Wave pattern

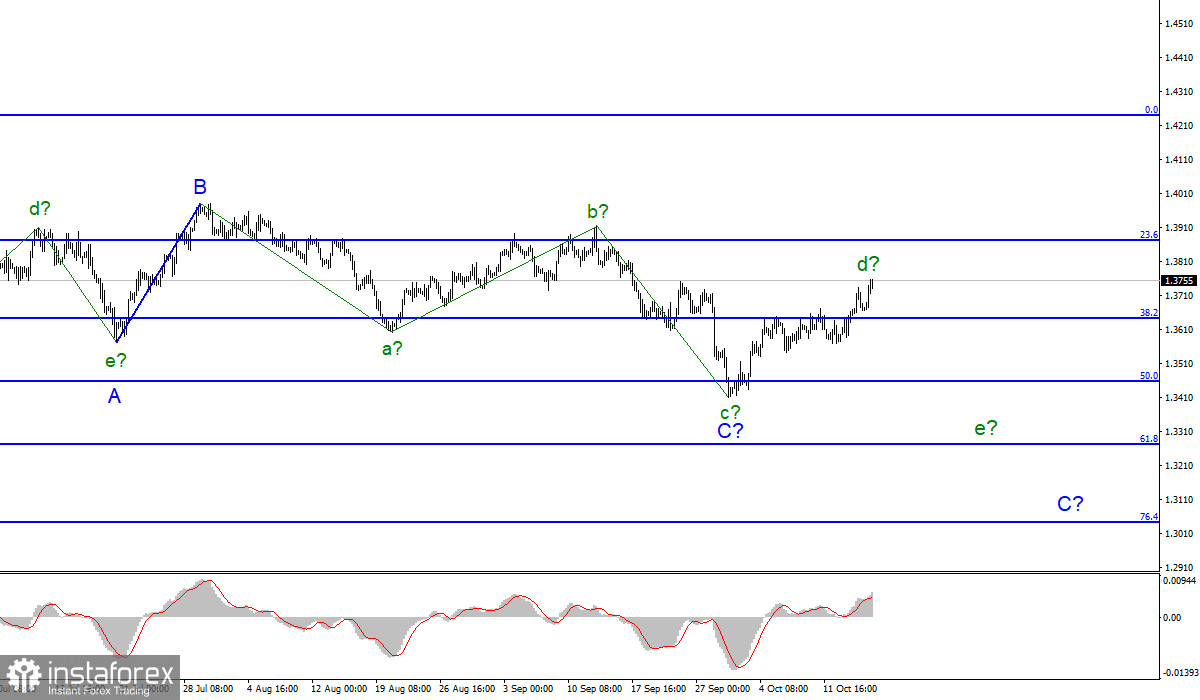

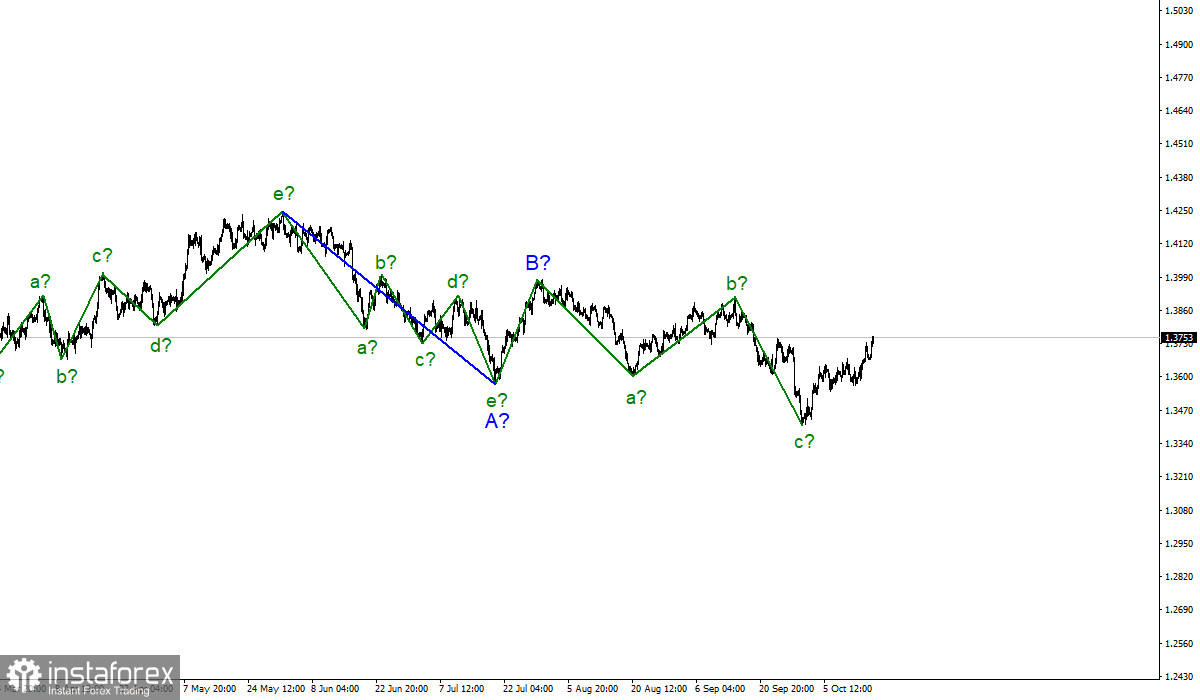

The wave counting for the Pound/Dollar instrument has become more complicated and now it is expected to continue building a downward trend section. The instrument made a successful attempt to break through the low of the previous waves a and e. Thus, adjustments were made to the wave pattern and now it has acquired the form of a downward trend section, which may be corrective in nature. This assumption is prompted by the internal structure of the proposed wave A, which cannot be called impulsive. The assumed wave c in C from this section of the trend also took an absolutely non-impulsive form, with only three waves visible in it.

However, within the corrective structures, wave countings can be either three-wave or five-wave and take a very complex form. Thus, after completing the construction of the current wave, presumably d in C, I expect a resumption of the decline in quotes within the framework of wave e in C. However, it should also be taken into account that wave C may turn out to be three-wave and be already completed. In this case, the construction of a new upward trend section could now begin.

The exchange rate of the Pound/Dollar instrument increased by almost 100 basis points on Friday. Thus, the construction of the assumed wave d continues. However, such a strong growth of the British pound cannot be attributed to the reaction of the markets to the news background. Economic events/reports were practically absent. Nothing interesting has happened in the UK at all. Thus, the increase in quotes was based on some other reasons.

U.S. Fed cannot find consensus on the timing of QE tapering

According to recent interviews with many representatives of the FOMC, the chance of starting to taper the QE program in November is high. However, the latest Fed minutes did not give a clear answer as to how many Fed members adhere to the November roll-off, and how many to the December one. The same thing happened this week. Federal Reserve Governor Michelle Bowman said she is ready to vote for a reduction in incentives in November, the same boat with St. Louis Fed President James Bullard and Atlanta Fed President Raphael Bostic. However, Richmond Fed President Thomas Barkin said that a certain number of workers who left their jobs during the pandemic may not be able to return to them. Thus, Barkin considers it necessary to wait and see whether those 5 million people who lost the labor market will return, and only after that should they decide to taper QE.

General conclusions

The wave pattern has changed dramatically in recent weeks. It received a downward view, but not an impulsive one. However, since the construction of an upward wave is continuing now, I advise you to wait for its completion before selling the instrument in order to build the expected wave e in C. A successful attempt to break the 1.3643 mark, from top to bottom, may be a confirmation of the readiness of the markets for new sales.

The upward section of the trend, which began its construction a couple of months ago, has taken a rather ambiguous form and has already been completed. The construction of the upward trend section has been canceled and now we can assume that on January 6, the construction of a new downward trend section began, which can turn out to be almost any size.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română