The absence of any new positive news on the market last week seems to have forced investors to completely switch all their attention to the published corporate reports for the third quarter.

The US inflation data presented last Wednesday showed that this phenomenon is likely to linger for a long time, as it has deep and unsolvable reasons for America. Excessive saturation of the local financial system with an unsecured US dollar, albeit with the best intentions – financial support for the country's population in the context of the coronavirus pandemic and business, led to a strong increase in inflation. The inability for political reasons to refuse financial support to the population will still force local authorities to withdraw the money supply by raising interest rates, which means that the lives of ordinary Americans will not improve, and all this will happen amid the slowdown in the growth of the American economy.

However, financial markets live by their own laws, which was clearly shown last week. Having made sure that the Fed will have to start raising the cost of borrowing in the near future, investors turned their attention to the corporate reporting coming out, which turned out to be very good for the United States. On this wave, investors' demand for company shares sharply increased, which led to an increase in the world's stock indexes for the week but did not affect the Chinese stock market. Nevertheless, there is a story that restrained local stock indexes and even put pressure on them.

Last Friday, European and North American stock indexes closed in the "green" zone, and this dynamics may continue today if the reports of American companies Tesla and Netflix, Procter & Gamble, Johnson & Johnson, United Airlines, American Express, Intel, and Honeywell, as well as European companies Philips, Danone and others will be on top. In this case, we will be able to observe the reaction of investors similar to the one that was last week – the growth of stock indices and the resumption of pressure on the US dollar.

On another note, the crude oil market continues to live its life. The main factor that supports the oil's quotes remains high demand for oil and gas in anticipation of a harsh winter in the Northern hemisphere, as well as US high inflation, which encourages investors to buy real assets. Another reason for the price increase is the actual failure of the "green energy" plans, which led to disastrous results before the winter.

What can be expected from the markets this week?

Investors will continue to monitor the publication of economic statistics primarily in America. Of the notable ones, we will highlight the publication of consumer inflation values in the eurozone, the index of business activity in the manufacturing sector and in the services sector in Germany and the EU, as well as the United States. The figures of sales in the secondary housing market in America will attract attention.

One should also pay attention to the number of initial applications for unemployment benefits in the States, and the speech of a number of important people both in Europe and in the United States.

Forecast of the day:

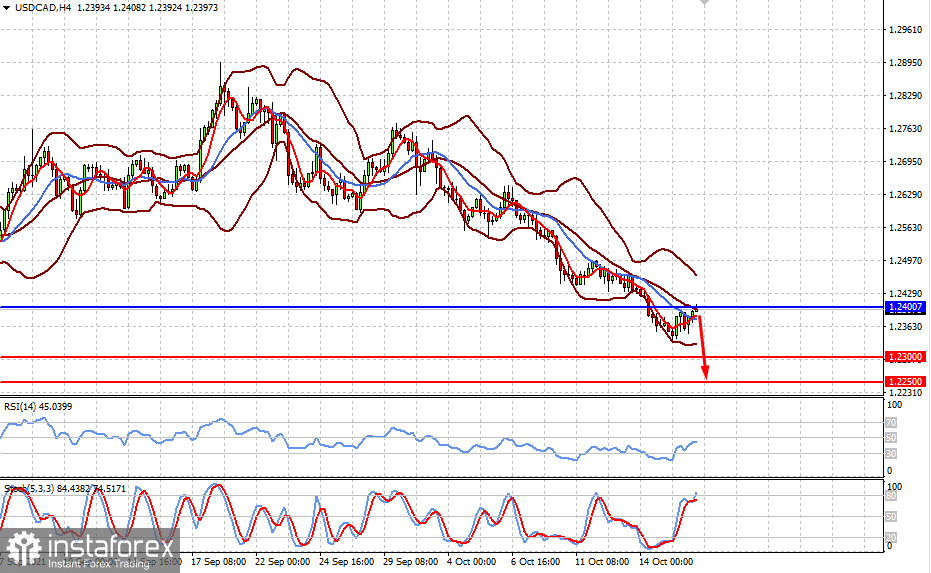

The USD/CAD pair made an upward pullback and is at the level of 1.2400. If it holds below it, the decline might continue towards our target levels of 1.2300 and 1.2250. The rise in oil prices is still an important factor supporting the Canadian currency.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română