Contradictory U.S. Nonfarm Payrolls discouraged traders - both bulls and bears of the EUR/USD pair. The key components of the data contradict each other, leaving more questions than answers. Against the background of such an ambiguous picture, the pair cannot decide on the vector of its movement. On the one hand, Friday's data is negative, as some indicators came out in the red zone, significantly falling short of the forecast levels. On the other hand, not all indicators disappointed investors.

In general, the Nonfarm Payrolls report is able to surprise: often, one of the components of a key release gets out of the general rut of forecast levels, demonstrating the ambiguity of the situation. Therefore, the initial reaction of the market is often false: traders evaluate the significance of one or another indicator in the context of other indicators and in the end makes their verdict. A similar situation has developed on Friday. On one side of the scale is a decrease in unemployment, an increase in salary indicators and the number of people employed in the manufacturing sector. On the other side are all the other components that did not reach the predicted values.

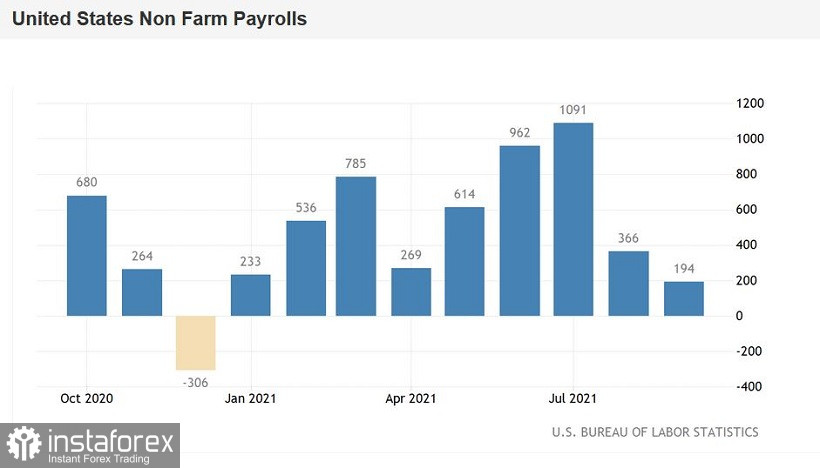

According to the report, employment in non-agricultural sector increased by 194,000, while experts expected this indicator to be much higher - almost at the level of half a million (490,000). A month ago, this indicator came out at the level of 366,000 (according to the data updated Friday). The growth of employment in the private sector of the economy was also somewhat disappointing at 317,000 (with the forecast of growth up to 455,000). The share of the economically active population has also decreased. In this case, we are talking about a minimal decrease (by 0.1% relative to the August figure) - but the "red color" of this component added to the contradictory picture. Moreover, most experts predicted its minimum growth (up to 61.9%).

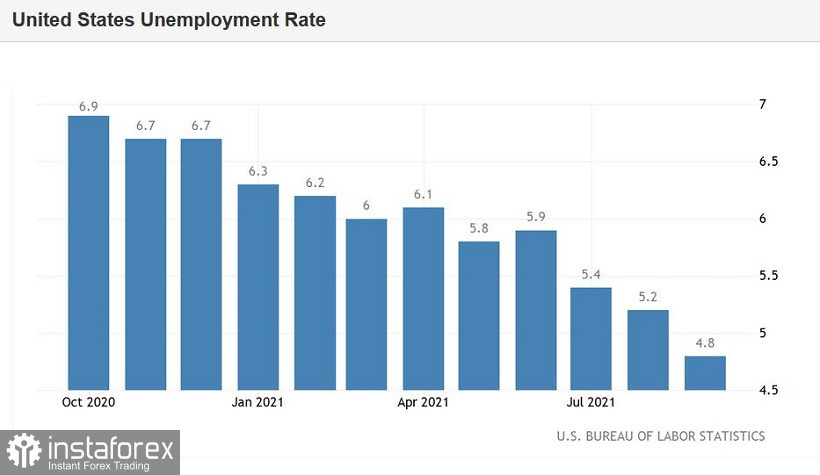

That's one side of the coin. On the other side is salaries, which turned out to be better than the forecast values. The level of average hourly wages on a monthly basis rose to 0.6% (the best result since April this year), which traders expected to be around 0.3%. In annual terms, the index also accelerated its growth, reaching 4.6% (the best result since February of this year). The unemployment rate, which fell to 4.8%, also posed a good result. The employment in the manufacturing sector of the economy also came out in the green zone: instead of a decline to 22,000, this indicator came out at the 26,000 mark.

In general, Friday's data disappointed both the EUR/USD bulls and bears. None of them received unequivocal support from the key macroeconomic report, and as a result, the price actually remained standing still, demonstrating a slight corrective growth. A slight advantage turned out to be in favor of EUR/USD buyers, but the price increase is more of a formal nature. The dollar is declining following the Treasury yields, but the quotes of futures on the federal funds rate are stable – the dates of the first Fed rate hike laid down in them have remained the same. Nevertheless, traders of the euro-dollar pair do not dare to open large positions - either in favor of the greenback or against it. Therefore, EUR/USD bulls are content with a 50-point correction, which is largely due to the notorious "Friday factor."

It is risky to open trading orders today, since the market has not yet "played back" the published data, and the fundamental background for the pair may change significantly by Monday. In my opinion, September Nonfarm Payrolls will not be able to "redraw" the fundamental picture for the US currency. In any case, the Federal Reserve will begin to taper QE in November, and representatives of the "hawkish" wing of the Fed will continue to advocate an increase in the interest rate next year. We can also recall the ongoing oil rally (the cost of a barrel of Brent crude oil today exceeded the $83 mark, for the first time since November 2014), and growing inflation expectations, and the divergence of the ECB and Fed rates. All these factors play in favor of the US currency.

If we talk about the medium term, then the current situation can be characterized by the catchphrase "execution cannot be pardoned": in our case, the decisive comma may be put in the next few days.

From a technical point of view, the EUR/USD pair still retains the potential for further decline: on the daily chart, the price is still located between the middle and lower lines of the Bollinger Bands, as well as under all the lines of the Ichimoku indicator. The nearest target of the downside movement is the 1.1510 mark – this is the lower line of the Bollinger Bands on D1.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română