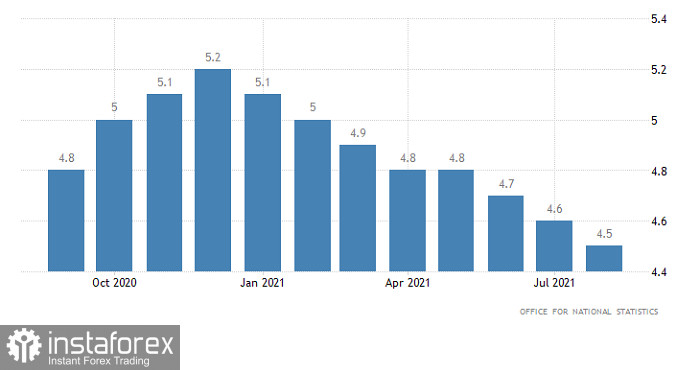

Following the pound's smooth and sluggish weakening yesterday, its rapid growth today seemed to be an already resolved issue. Moreover, the forecasts for the labor market in the UK were extremely optimistic. The data itself turned out to be much better than forecasts, but there was no rapid growth of the pound. The unemployment rate fell from 4.6% to 4.5% instead of remaining unchanged, while employment rose not by 225 thousand, but by 235 thousand. Nevertheless, the market behaved as if nothing had been published.

The pound, supported by truly excellent data on the labor market, will show growth, but it will be very stretched and will become noticeable only by the end of the trading day. At the same time, it is unlikely that the pound will be able to return to the maximum values of yesterday. After all, the trend of strengthening the dollar has not gone away. Last Friday, the market even received additional confirmation that the process of strengthening the dollar is very far from being completed.

Unemployment rate (UK):

The euro failed to break out of stagnation for three full trading days. However, there were all grounds yesterday for such in the form of a completely empty macroeconomic calendar. Although certain data are published today, the market is likely to continue its horizontal movement. From the point of view of the markets, the data on open vacancies in the United States are published quite late. But more importantly, the reduction from 10,934,000 to 10,800,000 does not contradict the United States Department of Labor report released on Friday. In fact, the data published today only further illustrate the improvement in the situation in the American labor market. We should also consider the secondary nature of the job openings data, which are not able to exert any noticeable influence on the market. Therefore, the European currency will never be able to break out of stagnation.

A number of Job Openings (United States):

The EUR/USD pair moves within the base of the descending cycle, having a slight pullback-stagnation. Despite the euro's oversold status, the downward trend is still relevant among traders. The subsequent growth in the volume of short positions is expected if the price is kept below the level of 1.1520. Until then, the risk of a technical correction will remain.

The GBP/USD pair has been following within the resistance area of 1.3620/1.3650 for almost a week, consistently reducing the volume of long positions. It can be assumed that the correction is replaced by a flat in the range of 1.3540/1.3670, where the best trading tactic will be considered the method of trading on a breakdown.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română