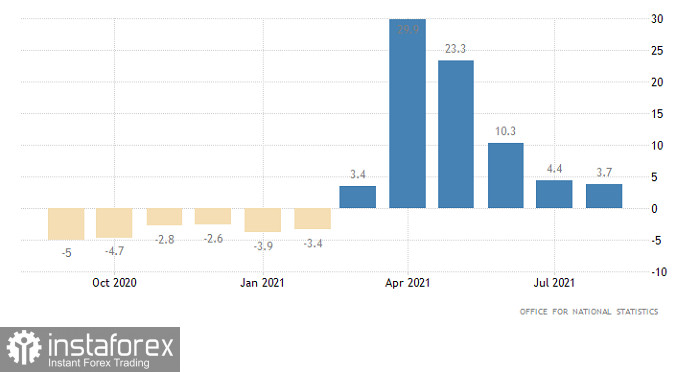

The previous day started for the pound with great news. And although the growth rate of industrial production slowed down, the data turned out to be not just noticeably better than forecasts. It was predicted that the growth rate would slow down from 3.8% to 3.2%, but it slowed down to 3.7%. Moreover, the previous data were revised up to 4.4%. If we look at the monthly data, then industrial production increased by 0.8% with a forecast of 0.4%.

In general, the industry data turned out to be really better than forecasts, and at least this segment of the British economy feels much better than expected. Therefore, it is not surprising that the pound started to rise.

Industrial production (UK):

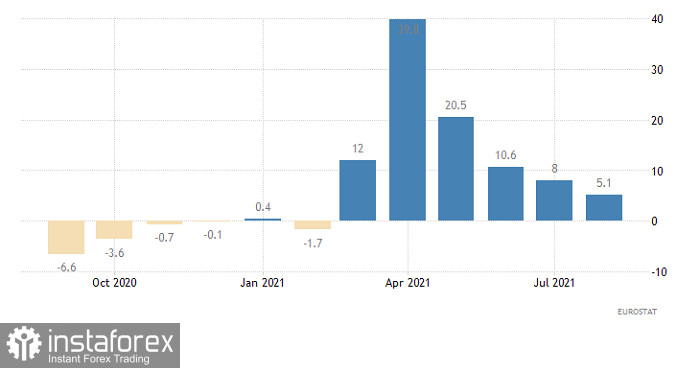

At first glance, Europe's industrial production data turned out to be much better than forecasts, and although its growth rate slowed to 5.1%, which coincided with the forecast, the previous data were revised up from 7.7% to 8.0%. It turns out that the European economy grew a little stronger than expected last month. However, it is precisely due to this that the latest data eventually turned out to be noticeably worse than expected. The fact is that industrial production was expected to decline by 1.2% on a monthly basis, but in the end, it fell by 1.6%.

Industrial production (Europe):

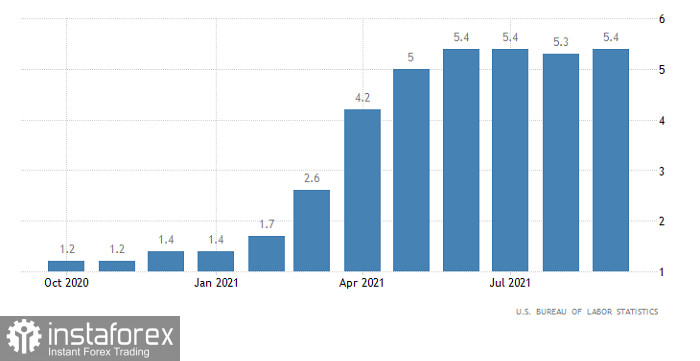

With all due respect to the European industry, its significance becomes lighter amid the US inflation the data, which is the main event of the current week. Instead of remaining unchanged, inflation rose from 5.3% to 5.4%. Its growth certainly means that the Federal Reserve System will begin to wind down the quantitative easing program in November. And as soon as the data was published, the US dollar began to grow steadily. However, something unimaginable began about an hour later, as the dollar literally lost all its gains in the blink of an eye, and then continued to fall in price. Such behavior simply contradicts common sense. And it's all about the countless comments that representatives of the financial sector of the United States began to make. Their whole essence boils down to a very simple thought – after inflation rises, the regulator will "probably" announce the curtailment of the quantitative easing program. Although not only inflation, but the state of the labor market clearly indicate that there is simply no other scenario.

However, the financial sector continues to convince itself that not everything is predetermined or it pretends that there is some hope. In principle, such market behavior can even be regarded as an attempt to put pressure on the Fed in order for the regulator to abandon plans to tighten monetary policy. It is clear that from the point of view of the financial sector, the curtailment of the quantitative easing program, which is the main driver of the growth of financial markets, is almost a disaster. In this case, the motivation of the financial sector is quite understandable. But the Federal Reserve System is obliged to be guided not only by the short-term interests of the financial sector. So in general, the regulator should ignore them, especially if they run counter to the long-term prospects of economic development.

Inflation (United States):

Everything can go back to normal today, and the US dollar is likely to rise again, although this is not about the claims for unemployment benefits, the forecasts for which are moderately positive. In particular, the number of initial applications should fall by 11 thousand., while repeated applications by 65 thousand. This does not contradict the content of the report of the United States Department of Labor, and rather only confirms it. Therefore, the market will not see anything new in this data.

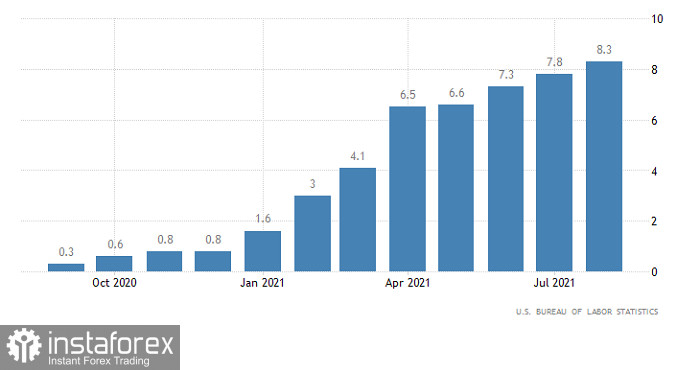

Yet, the producer price index can put everything in its place, which should grow from 8.3% to 8.5%. And this is the best case. There is every reason to believe that it will rise to 8.7%. Given that the producer price index is a leading indicator for inflation, its growth indicates that inflation will not decline in the near future, but rather grow. That is, the Fed simply has no choice but to tighten its monetary policy parameters. Thus, the producer price index will move the question of curtailing the quantitative easing program from the category of possible developments into an almost fait accompli.

Producer Price Index (United States):

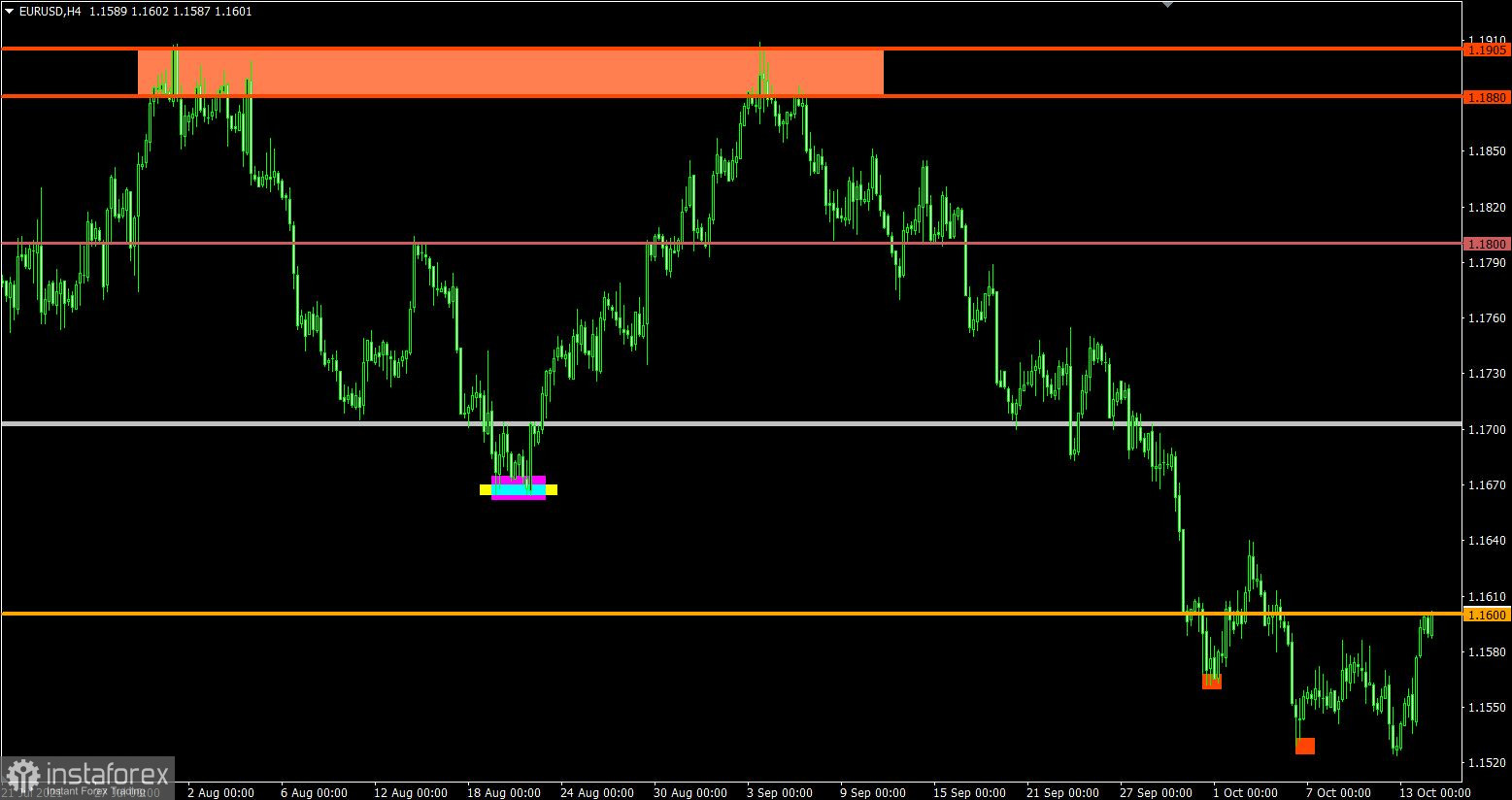

The EUR/USD pair rebounded from the pivot point of 1.1530 for the second time in a row, eventually rising by about 70 points. Given the oversold euro, the price changes are insignificant. So, holding the price above the level of 1.1600 could theoretically lead us into a correctional stage. Otherwise, the pivot point will be approached for the third time.

The GBP/USD pair still showed activity after a week of being in the area of 1.3540/1.3670, consolidating above the upper border. It should be noted that holding the price above the level of 1.3685 increases the chance of moving towards the local high of September 23. Otherwise, the price will return to the flat borders again.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română