Another major currency pair that we will consider today will be the dollar/franc. As noted more than once before, this pair is quite interesting and consists of two currencies, protective assets. Despite the rampant fourth wave of COVID-19, the US dollar failed to demonstrate strengthening against the Swiss franc and declined against the Swiss franc at the auction on October 11-15. Briefly describing the epidemiological situation is more positive in quiet and peaceful Switzerland than in the United States of America. Along with Denmark, the pandemic situation in Switzerland is quite tolerable. In this regard, the Swiss currency looks preferable. However, in my opinion, the main influence on the price dynamics of this trading instrument has a technical picture, which we will consider right now.

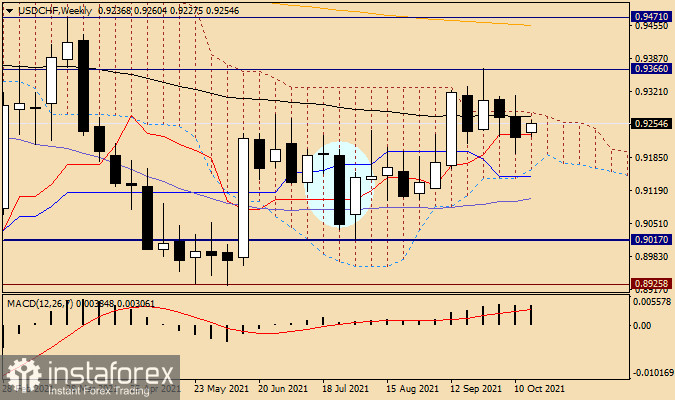

Weekly

Since the next trading week ended last Friday, the technical analysis on USD/CHF will begin with this time interval. The chart clearly shows what problems the bulls are experiencing for this instrument with the price moving up from the weekly Ichimoku indicator cloud. It would seem that the pair had already gone up from the cloud and showed maximum values at 0.9366, a downward reversal followed, and the quote returned to the limits of the Ichimoku cloud. Moreover, the quote again fell under the black 89 exponential moving average and also finished trading last week slightly below the red Tenkan line. All these factors indicate a bearish market sentiment. However, this instrument has no stable price dynamics, so it would not be quite right to draw far-reaching conclusions.

Now about the tasks of the opposing sides. Bulls on the instrument need to bring the price up from the cloud and breakthrough sellers' resistance at 0.9366, with mandatory consolidation above this level. Players on the downgrade need to exit the quote down from the Ichimoku cloud with a passing breakdown of the blue Kijun line, which is located directly below its lower border. Since the pair g much closer to the upper limit of the weekly cloud, the players' positions on the rate increase look preferable. However, as already noted in one of today's previous materials, nothing is impossible on the market, so we will not discount any of the possible options for the price movement of USD/CHF.

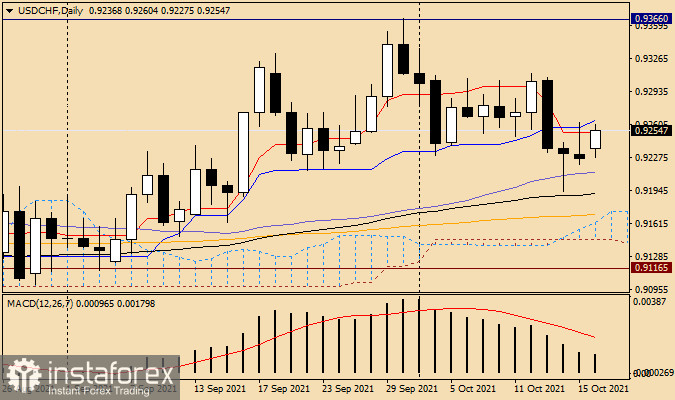

Daily

There is chaos and confusion on the daily chart. We can characterize the technical picture, taking into account the candles for October 14 and 15. It is very similar to the fact that the market is uncertain and does not know or understand where to move the course. Giving any trading recommendations in such a situation is like tossing a coin. It is why I suggest waiting for a clearer picture. However, let us take a break and stay on the dollar/franc out of the market for now. Since this review is technical, I will indicate the nearest resistance and support.

Resistance levels: 0.9300 and 0.9365. Support levels: 0.9200 and 0.9170.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română