The world markets will focus their attention today on the publication of employment data in the United States. There is no doubt that investors will consider the value of the number of new jobs, which can lead to noticeable movements in the markets.

On Thursday, the threat of a US default was postponed, but for two months only. The Congress voted for this, which calmed the markets and allowed stock indices in Europe, North America, and the Asia-Pacific region to increase. The growth of these positive sentiments also affected the commodity, currency, and debt markets. As expected, Congress simply had no choice but to continue increasing the national debt, which will eventually lead to the most severe consequences in the future and to the collapse of the American economy and the dollar hegemony reigning in the world.

Now, the market's attention can completely switch to the release of US employment data and properly respond to this. According to the forecast, the American economy was to receive 500,000 new jobs in September against 235,000 in August. At the same time, the unemployment rate will adjust from 5.2% to 5.1%. In the private sector, employment should rise by 455,000 against an increase of 243,000 in September.

The real values will be known at 12.30 Universal time, but if we consider the figures for private sector employment from the ADP, which turned out to be significantly higher than the forecast of 568,000 against 428,000, then it is likely that better data on the number of new jobs will undoubtedly support demand for company stocks and will increase the pressure of the US dollar, as investors perceived the positive dynamics in the labor market as a signal for more decisive action by the Fed regarding the process of not only reducing the volume of asset repurchases – government bonds and collateralized corporate mortgage securities; but, an earlier start of interest rate increases.

In order for the Fed to strengthen these expected actions, the positive dynamics in the labor market must settle. If the October figures published in early November also confirm this trend, then we should expect tougher statements from the regulator and its head personally at this month's meeting, which will clearly be the basis for increasing pressure from the dollar on the major currencies traded against it.

But there is another scenario – a pessimistic one. Bad news will lead to an increase in expectations that the Fed may not decide on a specific time frame for the start of rate hikes. In this situation, the US dollar will be under pressure.

In our opinion, investors will finally decide on the likely scenario after inflation data is published next week.

Forecast of the day:

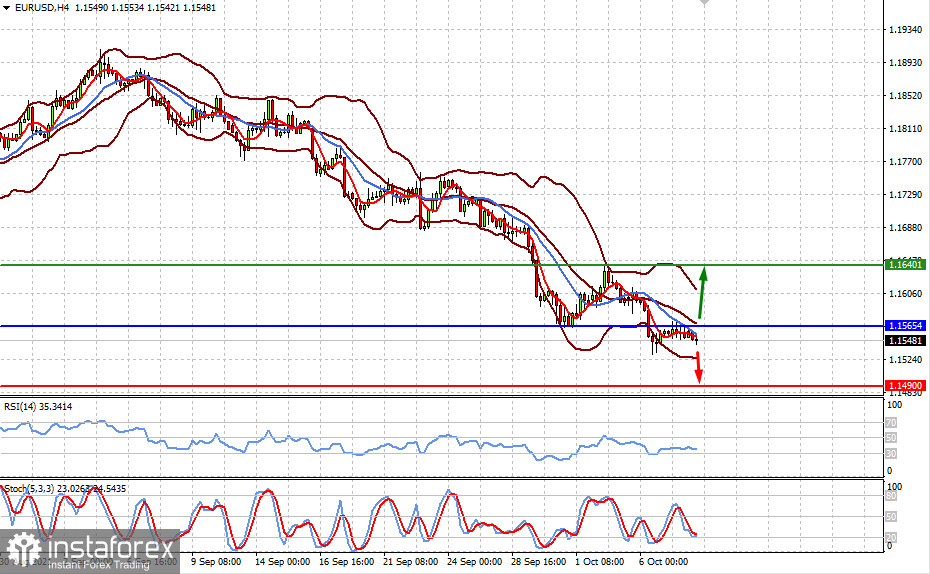

The EUR/USD pair is trading below the level of 1.1565 while waiting for the release of US employment data. The growth in the number of new jobs above the forecast will lead to the pair's local decline to the level of 1.1490. But if they are lower, this will lead to the pair's growth to 1.1640.

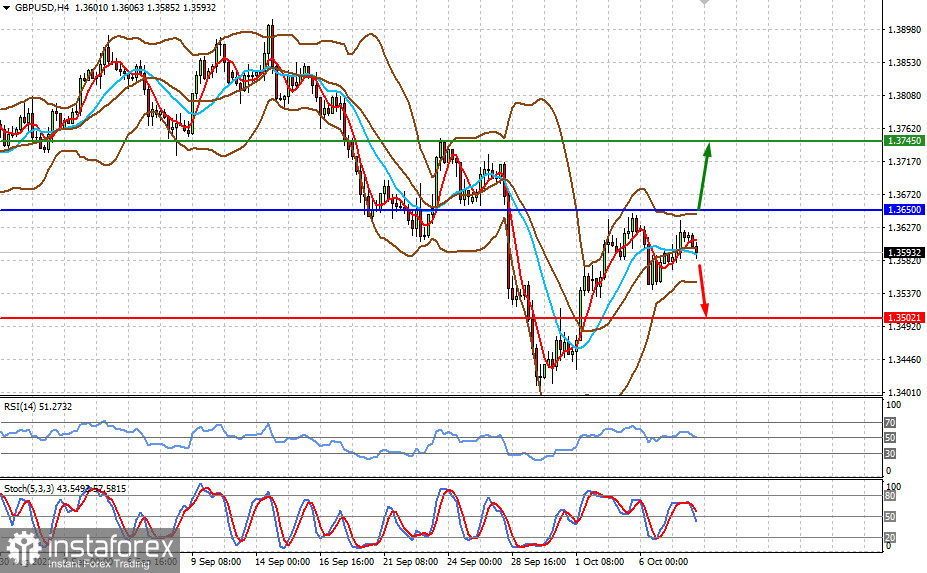

The GBP/USD pair is trading below the level of 1.3650. It may also receive support and rush to the level of 1.3745 in case of weak US employment data or decline to the level of 1.3500 if the data is strong.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română