The yield of 10-year UST declined to the level of 1.58% after reaching a peak of 1.6248%. Some disappointment is observed after the publication of weaker-than-predicted data on September's industrial production. Capacity utilization declined from 76.2% to 75.2%, while output dropped by 1.3%. Both of them were expected to grow.

This weak data served as the basis for the US dollar's weakening of the dollar, but it is still assumed that the US dollar remains the market's favorite and will resume its growth as soon as the demand for protective assets recovers.

NZD/USD

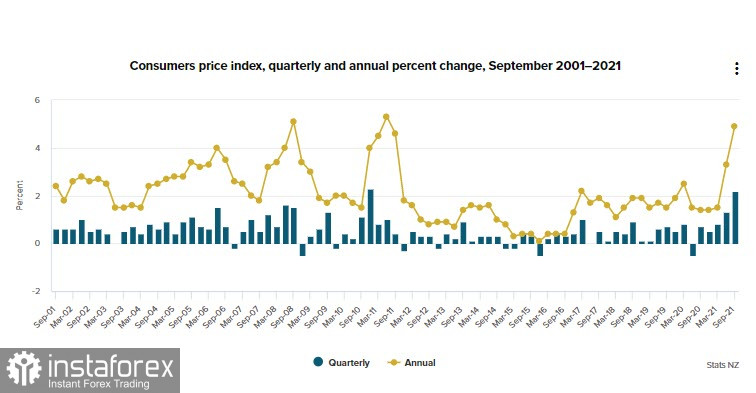

The consumer price index rose 2.2% in September 2021, which is the biggest quarterly change since the 2.3% increase in December 2010. Annual inflation in September 2021 was 4.9%compared to September 2020, and this is also the largest change since 2011.

As Stats NZ also specifically noted, the tightening of COVID-19 restrictions in August "had a minimal impact," that is, the increase in inflation is systemic, not temporary, which can be attributed to the pandemic. The growth is based on the rapid recovery of the labor market and wage growth, which means that the basic factors that the RBNZ has no right to ignore.

In this case, ANZ Bank said that "the disruptions that have plagued global supply chains over the past 18 months are not going anywhere, which means that we may not see a peak in inflation until the New Year." This indicates that the approach of the Christmas period can accelerate inflation even higher and stop its chances are small.

The rates are growing everywhere amid the rising inflation, the growth rates are highest in the UK and New Zealand. This means that the pressure on the central banks is growing stronger in these two countries than in the same Fed.

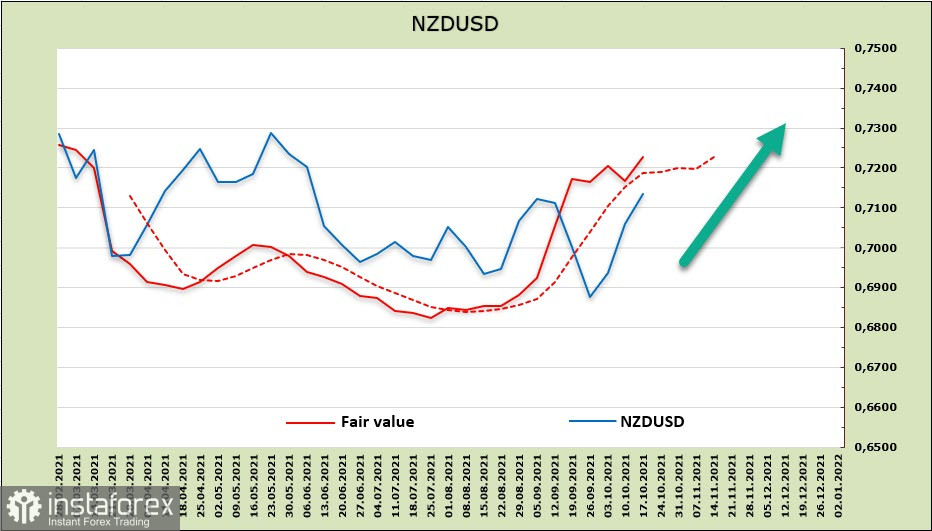

In New Zealand, confidence is maturing that the RBNZ will raise the rate by 0.25% next week. There is a 50% probability of a 0.5% rate hike has already formed, which makes New Zealand the leader in rate growth rates. Accordingly, the yield spread will grow in favor of NZD, and the chances of NZD/USD growth will become even higher.

The New Zealand dollar's net long position slightly increased by 45 million to 606 million over the week. There is a bullish trend, with an increase in the target price ahead of the spot.

A week earlier, it was assumed that the NZD would go into a correction before resuming growth, but rising commodity prices and macroeconomic indicators turned NZD/USD up without any correction. This currency is moving up from the correction channel, so a consolidation above the level of 0.7166 will mean an increase in bullish prospects. Here, the target is 0.7312.

AUD/USD

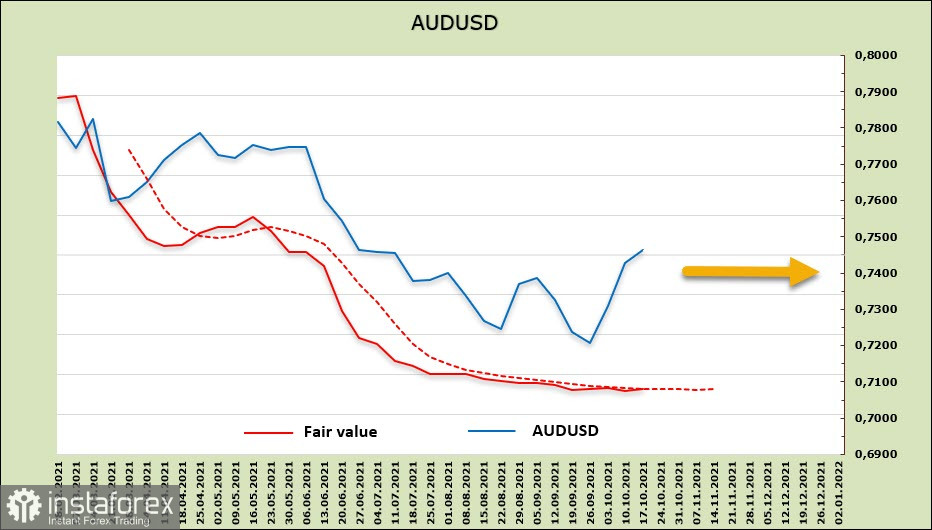

The minutes of the RBA meeting published this morning did not contain any revelations. The RBA noted that the outbreak of COVID-19 has delayed the recovery of the Australian economy, and the available data indicate a noticeable decline in GDP in the 3rd quarter. At the same time, it is expected that the decline will be temporary, and recovery will begin in the 4th quarter since as vaccination continues, the covid restrictions will be relaxed.

In contrast to New Zealand, the rate of inflation is weaker, so the rate will not increase until inflation is steadily within the target range of 2-3%. For AUD/NZD cross-pair, these expectations mean increased bearish pressure.

The Australian dollar's net short position slightly declined over the reporting week and amounts to -6.439 billion. According to the CFTC, the target price stayed around the long-term average.

There are low chances of a successful upside exit from the descending channel, so it is necessary to consistently consolidate above the level of 0.7530 and 0.7615 in order for these chances to increase.

The Australian dollar is supported by rising oil prices, but with China's slowdown, the probability of a bullish reversal remains low. It is assumed that the bearish pressure will persist, as it is logical to use temporary growth for long-term sales.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română