Wave pattern

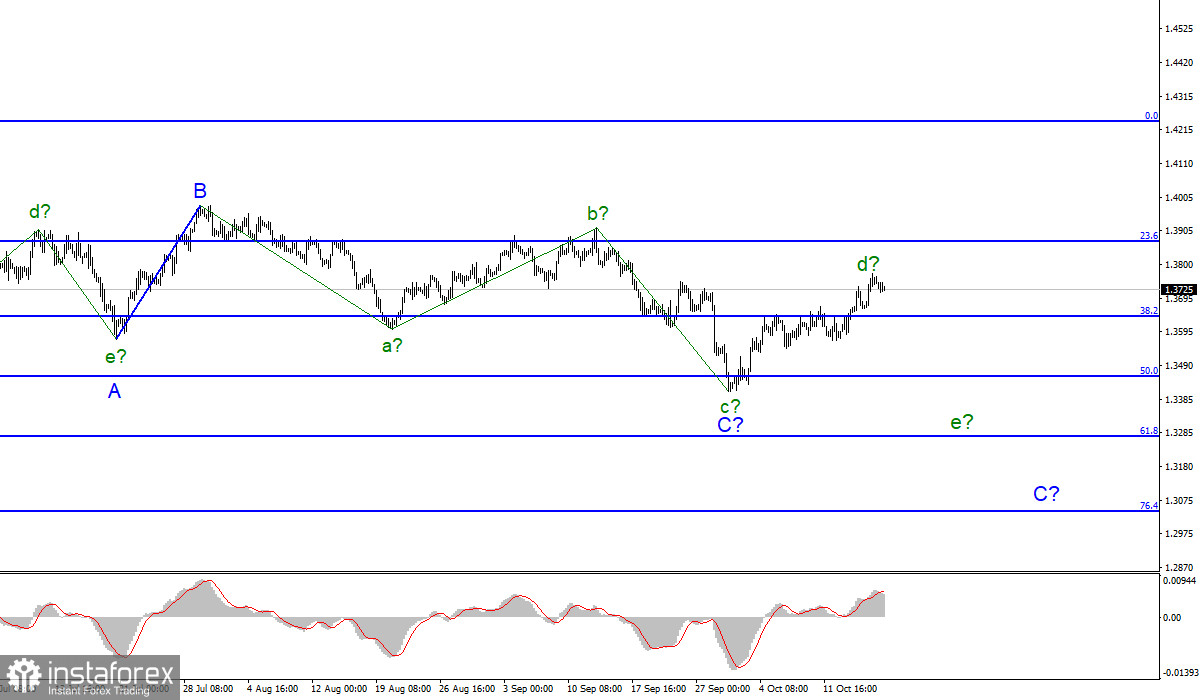

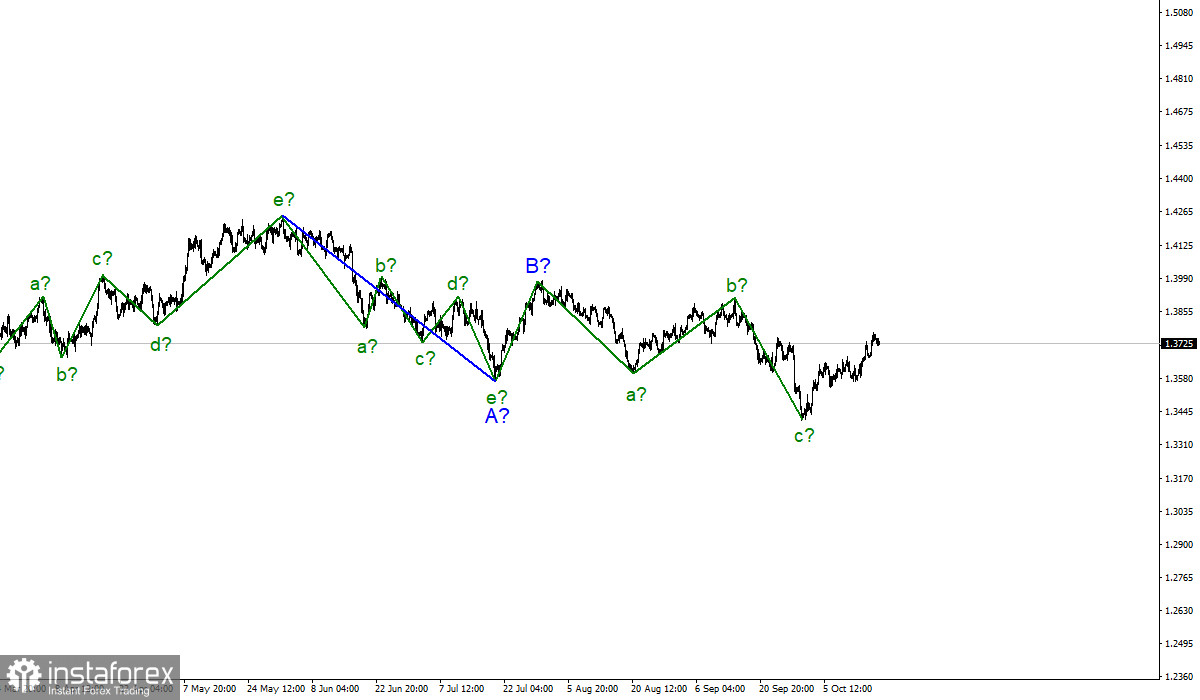

The wave counting for the Pound/Dollar instrument has become more complicated and now it is expected to continue building a downward trend section. The instrument made a successful attempt to break through the low of the previous waves a and e. Thus, adjustments were made to the wave pattern and now it has acquired the form of a downward trend section, which may be corrective in nature. This assumption is prompted by the internal structure of the proposed wave A, which cannot be called impulsive. The assumed wave c in C from this section of the trend also took an absolutely non-impulsive form, with only three waves visible in it.

However, within the corrective structures, wave countings can be both three-wave and five-wave and take a very complex form. Thus, after completing the construction of the current wave, presumably d in C, I expect a resumption of the decline in quotes within the framework of wave e in C. However, it should also be taken into account that wave C may turn out to be three-wave and be already completed. In this case, the construction of a new upward trend section could now begin.

BOE's Andrew Bailey attempts to inspire optimism.

The exchange rate of the Pound/Dollar instrument decreased by 30 pips on Monday. Such a minimal amplitude is due to the absence of interesting news. The proximity of the completion of the proposed wave d may also play a role. Nevertheless, on Sunday, the president of the Bank of England, Andrew Bailey, made an interesting statement. Bailey said the BOE was preparing to raise interest rates. Nevertheless, he considers the current jump in inflation to be temporary, noting that it will take a longer period of time than expected a few months ago, due to the rise in energy prices, which will drag up the price of almost all groups of goods and services.

UK inflation is expected to rise to 4%. "Monetary policy should take effect, and will do so if we see risks, especially for medium-term inflation," Andrew Bailey said. Thus, analysts expect that in the coming months, the Bank of England will also begin to reduce quantitative stimulus. The rate hike is unlikely to begin before the end of the QE program. That is, Bailey's statement has a very long shelf life. It is unlikely that the BOE will start raising interest rates before the middle of next year. Thus, the Pound/Dollar instrument has not received any real grounds for continuing to increase.

General conclusions

The wave pattern has changed dramatically in recent weeks. It received a downward view, but not an impulsive one. However, since the construction of an ascending wave is currently underway, I advise you to wait for its completion before selling the instrument in order to build the expected wave e in C. A successful attempt to break through the 1.3643 mark, which is equivalent to 38.2% Fibonacci level, but from top to bottom, may be a confirmation of the readiness of the markets for new sales.

The upward section of the trend, which began its construction a couple of months ago, has taken a rather ambiguous form and has already been completed. The construction of the upward section of the trend has been canceled and now we can assume that on January 6, the construction of a new downward section of the trend began, which can turn out to be almost any size.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română