On October 6, the Financial Times published an article titled "Central Banks Are Haunted By Fear of Stagflation." It contains the following lines: "Central banks are faced with the same bad dream almost everywhere: a combination of slower growth and inflationary surges that together threaten stagflation. So far, they are struggling with this problem in different ways. "

Stagflation is a combination of slow growth and rapid price growth. The threat of stagflation is one of the most significant threats since it is impossible to fight it with purely monetary methods.

US Energy Secretary Jennifer Granholm has proposed using the government's strategic oil reserve to curb the rise in gasoline prices. The situation looks threatening since OPEC + refused to satisfy the US request for an additional increase in production, which contributes to the growth of oil prices and raw material prices in general.

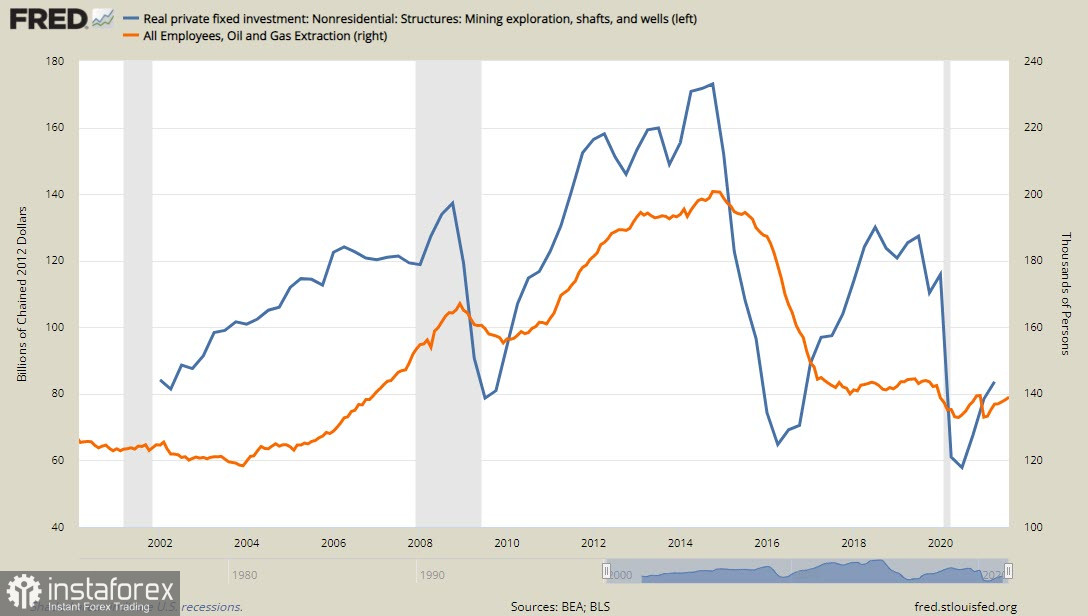

But let's look at what is happening with mining in the USA itself. After the 2008 crisis, investments returned to the mining sector, which led to an increase in employment. However, investments have been sharply declining since 2015, while the number of people employed in the sector has also fallen, and as of the end of the 2nd quarter, investment and employment were at 20-year lows.

All this one the wave of an unprecedented QE, which was supposed to revive economic activity in the United States. If the post-crisis recovery has not affected the physical economy in any way, then it turns out that there is an increase in inflation with simultaneous stagnation of the real sector. These are the obvious signs of stagflation. The question arises - if the US government failed to direct funds to the real sector, what does OPEC + have to do with it? Obviously, OPEC+ has nothing to do with the current energy crisis.

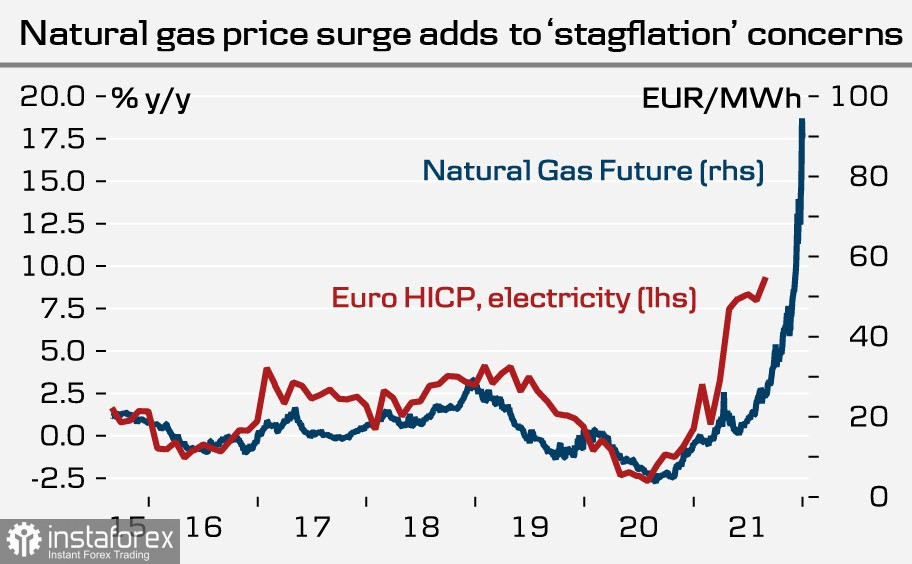

The largest banks are also beginning to openly warn about the threat of stagflation. Analyzing macroeconomic trends in the eurozone, DanskeBank concluded that the slowdown in growth is becoming more noticeable, despite the fact that Germany's inflation has reached its highest level since 1993. In addition, Germany is one of the sane European countries that receive gas from Gazprom under long-term contracts, where there is practically no spot component, which means that the insane increase in gas prices in the structure of inflation calculation does not affect in any way.

To lower stagflation risk, it is necessary to put pressure on the growth of inflation, which increases the chances of a faster exit from the ECB's ultra-soft policy (this is an argument in favor of the growth of the euro), while stimulating consumer demand and real production.

The Australian NAB is also increasingly mentioning the risk of stagflation, expressing the same arguments – the unwillingness of OPEC+ to raise production volumes beyond the schedule approved in July will lead to a further increase in energy prices, which will contribute to inflation. NAB also draws attention to the fact that a logistics crisis is developing, some critical industries that produce highly specialized products important for global production cycles (for example, chips for cars) will not reach the required capacity in any way, and as is known, the shortage always contributes to the inflation hike.

On the other hand, Mizuho Bank stated its opinion that one of the main conditions for reducing the threat of stagflation is to contain energy prices. Considering that no other obvious measures have been announced yet, it can be assumed that the decision will be translated into a political plane.

What consequences will the growth of stagflation threat create for the currency market? Most likely, a reversal in demand for risk may occur in the near future. Commodity currencies, which seem to be the current favorites, will decline, while the demand for protective assets will grow.

The USD/CAD pair above the level of 1.2414 will form a local bottom and make an upward reversal. The long-term target is 1.3300/50. Meanwhile, the AUD/USD pair will return to the lower border of the descending channel, with the key support of 0.6980/7000. Last, the GBP/USD pair is likely to further decline. Its nearest serious support is 1.3160/70.

In the current situation, the US dollar will look for benefits, as it is still the main defensive asset. The Bank of Japan will desperately resist the strengthening of the yen. The euro and the franc will decline unless the ECB and the NBG announce a faster than predicted exit from the ultra-soft policy.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română