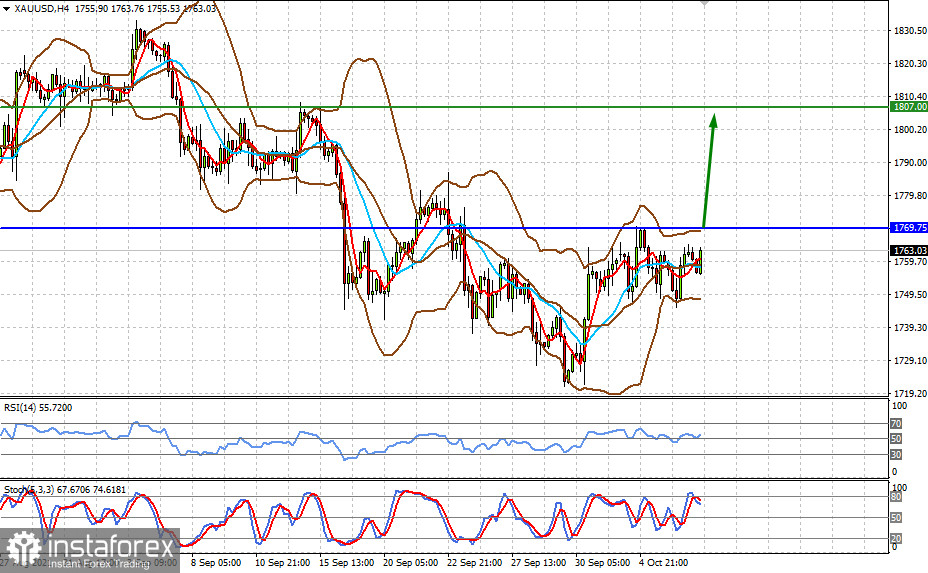

Spot gold could receive significant support if negative market sentiment rises. In this case, the breakdown of the level of 1769.75 will lead to the price growth to 1807.00.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română