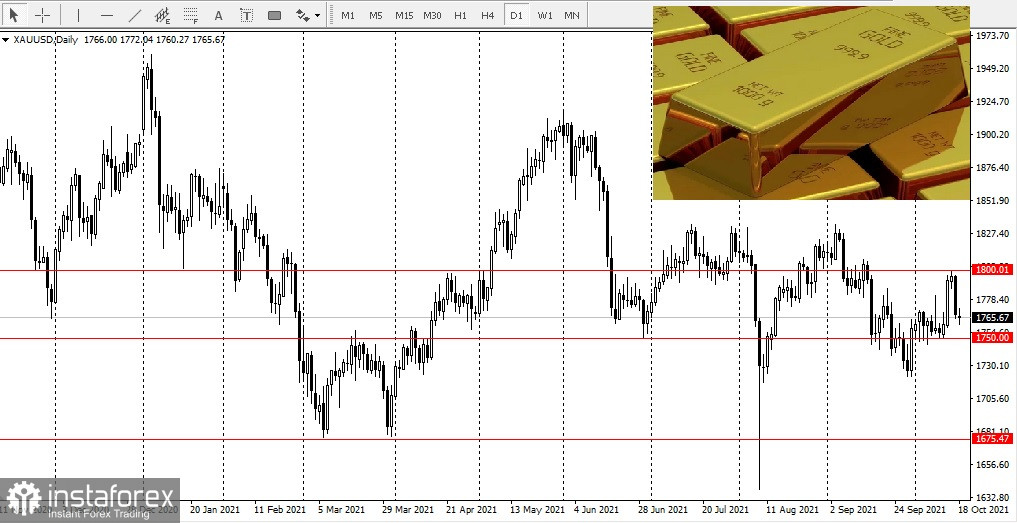

The Bank of America's analysts said that the gold market remains trapped below $1,800 per ounce, and even the growing risk of stagflation in the near future will not be enough to support prices.

Analysts note in a report published last week that the precious metal continues to face significant obstacles as central banks advance their plans to normalize monetary policy.

Economists say that the current threat of stagflation differs from other periods in which gold has been growing in that the labor market continues to hold up relatively well. They noted that not all periods of stagflation are the same and added that the measure of stagflation using the Poverty Index is a combination of inflation and unemployment.

It can be recalled that the poverty index and gold price quotes diverged in recent months during the period from 1971 to 1981 when poverty triggered two bull markets for gold. The "poverty index" remains below the level of 12.5%, which actually contributed to the steady growth of gold in the past.

Despite the fact that the global supply crisis is pushing up energy prices along with inflation, Bank of America said that prices are currently below the levels that previously caused problems for the global economy. In the 1970s, high energy prices contributed to stagflation. West Texas Intermediate (WTI) crude oil prices have increased since the beginning of this year by 70%, namely to $82.51 per barrel over the last period.

Analysts said that rising inflation leads to an increase in both nominal and real interest rates, which increases the opportunity costs of gold. According to Bank of America's forecast, US bond yields will rise to 1.90% by the fourth quarter of 2022. At the same time, the US consumer price index is expected to be about 2.4% by the end of next year.

They also said that bond yields could be capped at 2% before problems arise for the US economy and stock markets.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română